We all collectively dodged a bullet after the collapse of Silicon Valley Bank which threatened to destroy a whole generation of startups. Had the US Treasury and Federal Reserve Bank not intervened quickly, many companies would have lost their hard-won deposits and the market collapse would have made it extremely difficult for them to access new financing. Many more companies in and outside the tech sector would have struggled as their products and services stopped working because of reliance on these newly defunct tech companies’ products. While the short-term impact would have been dramatic for our entire economy, the long-term impact would have been far greater because it would have likely resulted in an unparalleled mass extinction event covering a whole generation of companies.

To understand the importance of that dynamic, this article explores the 100 largest employers in the US today and breaks them into decades since their founding to reveal insights on the long-term impact of losing a generation of startups.

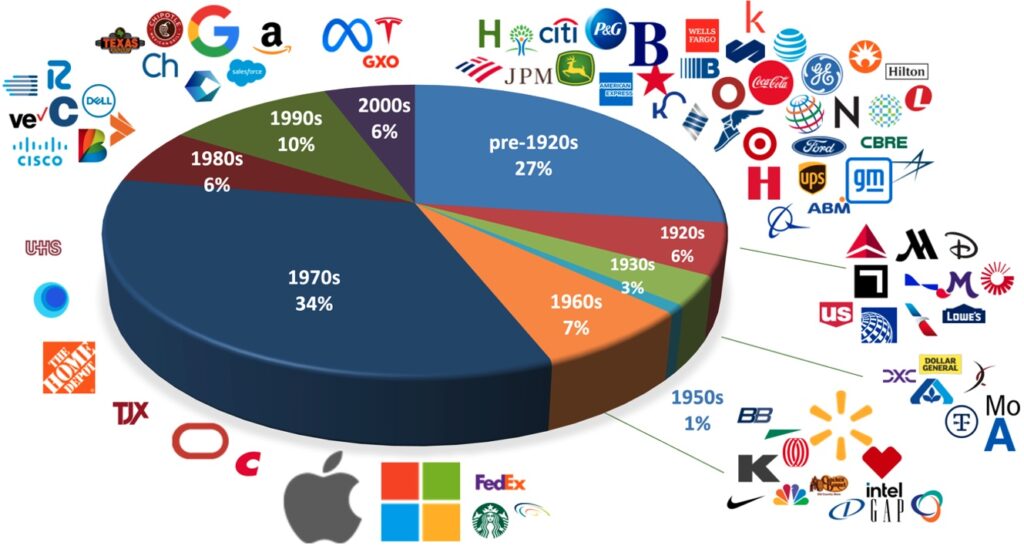

In terms of profit generation, 56% of profits in the top 100 companies today were from companies founded after the dawn of the era of venture capital and angel investing in the 1970s, and losing companies from any one decade would have wiped out between 6% and 34% of profit in the economy. That would have been hugely detrimental to the Government’s corporate tax base.

FIGURE 1: NET INCOME FOR TOP 100 EMPLOYERS BY DECADE FOUNDED

Source: Yahoo Finance for 2022 net income from continuing operations; Google search for year founded.

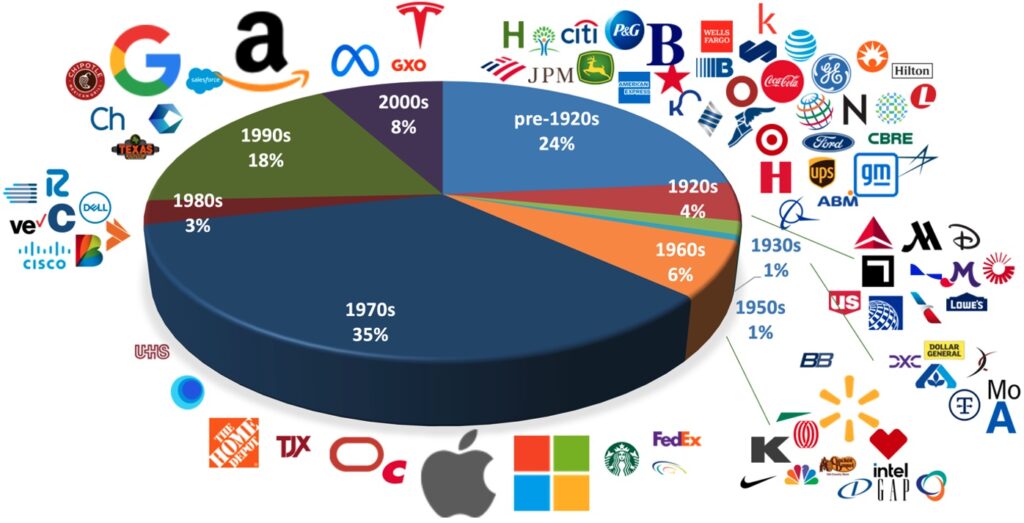

In terms of market cap, 64% of market cap of the top 100 companies were companies founded since 1970. That has generated enormous wealth and taxes through capital gains.

FIGURE 2: MARKET CAP FOR TOP 100 EMPLOYERS BY DECADE FOUNDED

Source: Yahoo Finance for market cap as of 6/6/23; Google search for year founded

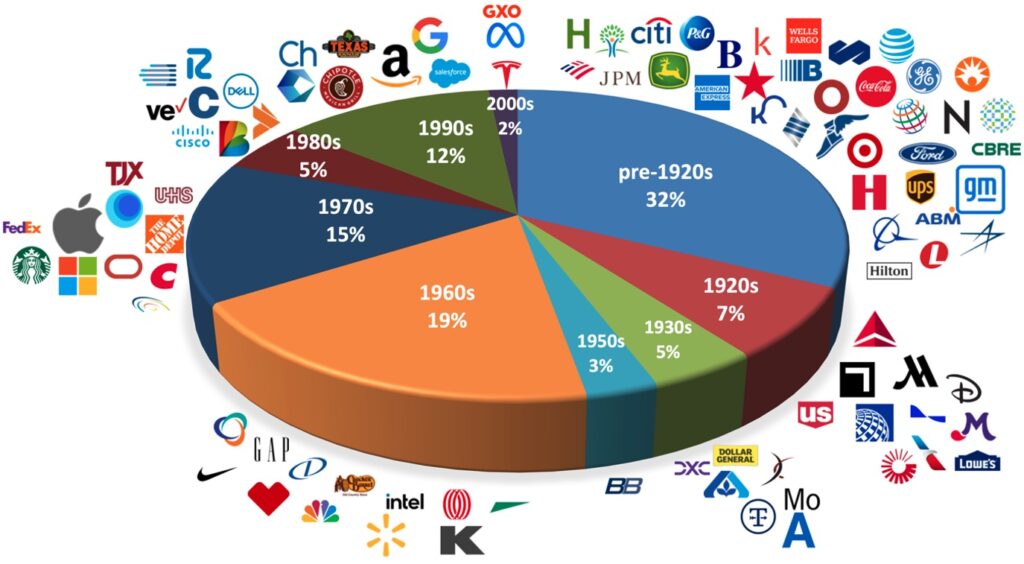

Finally, in terms of employment, early-stage investing is the engine of growth in national employment. A full 34% of employment at the top 100 companies comes from companies founded since 1970. Without them our economy would be a third smaller.

FIGURE 3: EMPLOYEES FOR TOP 100 EMPLOYERS BY DECADE FOUNDED

Source: https://companiesmarketcap.com/usa/largest-american-companies-by-number-of-employees/ ; Google search for year founded.

The impact of this startup ecosystem goes well beyond the jobs created at each company. For instance, Apple now has 164,000 employees but the total number of jobs created in the U.S. throughout its supply chain is well over 2 million including 450,000 jobs through U.S. based suppliers and 1,530,000 jobs attributed to the Apple App Store. And beyond Apple’s $385 billion in annual revenue, the Apple App Store ecosystem facilitated $1.1 trillion in developer billings and sales in 2022, comprised of $910 billion in total billings and sales from the sale of physical goods and services, $109 billion from in-app advertising, and $104 billion for digital goods and services. Additionally, new analysis from the Progressive Policy Institute found the iOS app economy now supports more than 4.8 million jobs across the U.S. and Europe, with approximately 2.4 million in each region.1

Comparing the top 100 companies on the 1960 Fortune 500 list to the list in 2020, only 17 made both lists. Change and churn is constant in our economy, and new companies are the lifeblood of the renewal process. Our investments are the catalyst and essential for bright future.

1 Per Apple Press release May 31, 2023

Key Takeaway:

- Beyond their contributions to societal improvements through innovation, the investments we are making today in early-stage companies will drive both near-term and long-term growth in employment, profits, and stock market gains for our economy, and tax revenue for the Government. Our economy would truly stagnate, and even decline, without that engine for growth.

Author:

- John Harbison, Chairman Emeritus of Tech Coast Angels and ACA Board Member.