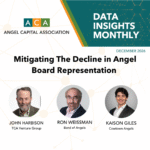

The 2025 ACA Angel Funders Report (AFR) highlighted a very disturbing trend — declining participation by angels on the Boards of angel-backed portfolio companies:

FIGURE 1: A DIMINISHING PRESENCE OF ANGELS ON BOARDS

Source: Angel Capital 2026 Angel Funders Report

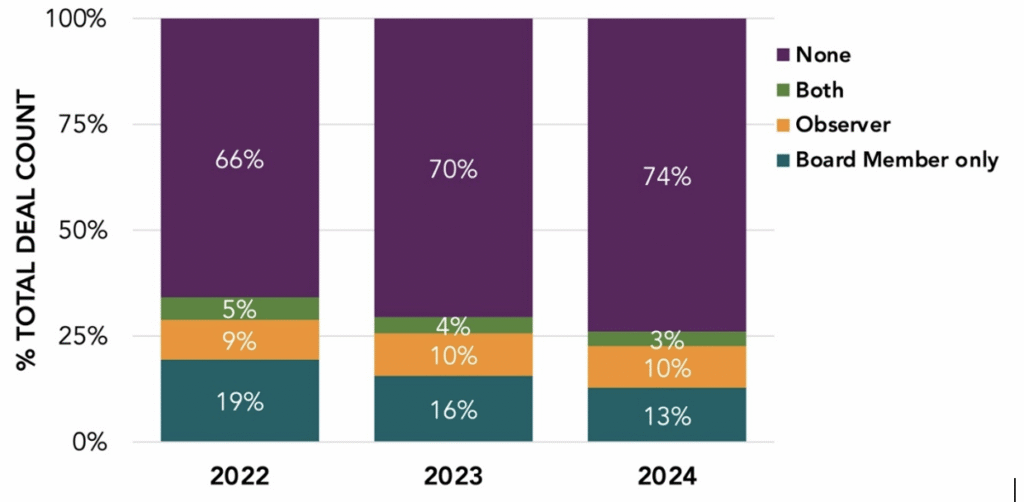

The AFR further highlighted a strong correlation between writing larger checks and gaining representation on a company’s Board of Directors. In fact, as Figure 2 indicates, angel groups awarded Board seats typically have invested twice what other groups have invested. Less capital often means an angel group will be less engaged with the company going forward.

FIGURE 2: BOARD PARTICIPATION REQUIRES 2X THE $ INVESTMENT

Source: Angel Capital 2026 Angel Funders Report

This decline in Board representation (Figure 1) is of significant concern because deal returns analyses indicate far higher returns for deals in which angels participate on Boards. In a previous ACA Data Insight, Central Texas Angels Network demonstrated that its exits with a CTAN Board Member had a MOIC (Multiple on Invested Capital) of 9.5x versus 1.3x for exited companies having no CTAN member serving on the Board; the IRR was also higher at 49% with a CTAN Board member versus 5% for exits in companies without a CTAN Board member.

Given the decline in Board representation, we believe it would be helpful to dig deeper into the drivers of this trend and suggest ways to reverse or mitigate it.

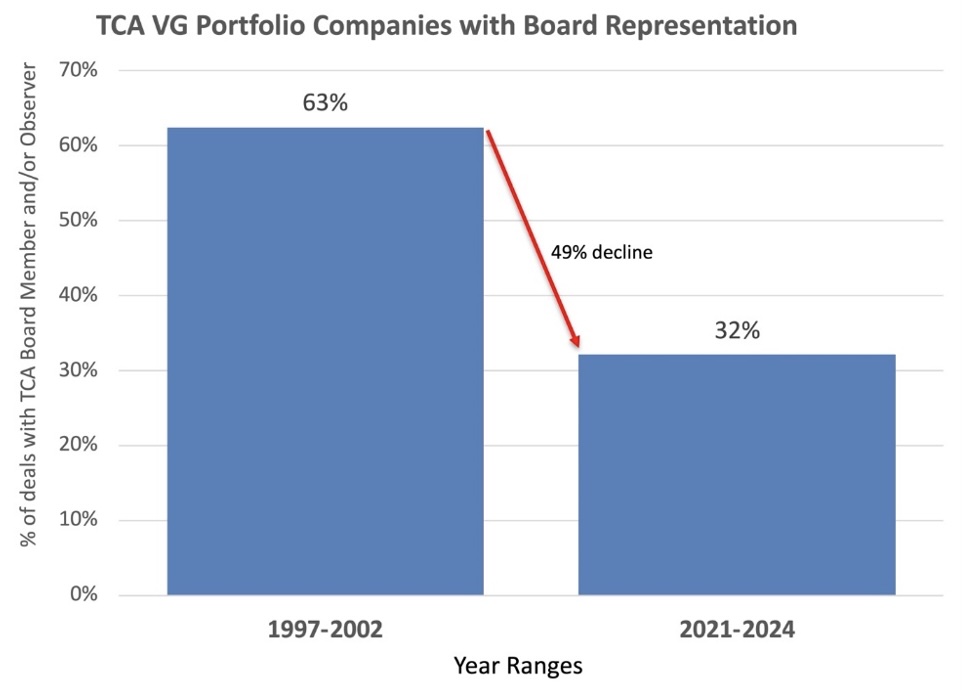

Our first question is whether this is a long-term trend, or just an anomaly in the last few years. While ACA’s AFR data only goes back three years, we turned, for a longer-term perspective, to data from the TCA Venture Group. TCA VG has been active doing deals and collecting deal data since 1997. We grouped companies funded by TCA VG between 1997-2002 into one cohort, and companies TCA VG funded 2021-2024 into a second cohort. Then we adjusted all amounts for inflation, expressing everything in 2024 dollars using the CPI.

Sixty-three percent of companies funded by TCA VG from 1997–2002 had board participation from TCA VG members. By 2021–2024, that figure had fallen to 32%, a 49% decline, indicating a long-term trend rather than a recent anomaly.

FIGURE 3: BOARD PARTICIPATION DECLINED 49% IN PAST TWO DECADES

Note: All amounts are dollars in thousands adjusted for inflation to 2024 dollars

Source: TCA Venture Group

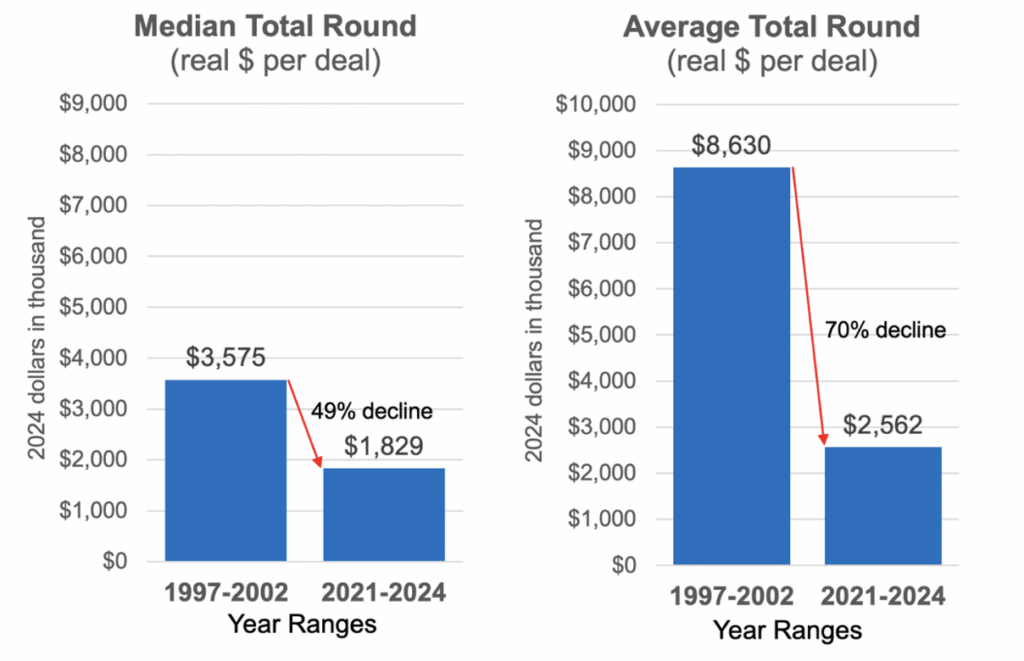

Adjusting for inflation, total round sizes declined over the past two decades. This is not surprising, since technology advances have allowed companies to be more efficient in the early stages of development. Companies two decades ago also tended to have fewer (but larger) rounds:

FIGURE 4: TOTAL ROUND SIZES DECLINED DRAMATICALLY IN PAST TWO DECADES

Note: All amounts are dollars in thousands adjusted for inflation to 2024 dollars

Source: TCA Venture Group

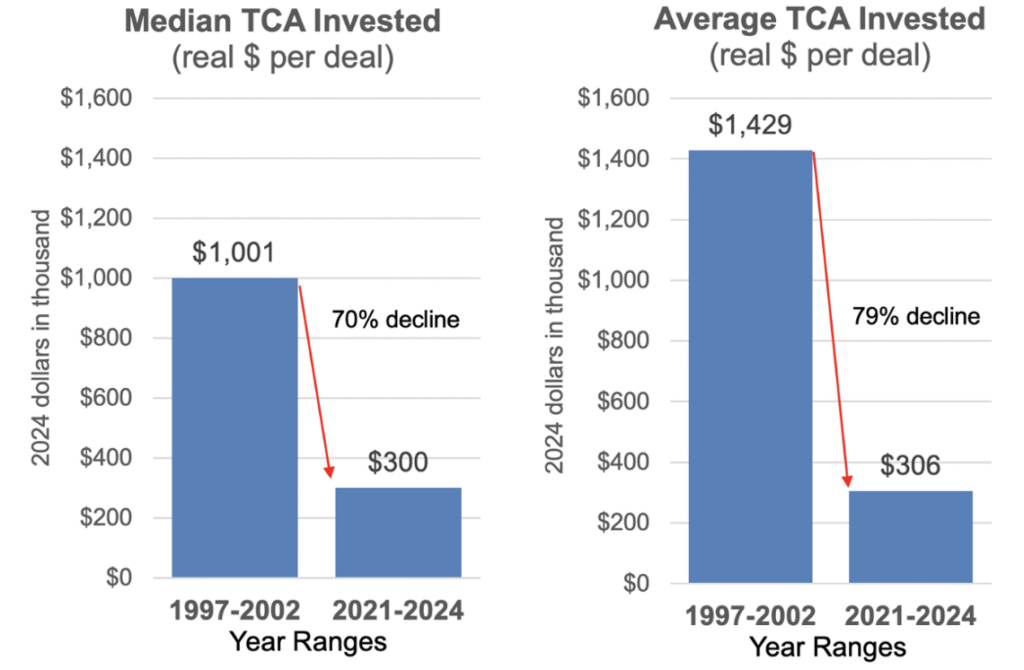

It is striking that TCA VG’s investment per deal has declined even more, and this was a contributing factor in the decline in TCA VG’s Board representation over those two decades, since smaller checks generally yield fewer board participation rights:

FIGURE 5: TCA VG INVESTMENT PER COMPANY DECLINED EVEN MORE IN PAST TWO DECADES

Note: All amounts are dollars in thousands adjusted for inflation to 2024 dollars

Source: TCA Venture Group

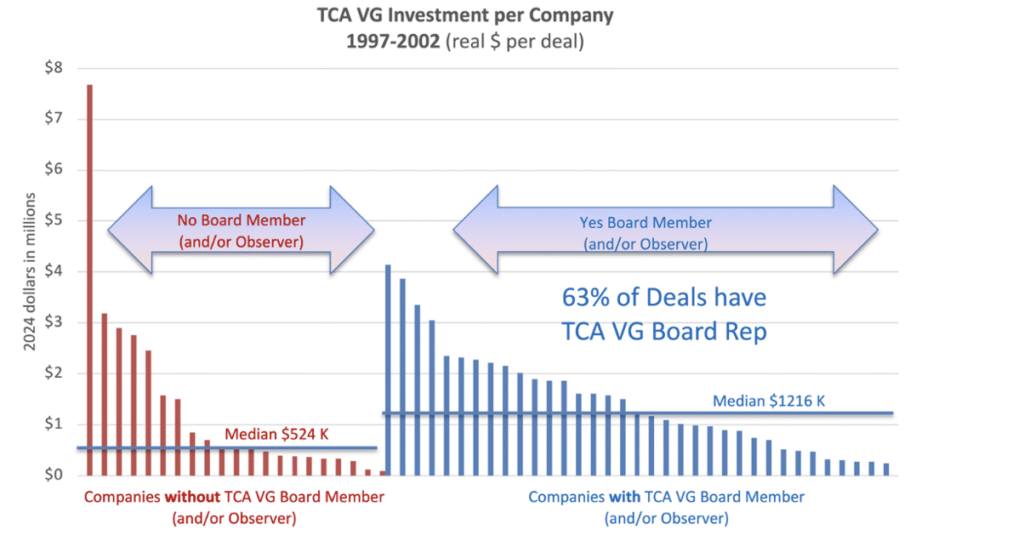

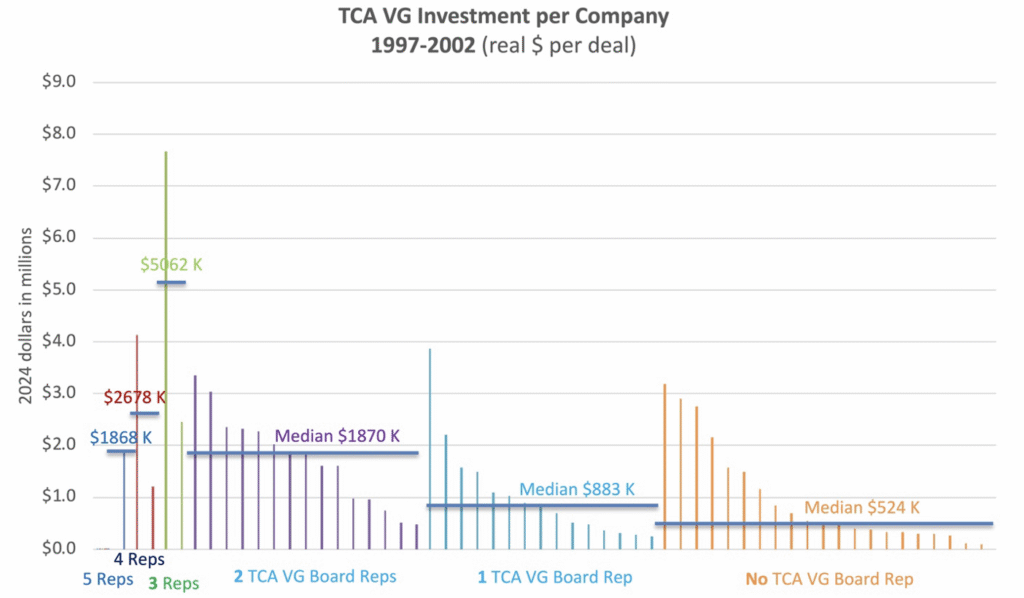

To test the relationship between investment and board representation, we will compare the TCA VG amounts invested across the two cohorts. For the 1997-2002 cohort, the 63% of the companies that had board representation received 2x the capital as those deals without a TCA VG Board member, median TCA VG investment of $1.216 M, compared to a median of $524 K for those with no board representation:

FIGURE 6: TCA VG INVESTMENT PER COMPANY DECLINED EVEN MORE IN PAST TWO DECADES

Note: All amounts are dollars in thousands adjusted for inflation to 2024 dollars

Source: TCA Venture Group

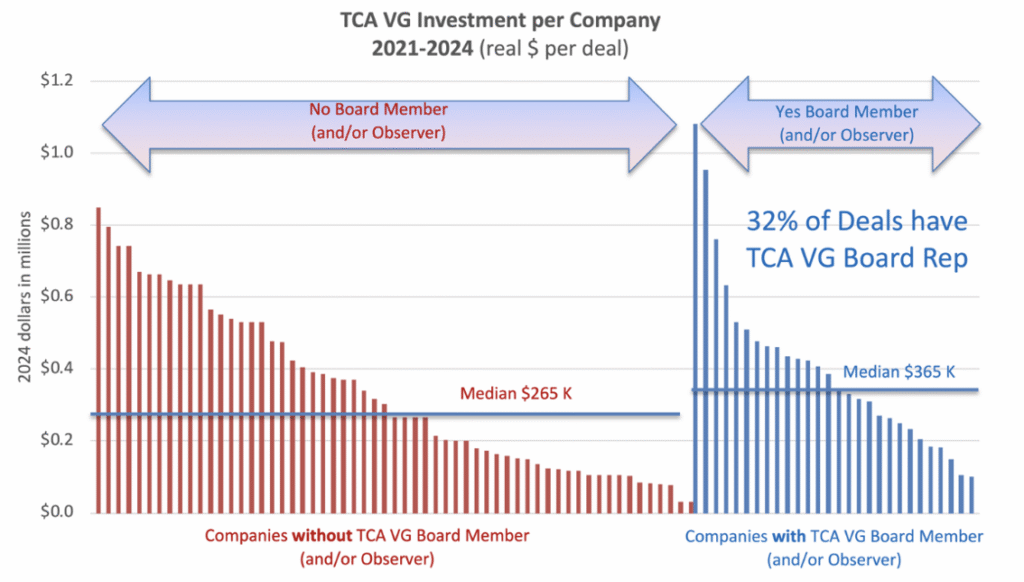

For the recent cohort of companies funded by TCA VG from 2021-2024, the 32% of companies with board representation had a median TCA VG investment of $365k compared to a median of $265k for those without board representation. For this latter cohort, a Board seat appears to have required TCA to invest nearly 40% more than the investment from investors not receiving a Board position.

FIGURE 7: TCA VG INVESTMENT PER COMPANY DECLINED EVEN MORE IN PAST TWO DECADES

Note: All amounts are dollars in thousands adjusted for inflation to 2024 dollars

Source: TCA Venture Group

The correlation between investment amounts and board representation is even clearer when looking at the number of board members and observers from TCA VG at the earlier cohort. Those without representation had a median of $524k, and the medians steadily increased with companies with more than one board member/observer:

FIGURE 8: TCA VG INVESTMENT PER COMPANY DECLINED EVEN MORE IN PAST TWO DECADES

Note: All amounts are dollars in thousands adjusted for inflation to 2024 dollars

Source: TCA Venture Group

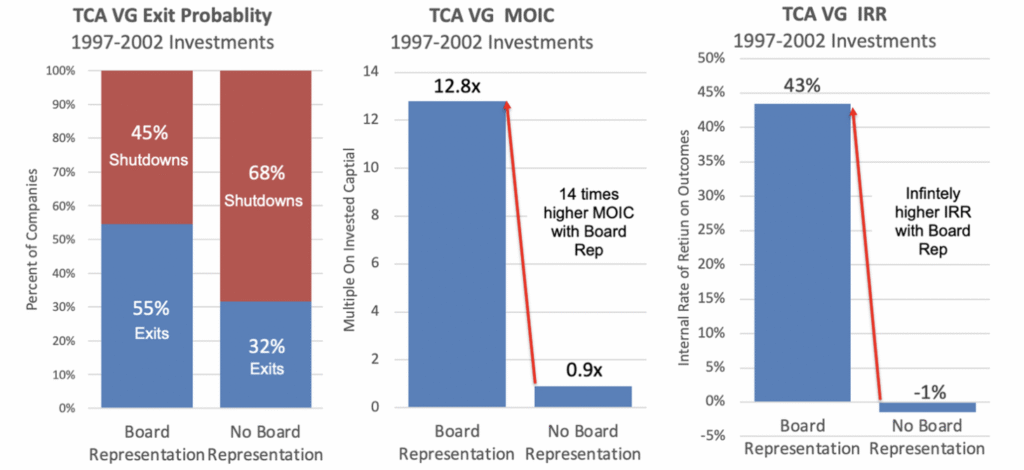

A final question is how these companies in the 1997-2002 cohort performed in terms of outcomes (Exits vs Shutdowns) and in terms of MOIC and IRR metrics. As Figure 9 shows, the companies with TCA VG board members did dramatically better in terms of outcomes. 55% of these companies with TCA VG board members realized an exit, compared to only 32% of those without TCA VG Board members. But even more dramatic was the difference in realized returns across all outcomes. Those with TCA VG Board members achieved a Multiple on Invested Capital (MOIC) of 12.8x and IRR of 43%. In contrast, those without TCA VG Board members returned less than the capital invested with MOIC of 0.9 and IRR of -1%. This is 14 times higher MOIC when there is a Board member or observer, and parallels the 7x times higher returns at CTAN previously mentioned.

One critical factor explaining why angel returns are higher when angels serve on the Board is that experienced angels can help grow and mature often inexperienced startup teams. By seed stage (the typical stage when angel groups invest) the issues confronting companies are far more complex and the risks far greater than during the product-focused pre-seed round. By seed stage, most companies (except life sciences companies) have customers, partners, employees. IP and larger investors—all opportunities for litigation risks. They have competitors, an ecosystem to manage and partnerships to craft. And exit opportunities can take place even at Seed Stage. Life Science, and financial sector companies or those with heavy use of AI all have additional, sector- specific risks, where lack of compliance can result in millions of dollars in losses and fines. Companies lacking experienced board members are, from a governance perspective, flying blind. A strong board can ensure good governance to avoid pitfalls and navigate serious operational challenges successfully, yielding stronger performance and higher-value exits.

FIGURE 9: BOARD REPRESENTATION DRAMATICALLY IMPROVES OUTCOMES AND RETURNS

Source: TCA Venture Group

Can we mitigate this trend of declining influence of angels on startup Boards? What can be done to improve the chances that a Board member and/or Board Observer can be negotiated into a deal? Let’s start by identifying the factors that seem to make that more likely.

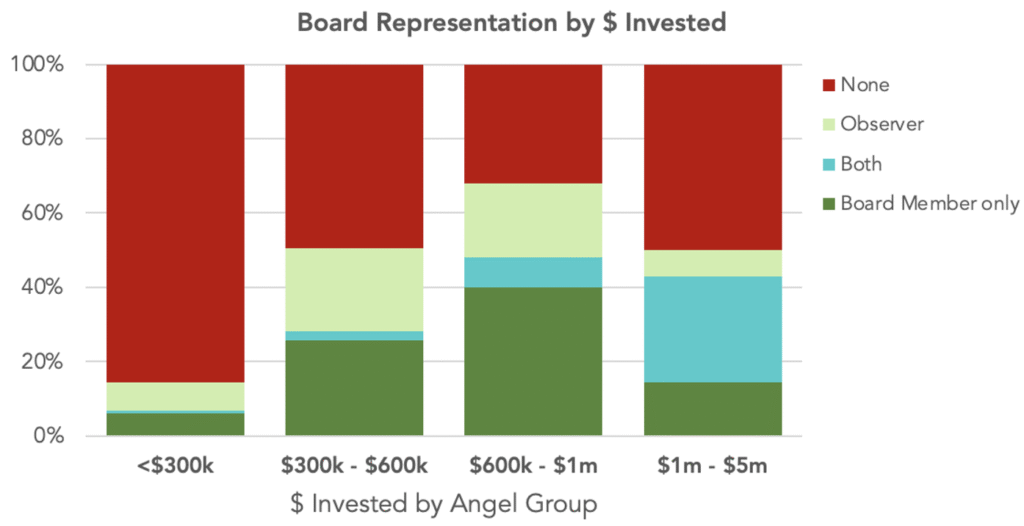

First, angel groups need to bring more capital to each deal. Looking at the AFR data from 70 angel groups in 2024, the most important factor is the amount invested by each group. While this may be beyond the control of angel groups, it is worth considering whether groups should allocate larger amounts of capital to fewer investments, increasing the chances of gaining Board representation for more of their deals.

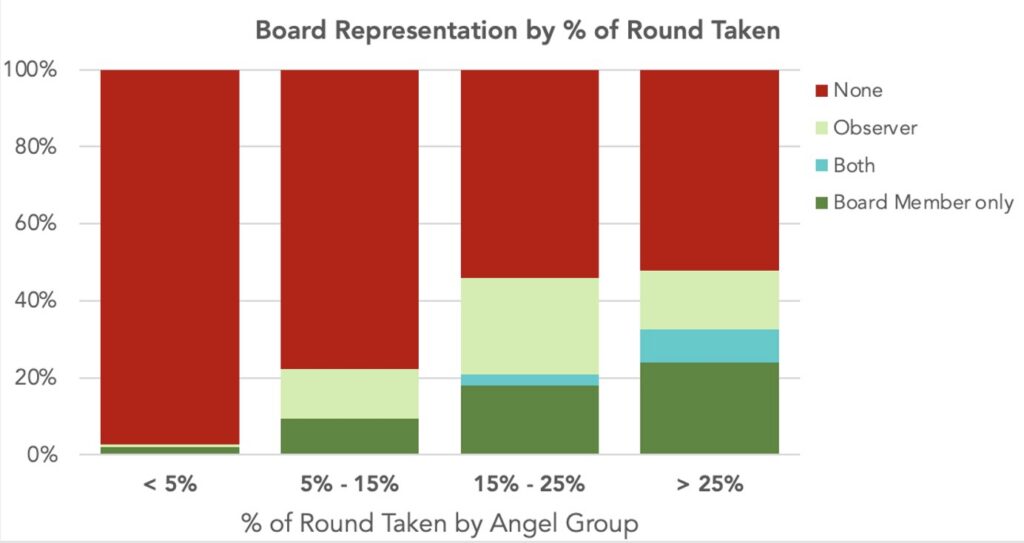

FIGURE 10: BOARD REPRESENTATION MORE LIKELY WITH HIGHER INVESTMENT BY ANGEL GROUP

Source: ACA Angel Funders Report Data for 2022-2024

Second, board membership is more likely when angel group investment is a larger percentage of the total round. Where the group’s investment is greater than 15%, having a board member and/or board observer happens half the time, compared to almost never when it is only 5% of the round and only 29% of the time when the group investment is between 5% and 15%: One way to increase angel contributions to a round is to actively syndicate with affiliated angel groups and be clear to management about the overall contribution of the lead angel group made via syndication to increasing the round size.

FIGURE 11: BOARD REPRESENTATION MORE LIKELY WITH ANGEL GROUP HIGHER % OF ROUND

Source: ACA Angel Funders Report Data for 2022-2024

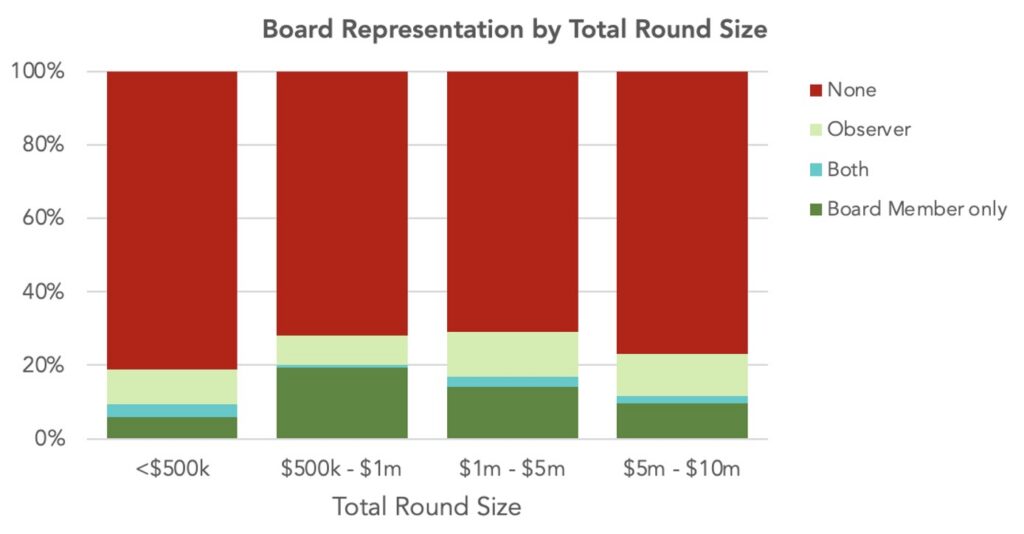

Third, the “sweet spot” seems to be total round sizes between $500k and $1 million, where 27% of the deals have board members, compared to 11% overall. Board member likelihood declines in larger rounds, probably due to the presence of larger institutional investors such as micro VCs who earn the board slots. But even in these situations, angels can advocate for board observer roles (citing the above analysis of CTAN and TCA VG returns being dramatically higher when angels are involved in the Board):

FIGURE 12: SWEET SPOT FOR ANGELS IS IN ROUNDS $500K – $1M

Source: ACA Angel Funders Report Data for 2022-2024

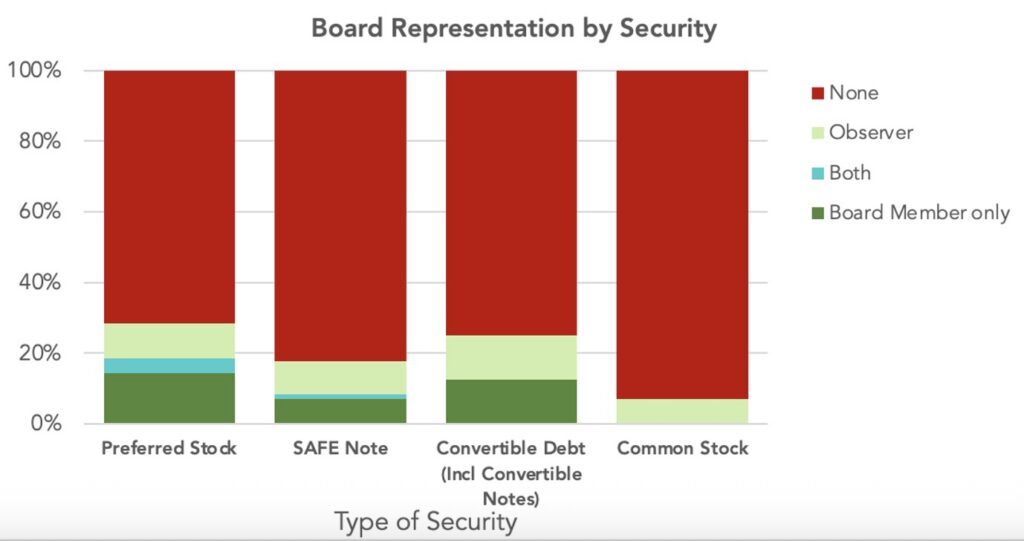

Fourth, there is some evidence that preferred equity deals are more likely to lead to board representation. There are many other arguments for preferring equity to convertible notes and SAFEs, but this is perhaps the most compelling argument: equity provides the best chance of a high value return; SAFEs, the worst chance. There were no instances of board members in common stock deals, and they were most common in preferred equity, followed by convertible notes. Board members were rarer in SAFE notes and investors are often explicitly excluded in the SAFE term sheet from serving on startup boards or having any other role in corporate governance. Therefore, advocating for preferred equity might lead to more board member seats. Since Board representation is highly correlated with higher returns, angels should think carefully about participating in deal structures denying one’s own group or other angels in the syndicate a Board seat. Indeed, deal structures which deny angels any role in company governance preclude angels from providing experienced guidance in any meaningful way, extending a company’s immaturity. A lack of experienced angel Board members is likely a contributing factor to the underperformance of SAFE deals compared to priced equity rounds. And the lack of a Board member representing the angel group or syndicate means that investors are denied access to information critical to deciding whether or not to participate in a follow-on round.

FIGURE 13: BOARD REP MOST LIKELY WITH PREFERRED EQUITY

Source: ACA Angel Funders Report Data for 2022-2024

Fifth, angel groups seeking Board representation often need to bring more than money to the deal. Having one or more members with deep industry background, success in growing or exiting companies in this sector, strong industry networks, a strong executive hiring network or deep governance skills are more obvious candidates for board roles. And continuing to add value as a Board member is the best way to retain a board seat during subsequent financings when angel seats are typically allocated to other investors unless value beyond the original financial contribution has been demonstrated by the angel group. Angels who are strong coaches and mentors or have managed high value exits are more likely to be retained for a longer period on the board. Adding business value is the surest way to gain and retain an angel board seat.

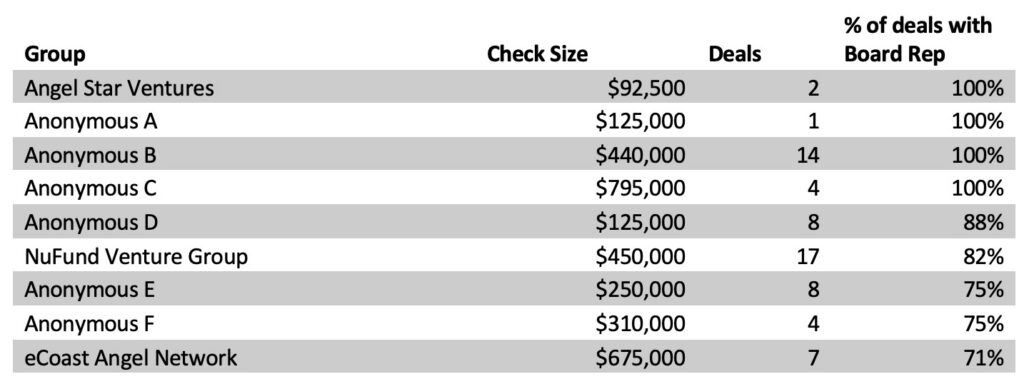

Sixth, an important way to strengthen board representation appears to be pursuing it actively as a deliberate part of the group’s overall investment strategy. During our analysis, a group of angel outliers emerged. These groups secured board representation far more than the overall population of angel groups. Their deal volumes and check sizes varied widely, suggesting that groups who prioritize boards and train their members to be value-added board members are far more likely to achieve board representation than those who offer money alone.

To better understand the practices behind this success in achieving board seats, we interviewed several of these angel groups, including Angel Star Ventures, NuFund Venture Group, and eCoast Angel Network.

- NuFund emphasized basing check sizes on board level participation, and this preference for larger investments is likely to have contributed to leading deals more often.

- eCoast considers board participation essential and actively pursues it, and when a board seat isn’t available, they request an observer role.

- Angel Star likewise reported consistently asking for a Board Observer role when a BBoard seat isn’t offered.

All three groups noted that their members provide meaningful value: connections, technical and business expertise, and strategic support, which strengthens their case for board membership.

Clearly, groups who actively pursue board seats are more likely to be awarded them.

Finally, and perhaps most critically, every negotiation for board seats should mention the key role that experienced angel board members play in generating better outcomes — something that the CEO should be as interested in as are investors. Cite the hard data-driven studies by CTAN and TCA VG that show returns are 7 times and 14 times better with angel participation on boards. Make sure all your deal leads understand analysis and can explain these outcomes to CEOs. Even if the amount invested is not sufficient to warrant a board seat, advocate for at least a board observer role. Based on our analysis, this is probably the single most important thing a CEO can do to position his/her portfolio company for success.

In summary, the decline in board representation by angel groups is extremely worrisome and counterproductive given the evidence that returns are far greater when angels are engaged on the Board. And experienced angel board members help strengthen companies by providing significant experience in negotiating the tough issues that growing companies face. While not every round provides the opportunity for reconstituting the board, there are, nevertheless, many ways to improve the chances of gaining and retaining a board or observer seat.

Key Takeaways

- Board Representation leads to dramatically better outcomes – 7 times better at CTAN and 14 times better at TCA VG

- Despite the demonstrable benefits to investors and management of experienced angel board members, the percentage of deals with board representation has been declining for decades, and has reached an all-time low of 16% in 2024

- There are things angels can do to improve their chance of board representation including:

- Bring more capital to each deal by concentrating on fewer but larger investments.

- Bring more than capital to each deal by demonstrating angels capability for true, value-added post-investment contributions: customer and partner introductions, hiring, navigating the market and ecosystem, effective governance, operational support, helping mature the management team and helping develop high value exits.

- Fund a larger percentage of the round – there is a significant difference between funding 10% of a deal and 20% of a deal

- Syndicate to increase the capital your group has brought directly and indirectly to the round

- Understand that the “sweet spot” seems to be round sizes $500k – $1M—round sizes that an angel group can dominate

- Advocate for Preferred Equity instead of SAFEs, with Convertible Notes with governance terms serving as a backup

- Perhaps most critically, angel groups should:

- Actively pursue board representation during negotiations

- Emphasize in negotiations the analysis on the critical role that angel group board participation plays in better outcomes, and make sure your deal leads have this analysis at hand.

AUTHORS

John Harbison, TCA Venture Group and ACA Data Analytics Committee Chair

Ron Weissman, Band of Angels, ACA Board Member, Immediate Past Chair of the ACA, and principal author of the ACA’s courses on Board of Directors

Kaison Giles, Cowtown Angels and ACA Data Analytics Committee Member