I’ve been an angel investor for more than two decades and have witnessed several investment cycles with over 60 investments made. In an earlier ACA Data Insight article published in June 2024 titled “Why Have Early Stage Valuations Remained Surprisingly High?, I wrote about the impact of economic cycles on valuations, and the fact that this current downcycle seems to be bucking the normal influence of downward cycles on lowering valuations.

That leaves the question of Why? This article analyzes the distribution of valuations and explores some potential quantifiable factors such as stage of development, revenues, employee headcount, and type of security, as well as the impact of higher valuations on the number of members with a group choosing to invest, and ultimately the total funding from an angel group.

The data is based on the submissions of approximately 65 ACA Member Angel Groups in 2022 and 2023, which covers 3,774 investments – clearly a representative sample of all angel activity. This is the database used in the ACA’s Angel Funders Report.

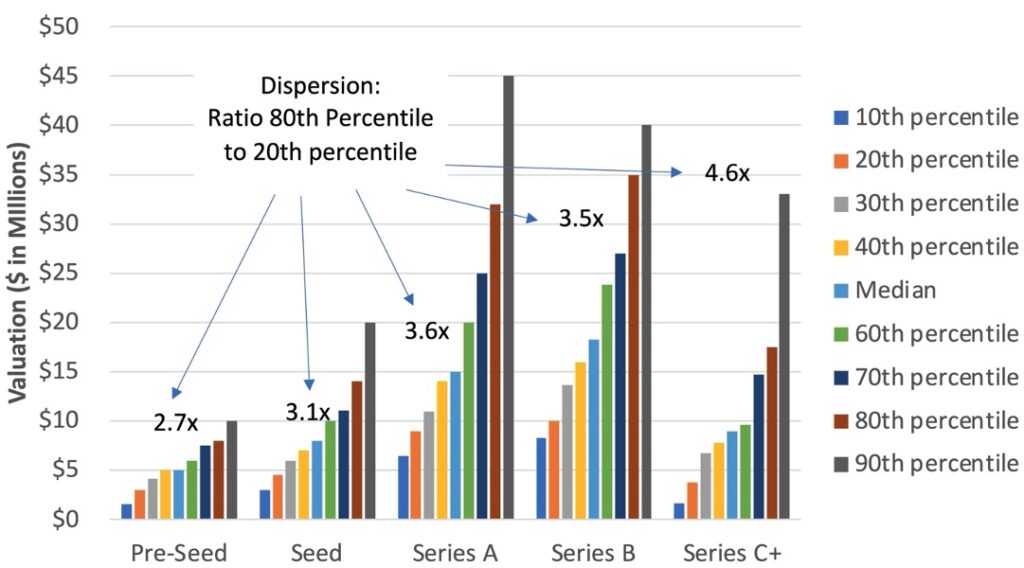

First of all, while medians are the best single way to measure valuations, the dispersion in terms of percentiles is also revealing. Valuations do tend to increase by round, but the dispersion also increases, with the ratio of the 80th percentile compared to the 20th percentile ranging from 2.7x in Pre-Seed to 4.6x in Series C+:

Figure 1: Valuations by Round (2022-2023)

Source: ACA Angel Funders Report Database of 3774 Investments in 2022 and 2023

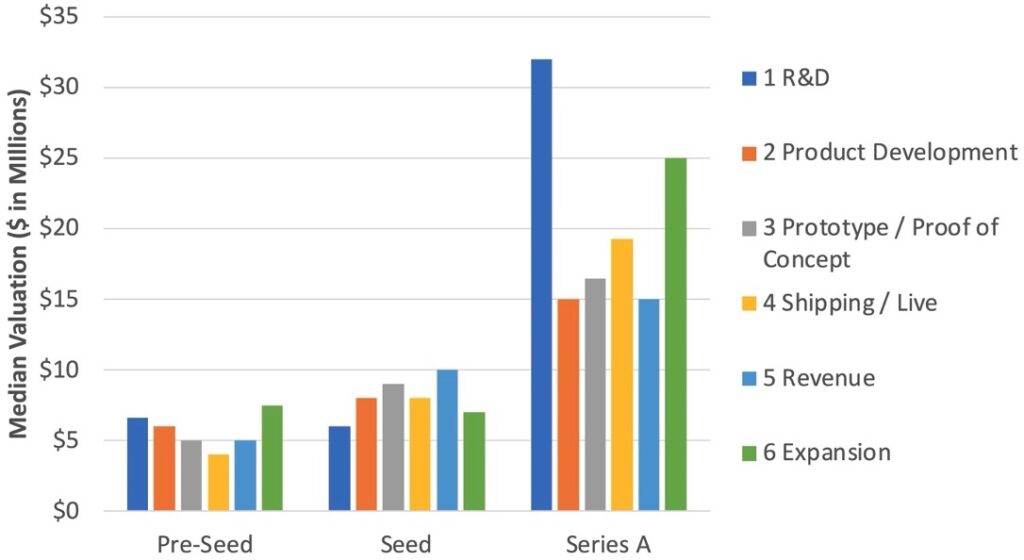

So what explains the dispersion? My first hypothesis was the stage of development of the company — postulating that those with products in the market would command a higher valuation than those still in development. However, for Pre-Seed, those companies shipping product and earning revenues did not command higher valuations compared to those earlier in the cycle. In Seed there is some positive correlation supporting the hypothesis:

Figure 2: Median Valuations by Stage of Development (2022-2023)

Source: ACA Angel Funders Report Database of 3774 Investments in 2022 and 2023

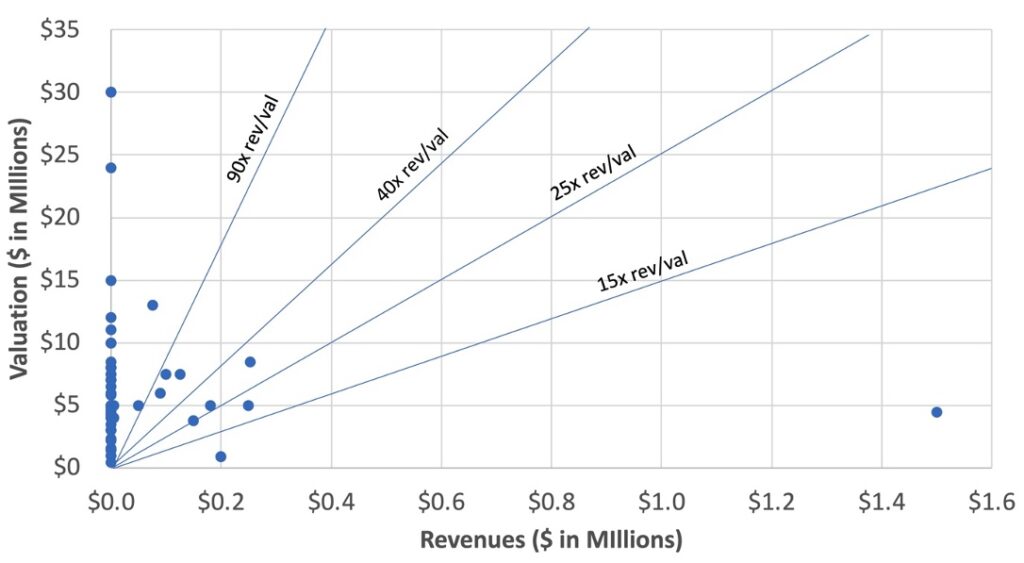

Surely, we would expect to see companies with higher revenues command higher valuations, but that did not bear out in Pre-Seed rounds:

Figure 3: Pre-Seed Valuation vs. Revenue (2022-2023)

Source: ACA Angel Funders Report Database of 3774 Investments in 2022 and 2023

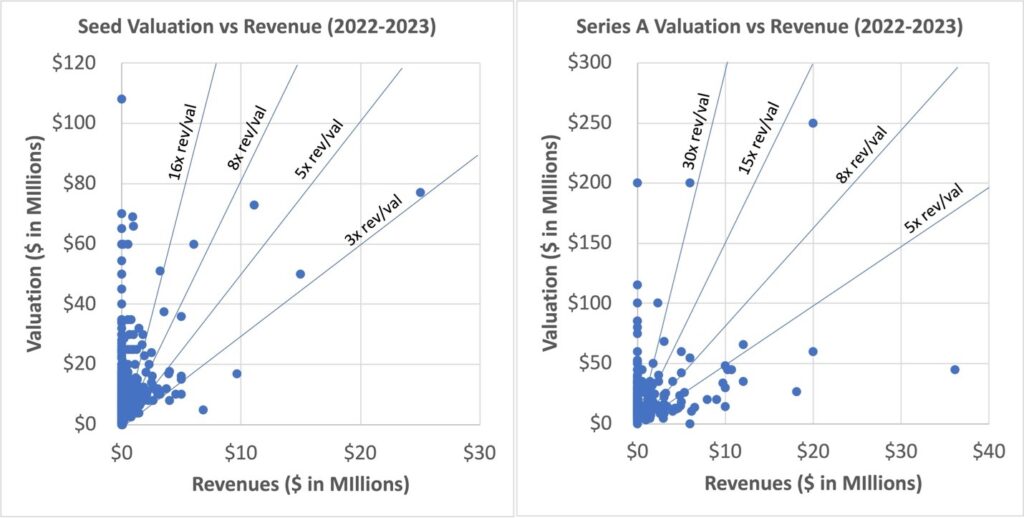

There was a bit more of a correlation in the later rounds, but still lots of exceptions:

Figure 4: Seed & Series A Valuations vs Revenue (2022-2023)

Source: ACA Angel Funders Report Database of 3774 Investments in 2022 and 2023

If proof of concept in terms of paying customers and revenue is not really moving the needle much, what else might matter?

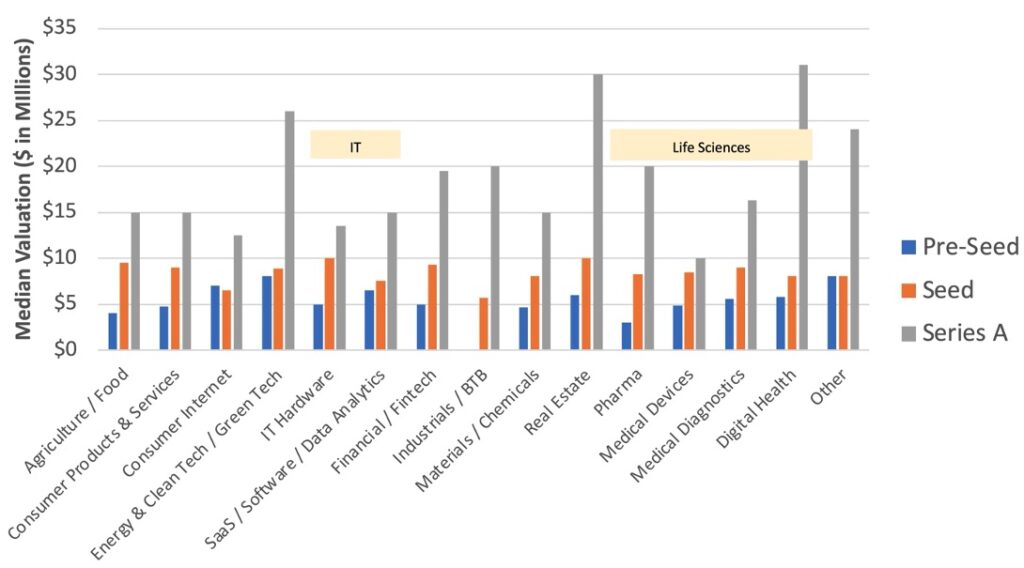

Which vertical a company is in seems a reasonable hypothesis, but the differences across verticals do not show a clear pattern across rounds:

Figure 5: Median Valuations by Vertical (2022-2023)

Source: ACA Angel Funders Report Database of 3774 Investments in 2022 and 2023

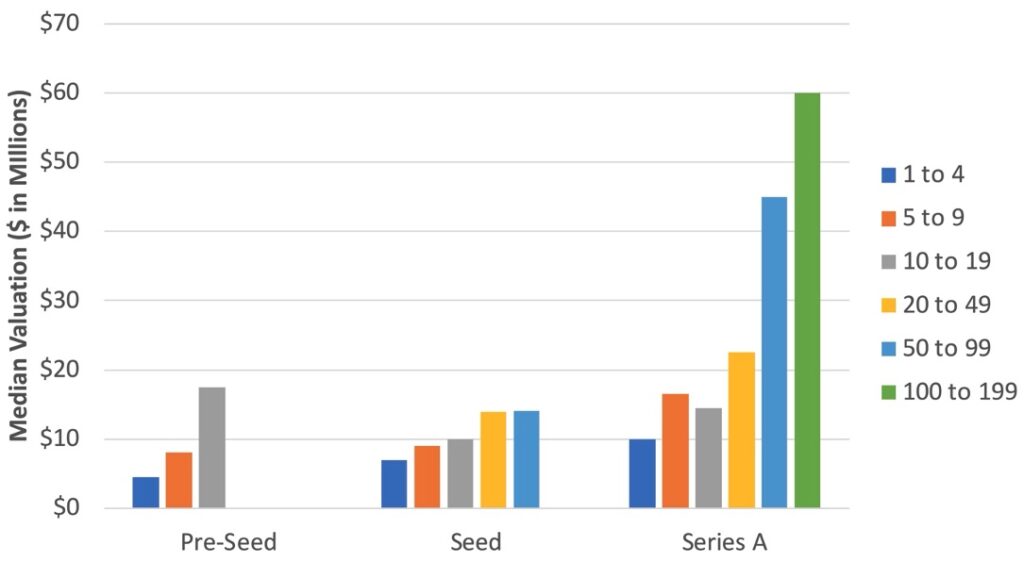

How about the number of employees, since some exits are more about “acqui-hiring” versus the value of the ongoing business? Here we do see a modest correlation, with larger teams commanding higher valuations. Part of this is due to expertise and skills accumulated, but part of it is the derived barriers to entry and speed to market that a larger already assembled team can bring:

Figure 6: Median Valuations by FTE Employees (2022-2023)

Source: ACA Angel Funders Report Database of 3774 Investments in 2022 and 2023

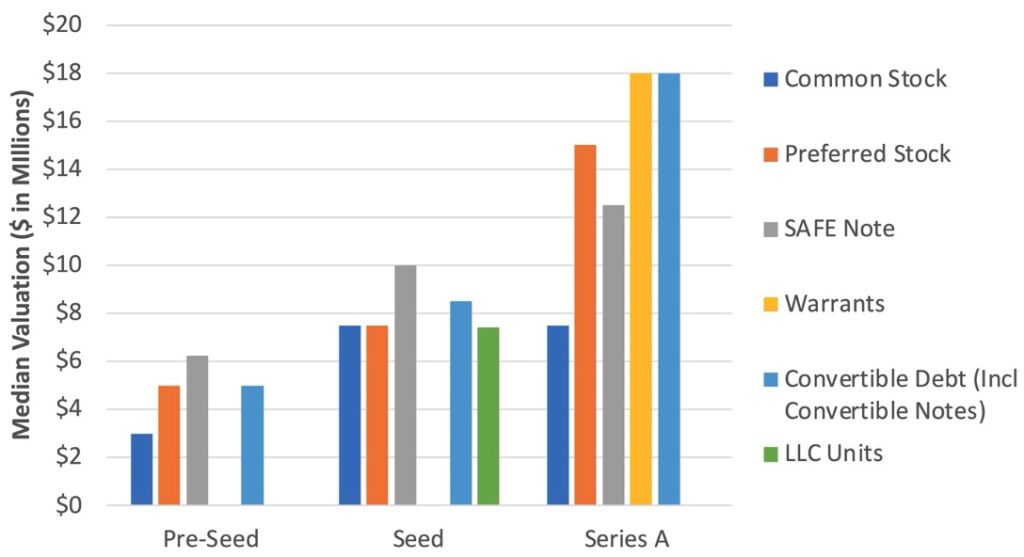

In terms of type of security, SAFE Notes captured a premium valuation in Pre-Seed and Seed, perhaps due to the use of SAFE signaling more bargaining power on the company side. However, this premium for SAFE’s went away in Series A deals:

Figure 7: Median Valuations by Type of Security (2022-2023)

Source: ACA Angel Funders Report Database of 3774 Investments in 2022 and 2023

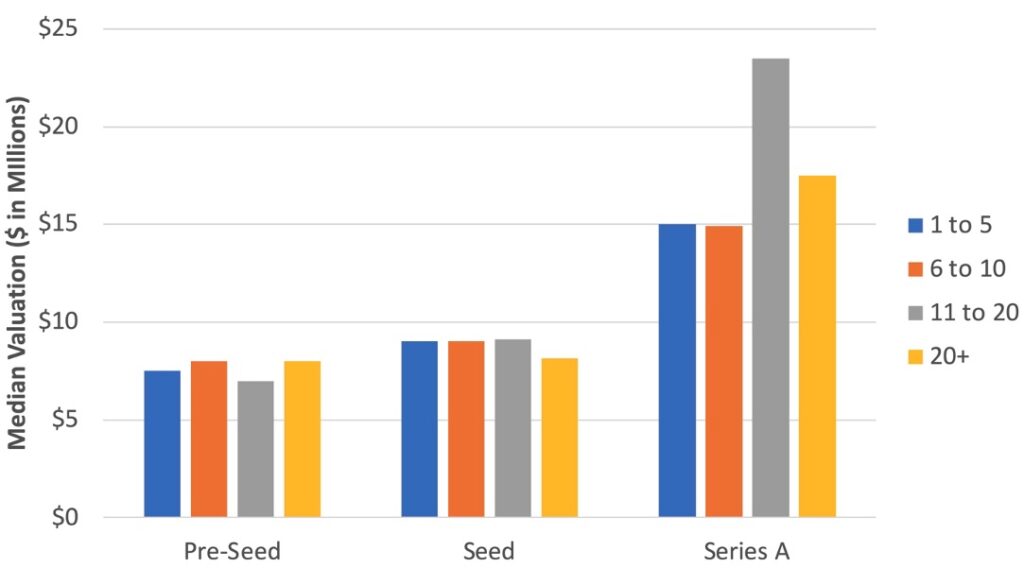

Do higher valuations discourage investment independent of other factors? Not really, since valuations within a round type did not vary significantly:

Figure 8: Median Valuations by # of Members Investing (2022-2023)

Source: ACA Angel Funders Report Database of 3774 Investments in 2022 and 2023

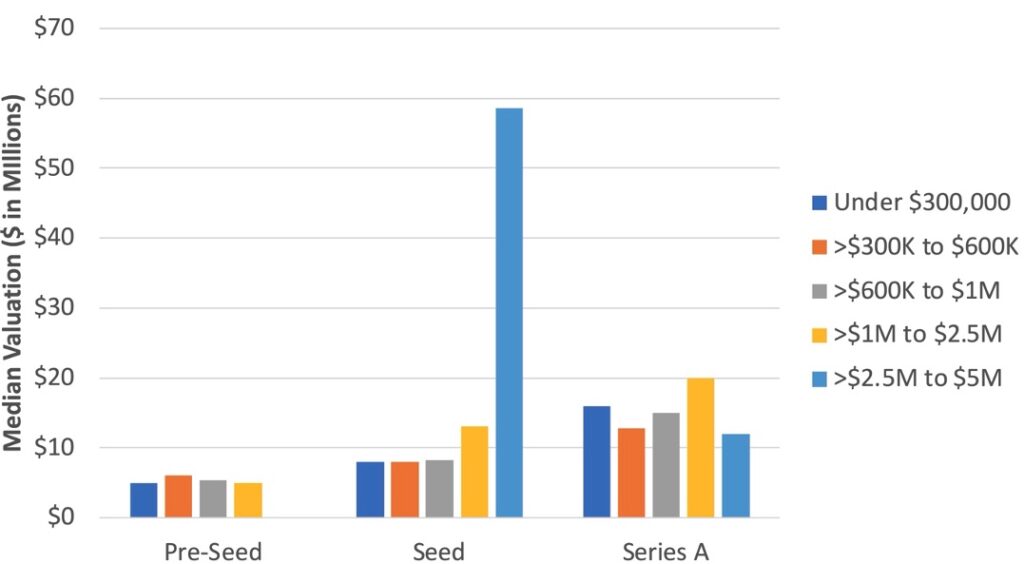

More members investing brings more capital to bear, and some of the largest investments are in companies with high valuations – suggesting that the enthusiasm for these companies is driving valuations up:

Figure 9: Median Valuations by Amount Invested by Group (2022-2023)

Source: ACA Angel Funders Report Database of 3774 Investments in 2022 and 2023

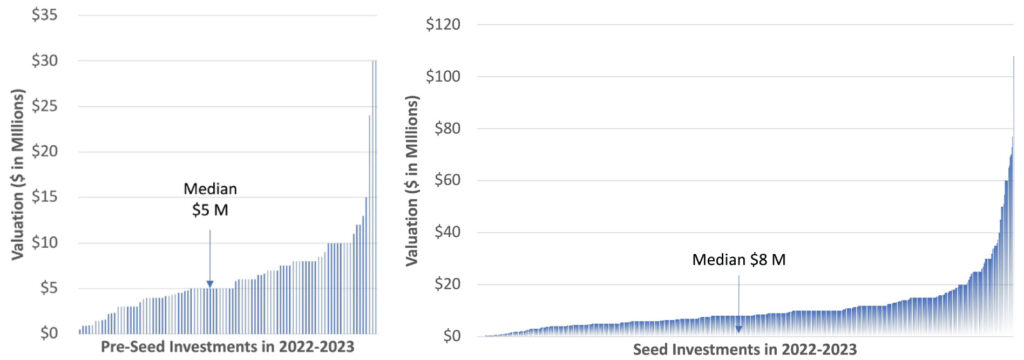

At the very high end of valuations, there are some outliers and these are ignored by appropriately focusing on median and percentiles. But the highest valuations in any stage of investment are truly extraordinary, and one wonders for example how any Pre-Seed deals can be valued as high as $30 million and how any Seed deal can be as high as $108 million:

Figure 10: Pre-Seed and Seed Valuations (2022-2023)

Source: ACA Angel Funders Report Database of 3774 Investments in 2022 and 2023

Here are some reasons why valuations are currently running high by historical standards:

- More deals in certain “hot” areas such as AI that command extraordinary multiples as the hot sector du jour. Today it is AI, and a year or two ago it was crypto. Most of these turn out to be bubbles that will collapse long before any of these companies reach an exit.

- More deals being led by relatively inexperienced angels who have been investing less than five years in this asset class, and don’t remember a time when starting valuations were much lower

- Too much reliance public market comparables, and neglecting to reflect the premium public stocks hold due to their liquidity

- Too much FOMO (Fear Of Missing Out) still keeping valuations high

- Too much capital chasing too few quality deals, notably including a higher percentage of capital from micro-VCs who see unicorn potential in many companies and FOMO leaves them accepting valuations too high

Clearly, there are company specific reasons to justify an “above market“ valuation. These include the strength of the team, the strength of their IP portfolio and other barriers, company’s proven ability to meet or exceed plan, etc. While that explains why some companies are doing better than averages, it doesn’t explain why the medians and averages are high in the first place.

We should also rethink what “Pre-Seed” and “Seed” really mean today. When I started my angel investing journey in 2003 the first round was called “Series A”, and before that there was just a “Friends and Family” round that was usually a common stock or convertible note round — not “Pre-Seed” and “Seed” as we know it today. Five years ago, ”Seed” and “Pre-Seed” were an acknowledgement that most of these companies lacked even an MVP and were pre-revenue. Yet the bar has been raised and 55% of “Pre-Seed” deals and 67% of “Seed” deals have product shipping, are in revenue or even are in expansion mode. The companies are more fully baked, and hence some risk of both technical viability and customer acceptance has been mitigated. That explains some of the rise in valuations. Nowadays, we expect more derisking before we write that first check, and we seem to be willing to pay more for that derisking. However, the jury is still out whether starting at higher valuations when the ending valuations upon M&A or IPO are moving in the other direction will prove a viable long-term investment philosophy. This is because we are less likely see as many big grand slam homeruns that are needed in order to earn the 20-30% IRRs that characterize historical portfolio returns in this asset class. Early evidence is that failure rates have not dropped due to this derisking, so buyer beware! At least half of these companies are still failing.

KEY TAKEAWAYS

- Within any stage of deal, the variation in valuations is astonishing with the ratio of the 80th percentile compared to the 20th percentile ranging from 2.7x in Pre-Seed to 4.6x in Series C+. So there are likely are a lot of factors at play, and little consensus on how to arrive at a fair valuation

- Traditional drivers of valuation such as stage of development, and revenue seem to be less relevant than they used to be. There is some correlation in team size

- Investors seem not intimidated by higher valuations, and some of the companies receiving the most investment are doing so at higher valuations

- “Pre-Seed” and “Seed” deals are more fully baked these days, and we are paying more in terms of valuation for this de-risking

- Higher early-stage valuations coupled with modest or no increase in valuations of follow-ons may mean that right now the best investments may be in well-performing follow-ons that have not seen much of an up-round due to starting off at perhaps too high a valuation

AUTHOR: John Harbison, Chairman Emeritus of TCA Venture Group and ACA Board Member