As we reflect on 2025, the Angel Capital Association (ACA) stands proud of its unwavering commitment to advancing the art and science of angel investing. Through advocacy, education, and community building, ACA has solidified its role as the trusted voice for angel investors, empowering them to fuel innovation and drive economic growth. This year’s accomplishments were made possible by the dedication of our members, the innovative spirit of our entrepreneurial ecosystem, and the tireless efforts of our professional team and volunteers. Together, we expanded professional education, championed critical policy initiatives, and enhanced member experiences through new tools, resources, and platforms.

Angel investing isn’t just about funding startups—it’s about enabling bold ideas, fostering creativity, and strengthening our economy. Without the vision and commitment of angel investors, society’s ability to innovate would falter, and opportunities for transformative change would be lost.

Join us as we celebrate the highlights of 2025, showcase the impact of our initiatives, and share our ambitious goals for 2026. From strengthening public policy advocacy to growing educational opportunities and amplifying the voices of angel investors, we remain steadfast in our mission to create a thriving ecosystem that supports early-stage companies and the investors who fuel their success.

The best is yet to come, and we invite you to be part of this journey.

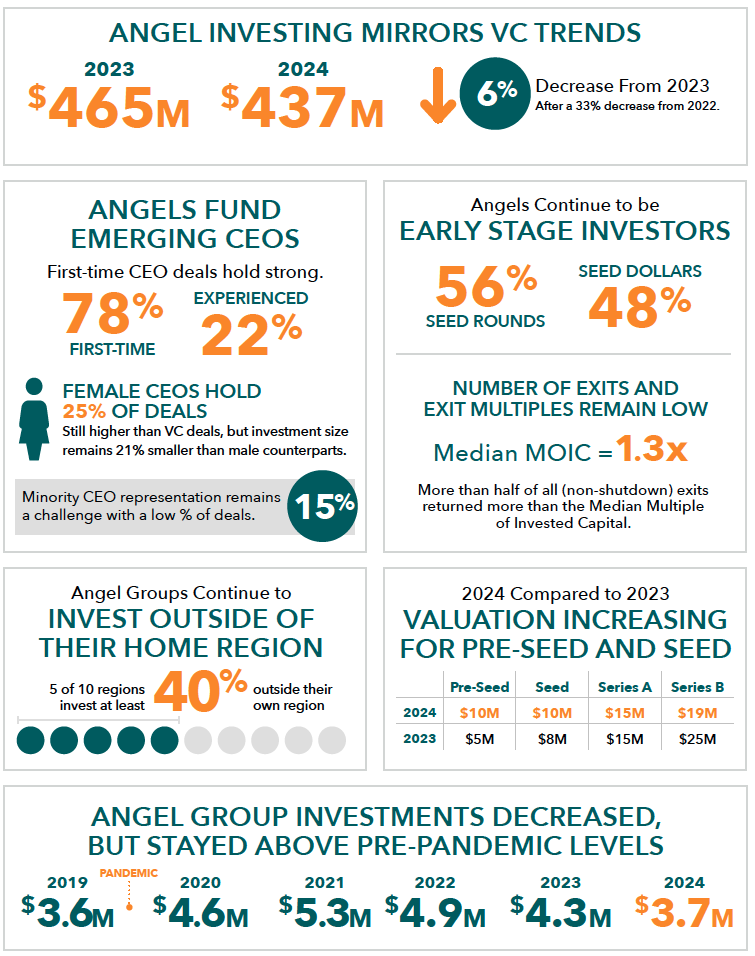

Highlights from the 2025 Angel Funders Report:

The Angel Funders Report 2025 delivers an in-depth analysis of U.S. and Canadian angel investment activity, drawing on direct data submitted by ACA member organizations across networks, funds, hybrid models, and syndicates. Despite a challenging fundraising environment for startups, the report underscores the resilience of angel investors as a stabilizing force in early-stage capital markets. While overall deal volume softened and exits slowed, ACA members continued to concentrate capital at the earliest stages, adapt deal structures, and support founders navigating market uncertainty.

Going beyond raw data, the report provides critical context on shifting sector allocations, evolving governance norms, valuation dynamics, diversity trends, and cross-regional investing. As I noted earlier, the findings reveal a nuanced and adaptive market—one in which angel investors continue to back bold ideas, support diverse founders, and evolve their approaches to ensure early-stage companies can thrive. Together, these insights make the Angel Funders Report one of the most comprehensive, member-sourced views of angel investing in North America.

What We’ve Accomplished and What’s to Come in 2026: Growth in Member Benefits, Syndication, Education & More

Membership & Engagement – ACA members are connected to the industry’s most trusted sources of capital and insight. Membership provides access to emerging investment trends, evolving deal terms, and proven exit strategies, while creating opportunities to connect with like-minded investors and entrepreneurs from around the country. The Angel Capital Association welcomes individual angels, accredited platforms, angel groups, networks, funds, ecosystem builders of all types, and family offices committed to advancing early-stage investing.

- Welcomed 15 new investor groups and ecosystem builders, as well as 60 individuals to ACA’s membership.

- Hosted an exciting and well-attended Summit of Angel Investing in Colorado.

- Onboarded hundreds of ACA Group Leaders to the new ACA online community platform and look forward to the rollout to full membership in 2026.

- Developed more tools for angel groups and grew our resource library with new webinars and content.

- Made upgrades to the ACA member portal, improving efficiency and access to ACA’s member benefits and updates.

- We added 105 ACA members to one or more syndication communities and amongst them 87 deals were shared.

Education:

In 2025, the ACA continued to deliver Angel University courses to aspiring angels, entrepreneurs, and community ecosystem builders.

ACA Educational Highlights from 2025:

- Thanks to the multi-modal opportunities of Angel University In-person, AU Live, and now AU On Demand, hundreds of hours of community-based education were delivered to investors, entrepreneurs, and ecosystem builders.

- The following organizations sent several members to Angel University classes demonstrating their thought leadership in the community: Catalyst Angel Program, TN Tri-Star Angel Program, University of Texas at Rio Grande Valley, and SeaAhead/NEAQ.

- Face-to-Face Courses were held at the following locations: Charlotte, NC, Jackson, MS, Shreveport, LA, Buffalo, NY and Rochester, NY.

- A new course, Angel Group Formation, was launched as part of Fall Angel University curriculum.

- A new instructional experience, Angel University on Demand, was launched. This delivery format allows participants to complete Angel University courses in a self-paced, asynchronous learning environment.

- Several communities took advantage of a new hybrid approach to community and investor nurturing – the Angel University Watch Party! Thank you to Buffalo, NY, Shreveport, LA, and Dayton, OH for being early adopters. More are already planned for 2026!

- Go online to check out our courses!

The Angel Next Door Podcast, Hosted by Marcia Dawood:

2025 was a year of transformation for the Angel Next Door podcast, as we expanded our perspective of wealth—embracing angel investing, as well as new definitions of abundance, purpose, and possibility. Together, we challenged old money stories, grew in knowledge, and built deeper connections, shaping a more inclusive and empowered vision for the future of investing. As we look ahead, the horizon is full of opportunities to keep learning, investing with intention, and reimagining wealth in ways that create lasting impact for ourselves and our communities.

The Angel Investor Foundation: is ACA’s wholly owned 501c3 subsidiary that supports our education, data and research programs. The Angel Investor Foundation:

- Raised nearly $30,000 for AIF in 2025 to support ACA’s education, data and research programs and deliverables.

- The annual Bill Payne Memorial Scholarship was awarded to Julia Morelli, President of George Mason University Institutional Foundation, Inc.

- Sold out “A Taste of Colorado” – an event celebrating AIF at the annual Summit.

Public Policy:

ACA believes in the impact and benefits of angel investing to entrepreneurs, job growth and the economy. Deeply active on the federal legislative and regulatory fronts, ACA helps safeguard and galvanize the rights of American angel investors so that we can protect the foundation that fuels the startup economy. ACA represents our members, but we invite investors to lend their efforts – a combined voice matters.

2025 Highlights in Public Policy:

- Distribution of a quarterly newsletter, recapping and highlighting the current hot topics and ways that ACA has supported and protected angels on the hill.

- The ACA Public Policy Committee went on the offensive to enhance the 1202 qualified small business stock gain exclusion passed into law with H.R. 1 (aka One Big Beautiful Bill) which added a phase in period beginning at year 3 of a qualified investment.

- Similarly, we fought off threats to raise the financial thresholds on the accredited investor definition and continued to advocate for new on-ramps that would provide a more inclusive path to accreditation. These provisions are part of the INVEST Act which is anticipated to be passed in the days ahead.

- Active engagement: ACA remains a critical member of several coalitions amplifying our voice and influencing both legislation and regulation. Two of these important coalitions are the www.innovatoralliance.org and the Accredited Investor Alliance.

- ACA had a front row seat with active participation on the Security and Exchange Commission’s Small Business Capital Formation Advisory Committee where former ACA chair, Marcia Dawood participated in quarterly meetings in February, April, May, July, and November and ultimately became the Chair of this important advisory group. On multiple occasions additional face to face meetings with elected officials and senior staffers were set up to educate and advocate on the most pressing issues affecting investors, entrepreneurs, and the startup ecosystem. The Public Policy Committee also conducted more than 50 virtual meetings throughout the year.

- Over the course of the year we submitted 18 comment letters that can be found in chronological order here.

- These comment letters were often done with coalition partners amplifying the voice we would otherwise have.

- Issues covered include Expanding Accredited Investor Eligibility, American Innovation and R&D Competitiveness Act, DEAL and ICAN Act, SBIR/STTR Reauthorization, INVEST Act, and other areas of critical importance to investors and entrepreneurs alike.

Throughout the year we built on the momentum generated by the innovation coalition (www.innovatoralliance.org) with our advocacy friends. This coalition website features one pagers on topics of critical importance to the community including enhancing Section 1202, restoring the provisions of Section 174, Modernizing the tax treatment of NOLs with Sections 382 and 383, Expanding the ownership economy by aligning tax to time of sale, and maintaining treatment to incentivize investment with carried interest. Look for more on ACA’s role in this alliance on innovation in 2026!

Partnerships:

Partnerships are critical to the ACA – not only in terms of revenue that supports our work, but also in connecting the right organizations who can support our angel investors.

In 2025 we:

- Launched a Partnership Advisory Council to bring in additional expertise that will allow us to better meet the needs of partnering companies.

- Raised the average transactional value for partners providing new opportunities and exposure to them.

- Created ACA Advantage with exclusive partner offers that are uniquely positioned for the membership.

- Expanded eligibility criteria for Innovation Funders Showcase companies beyond just member groups allowing ecosystem builders who have capital ready founders a new channel to complete their raise.

Growing the Voice of Angel Investors:

In 2025, we grew the readership of ACA publications by more than 11.51% – meaning a growth of 36.34% over the past two years. This means that more potential angel investors have access to the smart practices and knowledge within the ecosystem and that more angels have the tools to create better outcomes for their established groups. It also means that entrepreneurs and ecosystem builders have inside knowledge on thought leadership and understanding of the typical Angel which allows alignment on expectations to occur more efficiently.

Ways You Can Stay In-the-Know in 2026:

- Subscribe to the ACA LinkedIn Newsletter

- Get involved! Our work is driven by dedicated volunteers across many strategic areas and we are always looking for enhanced volunteer participation as instructors for Angel University or participation on one of our committees: Education and Smart Practices, Public Policy, Marketing, Membership, Syndication or Data Analytics!

- Attend the Angel Capital Association Summit in Denver, Colorado. Led by Rockies Venture Club’s Kevin Kudra, this event is a not-to-miss gathering of angel investors, startups, ecosystem builders and other experts where you can learn, expand your network, develop relationships and so much more!

- Explore Angel University – ACA’s flagship education platform offers in-person, live virtual, and on-demand courses designed for angels, entrepreneurs, and ecosystem builders at every stage. Angel University delivers practical, experience-driven learning to help participants build skills, strengthen networks, and improve investment outcomes.

- Join or Renew Your ACA Membership – ACA membership connects you to the largest professional network of angel investors, groups, funds, and ecosystem builders. Members gain access to exclusive education, research, policy advocacy, syndication communities, events, and tools designed to support successful early-stage investing.

2026 Promises to be an Incredible Year: Get Involved

Our community will always be only as strong as the commitment of our members. Join, get involved and increase your engagement to build a brighter tomorrow than would otherwise be possible. We want to encourage all of you and the millions of potential/future angels to join us in our journey. If you are deploying capital to grow early stage companies, growing that company, or otherwise contributing to their maturation, you are part of this critical ecosystem and we invite you to engage with us! Help us create a powerful network of entrepreneurs, investors and community resources so that we can continue to support economic growth and drive innovation. Angel investing is a team sport and ACA welcomes you to join us as we strive to make angel investing more accessible and successful for all.

The ACA Summit in 2026 is returning to the Mile High City – where all things are possible! Join us for three days of quality content, interactive discussions and vibrant networking to elevate your angel investing experience. Whether you are a new or experienced investor, angel group leader or part of the broader community supporting entrepreneurs and early-stage investments, you’ll learn the latest on trending topics and meet new people, all to help improve your outcomes.

We need you! Take advantage of ACA’s many opportunities to get involved. Thank you to our passionate membership for actively creating a more innovative world. We look forward to increasing our value to you as you progress along your journey. For those new to ACA, join the organization and take advantage of valuable member benefits or register for an upcoming event or course. We can’t wait to meet you and connect you to our incredible network of angels, ecosystem players and early-stage companies.

Sending my best wishes for a successful 2026 to come!

Patrick Gouhin

Chief Executive Officer, Angel Capital Association