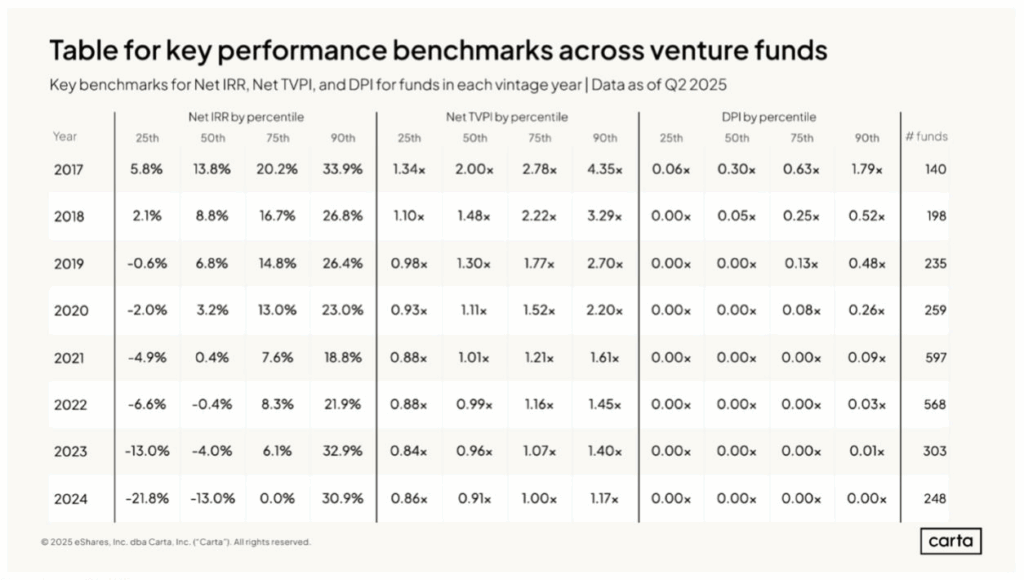

Source: Carta

Note on definitions: TVPI (Total Value to Paid in Capital), DPI (Distributions to Paid-In Capital)

Carta pooled data from 2,715 US venture funds and this is what it told us:

- Key metrics are on the rise: Median net TVPI increased at every fund vintage from 2017 to 2023 in Q2. For the 2017 vintage, median TVPI rose to 2.00x. Net IRRs also mostly trended up in Q2.

- Average LP check sizes have grown: At the smallest end (funds $1M-$10M), the average check was $127,000 between 2018-2021 and rose to $165,000 between 2022-2025. This same trend of larger checks from 2022 on holds true for funds up to $100 million in size.

- Dry powder is drying up: Most VC funds raised prior to 2021 have little dry powder remaining. Funds in the 2020 vintage, for instance, have just 11% of their total committed capital still available to invest. More recent funds are also deploying capital quickly. Funds in the 2023 vintage have 42% of their cash in reserve, while 33% of capital from the 2022 vintage remains as dry powder.

You can read Carta’s full VC Fund Performance, Q2 2025 report here.

KEY TAKEAWAYS

- DPI (Distributions to Paid-In Capital) is building slowly in a low-exit environment – even the best performing funds (90th percentile funds) since 2017 have only returned half their capital

- TVPI (Total Value to Paid in Capital) is still growing for all cohorts, although the Net IRR for all cohorts since 2021 is less than 10%

Subscribe to Carta’s Data Minute newsletter here for this sort of data-driven startup analysis every two weeks.

AUTHOR: Peter Walker, Head of Insights @ Carta and Data Storyteller