This is a summary of the Carta 2024 “State of Startup Compensation” study. The idea is to give our investors and CEOs a sense for the current cost of “talent” in the Early-Stage market. The entire study is available here.

Carta is providing increasing amounts of high quality data to the Early-Stage industry. It comes from the 3.8MM employees tracked by Carta’s Total Compensation system. Data like this is never specific enough as to the size of the companies being evaluated, but it provides some perspective on how and how much things have changed since the 2021-22 Early-Stage investment peak.

The news here is pretty dull. Employment goes up and down, but not a lot. Salaries are pretty flat. The trend to smaller teams and fewer leadership hires continues, perhaps at an accelerated pace. Companies are focused on essential in-house roles like sales, while more and more activity is either outsourced or simply dropped.

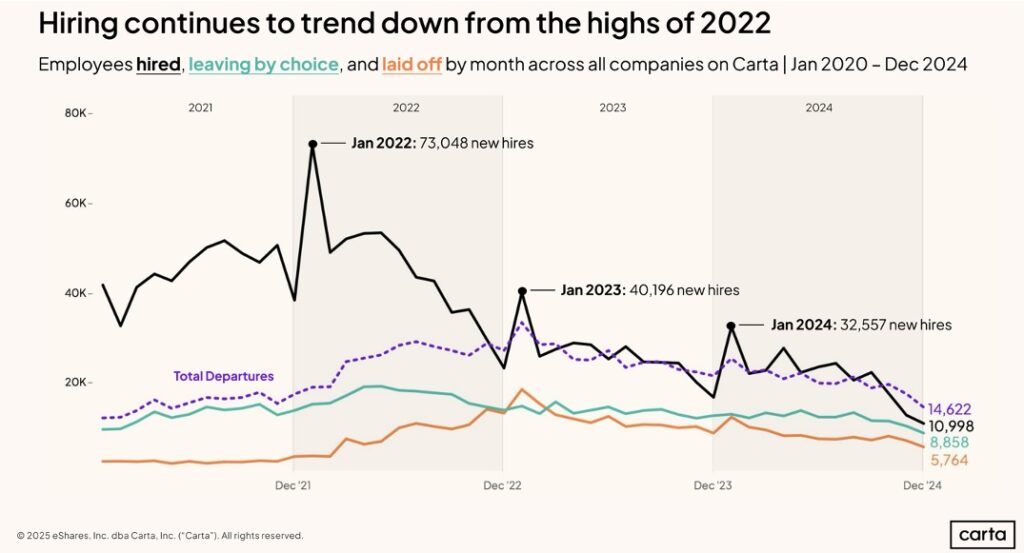

- Employment is relatively stable. Across all industries and stages, companies are operating with fewer employees than a year ago, with net head count falling in 4Q2024. It grew the fastest in energy and hardware companies and fell in consumer, pharma/bio, education and gaming. Average headcounts declined across Series Seed, A and B. New hires (employed less than a year) in January 2024 were about half of those in January 2022. Across 2024, new hires fell by about by two-thirds from January to December.

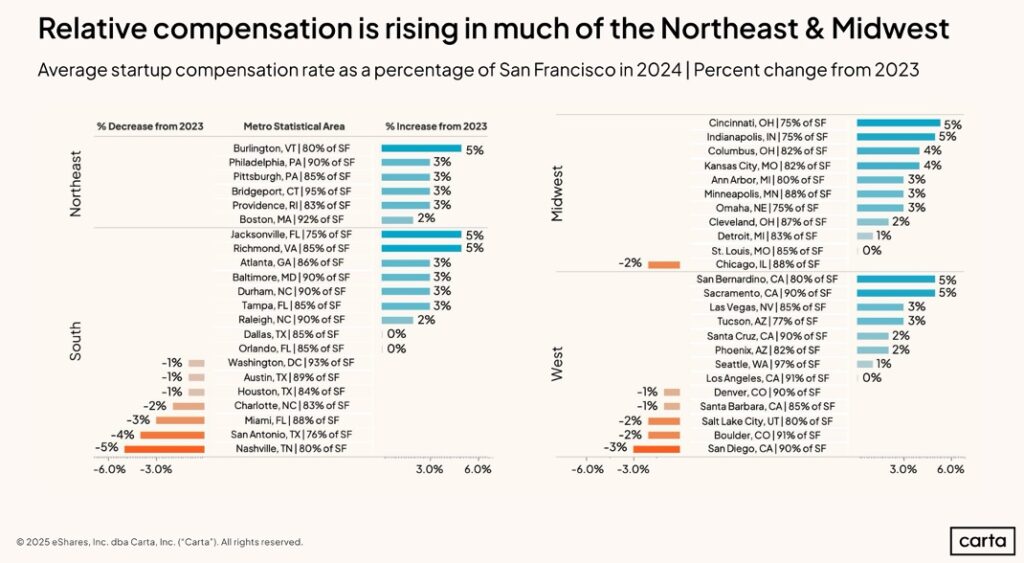

- West Coast compensation levels are slowly becoming national. Using SFO as a reference point, the gap between salaries on the West Coast and other regions seems to be shrinking. For example, Cincinnati/Omaha/Indianapolis are the lower cost at 75% of SFO. But they were 72% Year Ago. LA, Dallas and Orlando stayed flat versus SFO. Most of the rest moved toward the SFO benchmark.

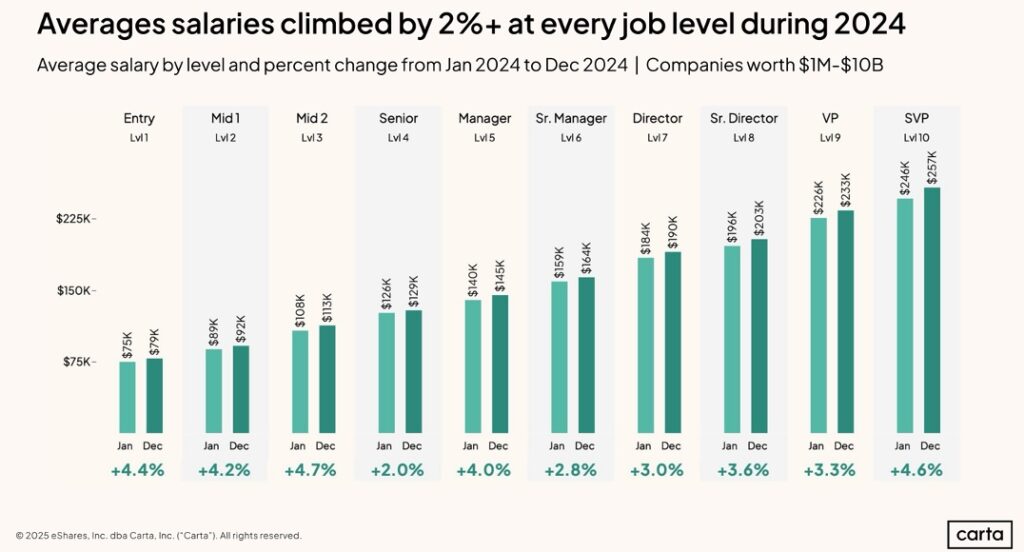

- Salary levels. Median salaries across all of Early-Stage increased only 2% in 2024 at companies with valuations of $1MM to $10B. Salaries in technical roles continue to outpace those in other functions. This suggests that if inflation returns, Early-Stage Companies may face salary issues with retaining people. Again, recognizing the limitations of the data, salaries for directors to SVP levels have been on a slow rise over the 2022-2024 period. Salaries for design and sales professionals have been on a stronger uptrend. It is not clear if the sales comp reflected here includes earned commissions.

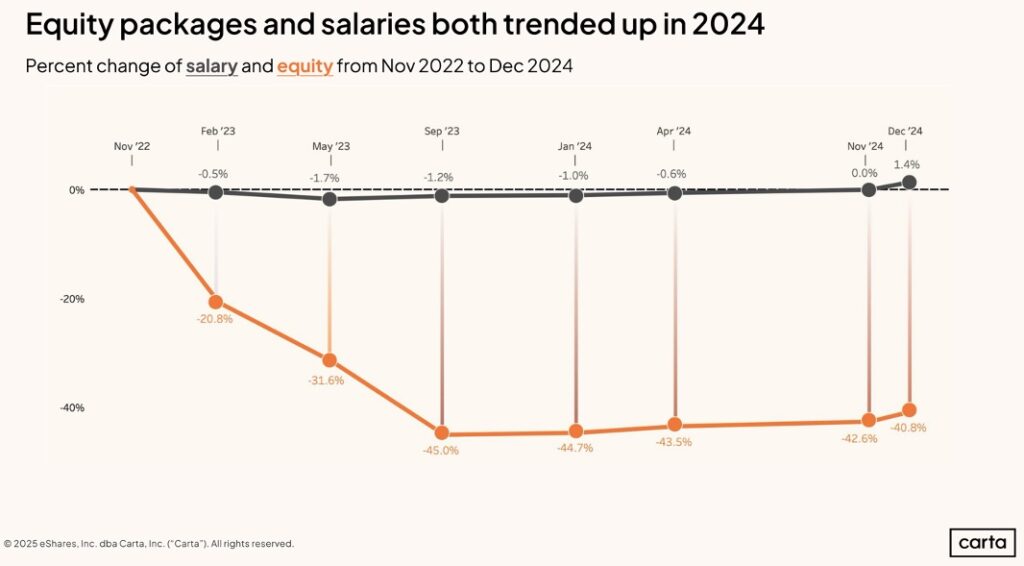

- Equity compensation. The value of options and warrants increased slightly over 2024, but only at the “last minute.” Equity comp in December 2024 was still about 40% below January 2022 – a.k.a. the good old days. Of interest, only one third of vested options were exercised in 2024; another reflection of tough times in Early-Stage.

KEY TAKEAWAYS

- Angel investors have many things to worry about, but runaway salaries for C-Suite players doesn’t appear to be one of them…at least not now.

- The number of employees per Early-Stage company continues to decline bit by bit, perhaps due to the tight funding environment or because technologies such as AI make it possible. Generally, this is a good sign, as long as it isn’t because the companies are having trouble finding the right people. This seems like a non-issue at the moment, but we should keep asking our CEOs “Do you have the right people on the bus, in the right seats?”

- In the current fund-raising environment, Early-Stage investors need to be sensitive to the idea that we may be working our CEOs past the point of “stretched thin.” Especially given the tariff morass, we need to be sure that our key people don’t just throw up their hands.

AUTHOR: John Lilly, Lateral Capital Management LLC / Lateral Capital Advisors LLC, Managing Member