TBD Angels, an operator-heavy, Boston-based network, was founded on the thesis that together, and through collaboration and leveraging the collective knowledge of our diverse group of investors, we could make better investment decisions. Over the past five years, the group has grown to an investor base of nearly 300 who have invested in over 90 deals. Our tech-driven approach streamlines investing, fosters collaboration, and extends support beyond funding – offering founders insights and guidance.

We utilize All Stage for deal flow management, investor engagement, and analytics, allowing us to streamline operations, improve decision-making, and gain valuable insights from the platform’s data. Annually, we produce an annual report highlighting key statistics and interesting insights. The report helps us better understand a snapshot of metrics related to our deal flow and membership, but when we view the data holistically across time, emerging trends are uncovered. By sharing these insights from our 2024 report, we aim to benefit fellow ACA groups and the broader investment community.

This Data Insight article looks at a subset of that analysis on trends covering deal lifecycle and team dynamics.

Deal Lifecycle

The TBD Angels deal lifecycle incorporates multiple phases, where members assess the deal, interact with the founders through Q&A, and express their interest by voting, providing feedback, and making commitments.

At a glance, the process seems either overly chaotic, like the Boston roads, or tightly buttoned up like a tailored suit. However, when we evaluate these lifecycles over time, it allows us to explain what we see.

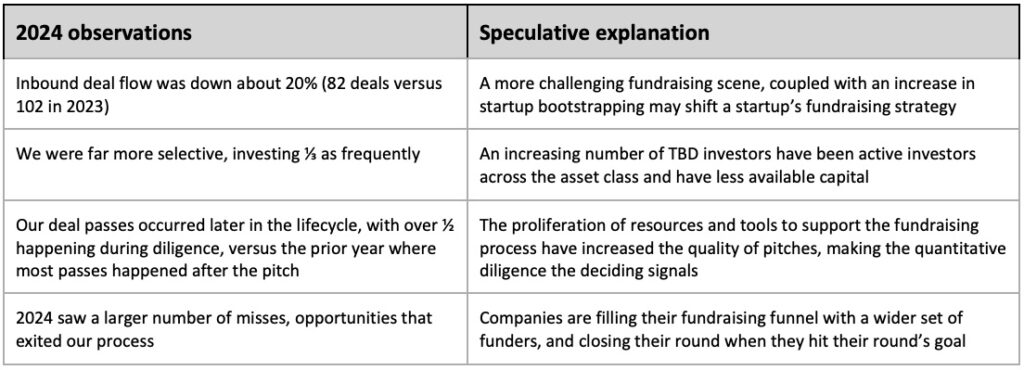

2023 DEAL FLOW DYNAMICS

Source: TBD Angels 2024 Annual Report.

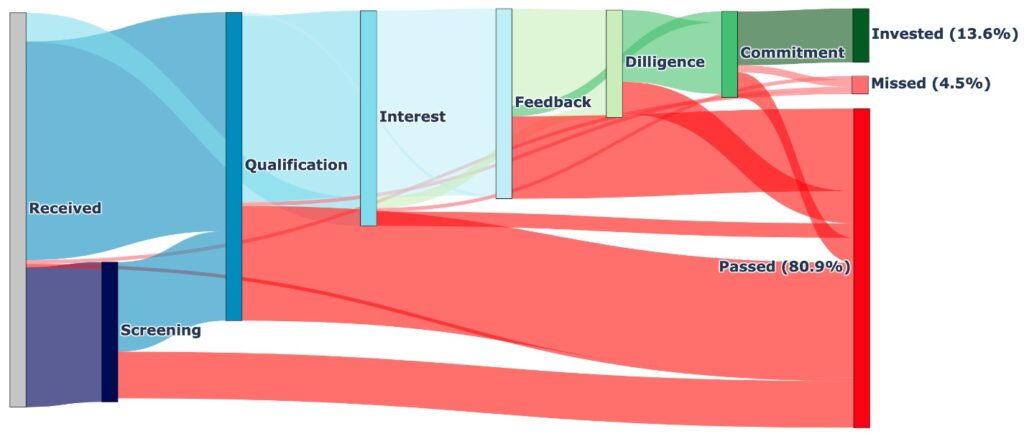

2024 DEAL FLOW DYNAMICS

Source: TBD Angels 2024 Annual Report

Status Key

- Received: All deal submissions

- Screening: Triaged by screening team

- Qualification: Voted on by membership

- Interest: Invited to pitch

- Feedback: Received feedback from membership

- Diligence: Moved to deeper review by subset of membership

- Commitment: Received commitments from membership

- Missed: Deal was terminated by choice of company

- Passed: Deal was terminated by choice of membership

- Invested: Funding from membership

- Still Active: Remains in deal flow in the following year

Team Attributes

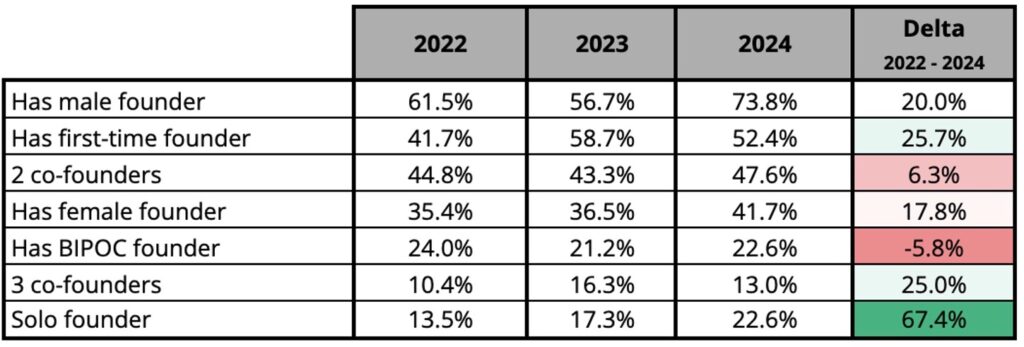

In the five years since our founding, we’ve observed changes in the prevalence of certain team makeups. We’ve also witnessed the influence that these attributes can have on investor sentiment towards a deal.

When we evaluate the share of deals with a certain demographic attribute, we find some notable increases in incidence

- The significant increase in the percentage of solo founders is noteworthy. This is likely a sign of more acceptance around independent entrepreneurship and the availability of AI tools such as code co-pilots, and generative AI, allowing entrepreneurs to automate tasks and accomplish more with less human capital.

- The consistent increase in the percentage of companies with female founders suggests a positive trend towards greater gender diversity in the startup ecosystem, which aligns with a diversity mission we have at TBD Angels.

TRENDS IN TEAM COMPOSITION

Source: TBD Angels 2024 Annual Report

We continue to hold strong to our founding thesis that diversity in portfolio company team makeup is part of the recipe for success and may contribute to some of the deal feedback results each year.

- Data reveals that aggregated feedback scores have been decreasing with time, and in parallel, long-term members are typically more critical in their evaluations compared to newer members.

- The significant drop in feedback scores for deals with solo founders in 2024 may be linked to the increased prevalence of such deals, suggesting a potential dilution of overall deal quality within this segment.

- Deals with a black, indigenous, and people of color (BIPOC) founder were the only team attribute category experiencing an increase in feedback scores in the past five years. We are hopeful that it will help contribute to diverse teams securing more early-stage capital

TRENDS IN FEEDBACK SCORES

Source: TBD Angels 2024 Annual Report

KEY TAKEAWAYS

- Fundraising pitch material and investor engagement is getting tighter, resulting in passes happening further in the deal lifecycle.

- Companies are closing their fundraising rounds early, having secured sufficient funding from other investors in their pipeline.

- The rise of deals led by solo and first-time founders signifies the positive impact of founder education and AI tools, which empower entrepreneurs to create value with fewer resources.

- Feedback scores on deals from companies with BIPOC founders improved, despite an overall decline in investor feedback ratings over the past three years.

AUTHOR: Jason Burke, Managing Director & Co-Founder of TBD Angels