“Home Runs” Are as Instrumental to Success in Angel Investing as They Are in Public Market Investing

By Rick Timmins

We have all heard the importance of having one or more of our angel investments noted as a “home run” In terms of a return exit. What is a “home run”? Generally speaking we can define a home run for an angel investor as a company having a very successful return multiple at the time of their exit, generally with a return multiple of 10.0x or more. Why is this important? In round numbers approximately 50% of angel investments go out of business or shutdown, another 25% to 30% will return less than 1x to 4x and finally approximately 20% to 25% of angel investments will be greater than 4x. The “home runs” I believe, fall into the 10x or greater return multiple.

Based on this knowledge it is very important for angel investors to build a portfolio of angel investments to potentially increase the likelihood of having a “home run” in the portfolio. How many investments are required to build a potentially successful angel investing portfolio? Irvine Ebert of Purple Angels in Ottawa performed a Monte Carlo simulation of the 2007 Rob Wiltbank study of angel investing and noted that 22-24 investments were necessary to have a 90% probability of a 2.6x return. That internal rate of return is approximately 27%. Monte Carlo studies of the Tech Coast Angels portfolio done by John Harbison have also confirmed this figure of 22 to 24 investments in a portfolio necessary to achieve a 2.5x to 2.6x return multiple or an internal rate of return 22% to 26%.

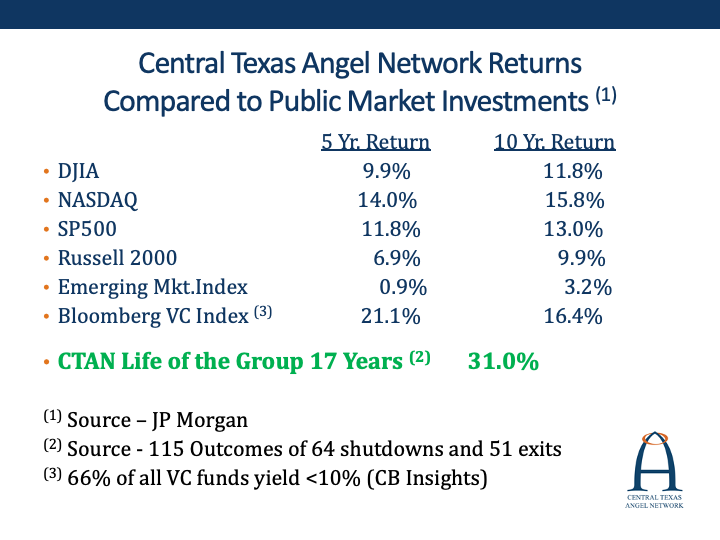

Now let’s look at the Central Texas Angel Network (CTAN) portfolio. CTAN is a very active angel group formed in 2006 and operating through 2022 in Austin and has invested in a total of 208 companies and a total of $125.2M. In 17 years of investing by CTAN members, the total portfolio has had 64 company shutdowns/companies out of business, 51 companies with an exit and 93 companies still active. The 115 companies with outcomes (64 shutdowns and 51 exits) have an overall internal rate of return of 31%. As shown on the chart below that 31% IRR compares very favorably to the 5 year and 10 year returns of several public market indices also noted on this same chart.

FIGURE 1: CTAN Returns vs. Public Market Returns

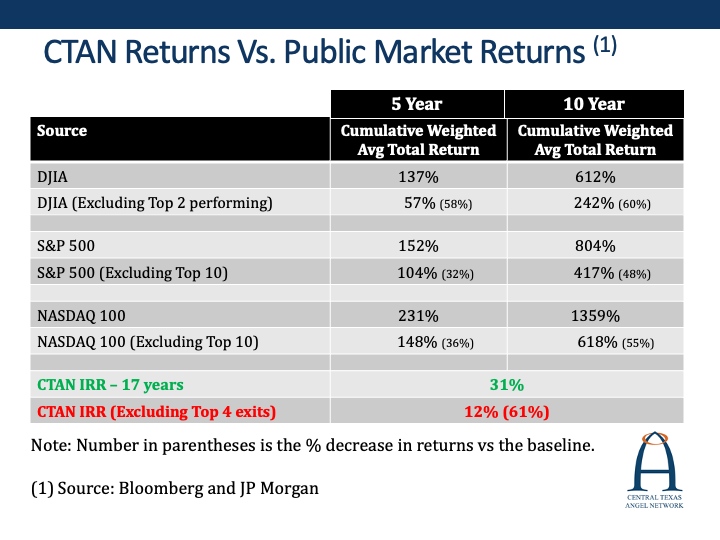

In order to better understand the potential impact of “home runs” in public markets, I focused on the public market indices which are the Dow Jones Industrial Average (DJIA), the S&P 500 and the NASDAQ 100. These three indices are snapshots of the equities markets that can provide investors with an idea as to how the overall stock market is performing. The chart below shows us the cumulative weighted average total returns over a 5 Year and 10 Year period. I have been provided this data by JP Morgan associates using the Bloomberg data base. On the chart below the weighted average total return is a calculation of the return of these respective portfolios according to the market capital weights of each stock in their corresponding index. These index weightings are pulled using the Bloomberg index member weightings. The weighted average total return is the cumulative return on the various indexes, in this case five and ten year cumulative returns.

FIGURE 2: Central Texas Angel Network Returns vs. Public Market Returns

Want to learn more about Angel Investing?

The ACA catalyzes angel investing resources and drives thought leadership in the early-stage capital ecosystem to fuel innovation and economic growth for all communities.

You may also like...

Angel University

Virtual Courses Offer Angel Expertise at Your Fingertips

Ann and Bill Payne ACA Angel University is built to deliver cutting-edge insights, practical tips and lessons learned for early stage investors. Attendees gain meaningful expert connections in comprehensive, easy-to-access virtual courses.