It has been a tough funding environment over the past few years. The ACA 2024 Angel Funders Report showed that early stage funding by the groups that comprise the Angel Capital Association dropped 33% in 2023 compared to 2022, and the average funding per deal dropped 15%. This is on top of a 27% drop in 2021.

This Data Insight article looks at trends in funding rates using data from Dealum, the leading deal flow and collaboration platform for angel groups. The first US angel group started using Dealum in 2021, followed by more groups in 2022, so they have three years of data about the US fundraising market covering over 12,000 applications for funding; this is probably the most extensive source of information on funding rates available. In addition to exploring the overall trends, this article will dig deeper into the factors that seem to be influencing funding rates – giving us a guide to what’s hot and what’s not.

Let’s start with the overall funding rate, which is defined as the percent of applications that receive funding. Over the three-year period of 2022-2024 the average was 6.1%, but there was a dramatic drop from 9.2% in 2022 to less than half that at 4.3% in 2023. Thankfully, it seems to have recovered somewhat to 7.3% in 2024 although it is too soon to tell is that is a trend that will hold in 2025.

Funding Rate Overall 2022-2024

Source: Dealum

So what is hot and what is not? This article will explore the implications for funding rate for the following factors:

- Funding Stage

- Development Stage

- Customer Focus

- Accelerator/Incubator

- Pre-Money Valuation

- Commitments

- Lead Investor

- Prior Funding

- Registered/Incorporated

- Under-Represented Founders

Part Two which will be published in March and will cover:

- Country

- Region within the USA

- State/Province

- Industry

- Hardware/Software

- Technology

- Exit Strategy

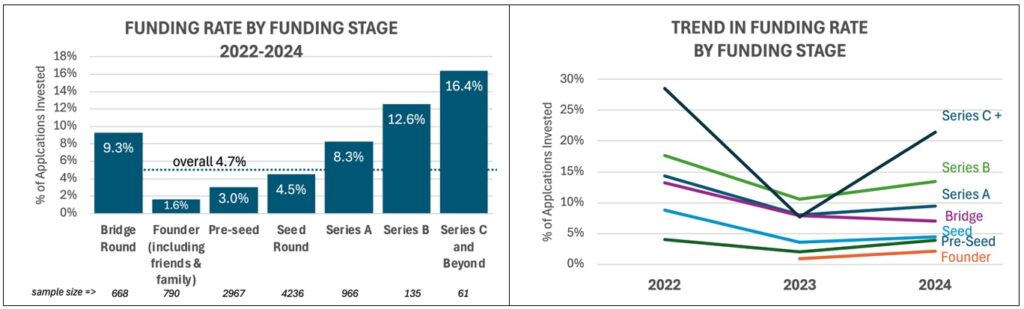

Let’s start with the stage of funding. As companies make progress along their fundraising journey, there is a clear and consistent increase in funding rates. While only 3% of Pre-Seed deals receive funding, that grows to 4.5% in Seed Rounds, 8.3% in Series A, 12.6% in Series B, and 16.4% in Series C and beyond. Apparently, the systematic reduction in risks as companies grow and mature has a direct correlation with the likelihood of funding.

Source: Dealum

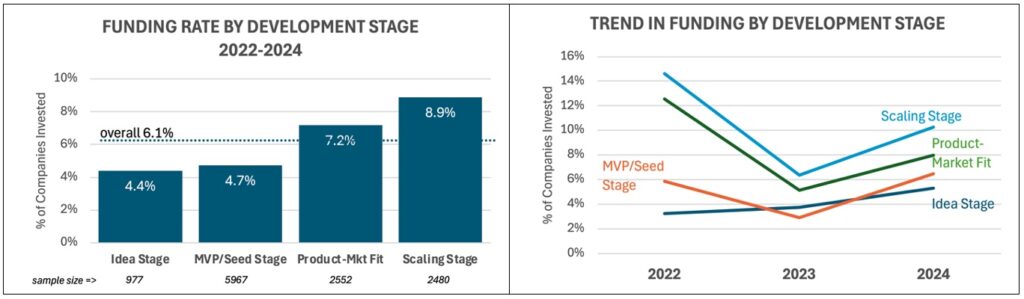

Next, let’s look at the development stage of the company. Again, the funding rate increases as companies progress through the stages of development. While the funding rate is only 4.4% for companies in the idea stage, it grows a little in the MVP/Seed Stage to 4.7% before rising to 7.2% in the Product/Market Fit stage and then 8.9% in the scaling stage.

Source: Dealum

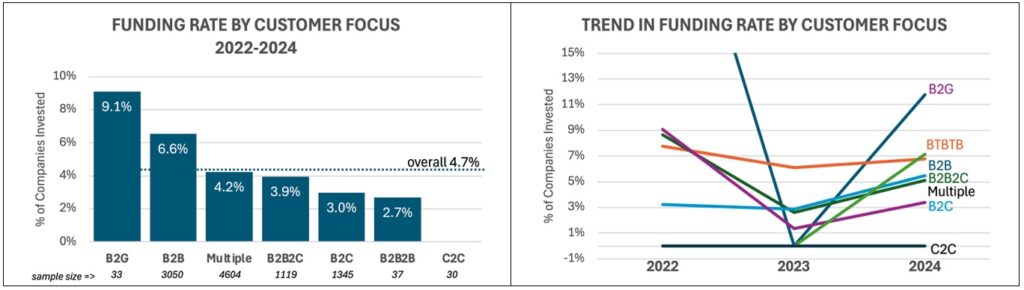

But what about the Go-To-Market strategy? Funding rate is highest for B2G (Business-To-Government) businesses, perhaps due to relative stability in the needs and channels to reach those customers and in some cases early customer adoption; however, due to recent abrupt changes to procurement in DC that stability may not be true moving forward. B2B businesses have the next highest funding rate at 6.6%. At the low end is B2C businesses – most likely due to the limited upside in terms of exit values in those types of businesses coupled with potentially high customer acquisition costs relative to lifetime value.

Source: Dealum

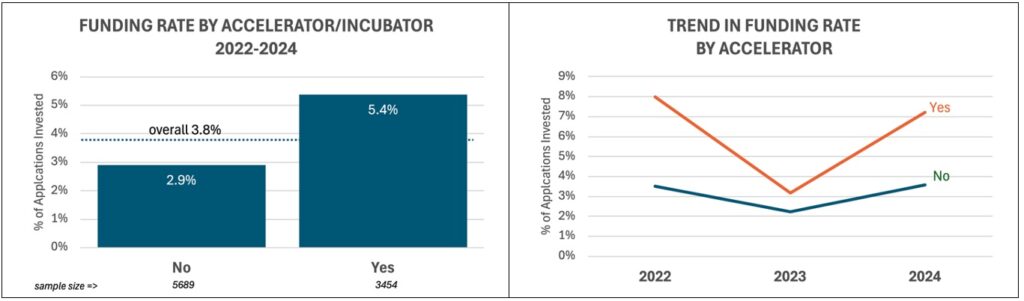

It seems to help if the company applying for funding is a graduate of an accelerator or incubator. For those companies, the funding rate is 5.4% compared to 2.9% for those companies that have not been through such a program. Part of this is likely due to risk reduction and polishing the investor pitch, and part may be due to help that accelerators may provide in opening up doors to potential investors.

Source: Dealum

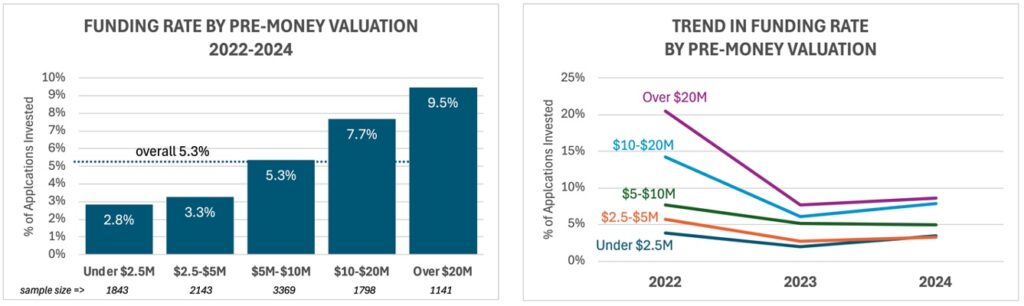

Turning to Pre-Money Valuation, the results seem counterintuitive at first glance. Companies with higher valuations seem to have higher funding rates. But perhaps this is nothing more than reflecting a reality that many companies at higher valuations have also made more progress and hence are perceived as posing less risk?

Source: Dealum

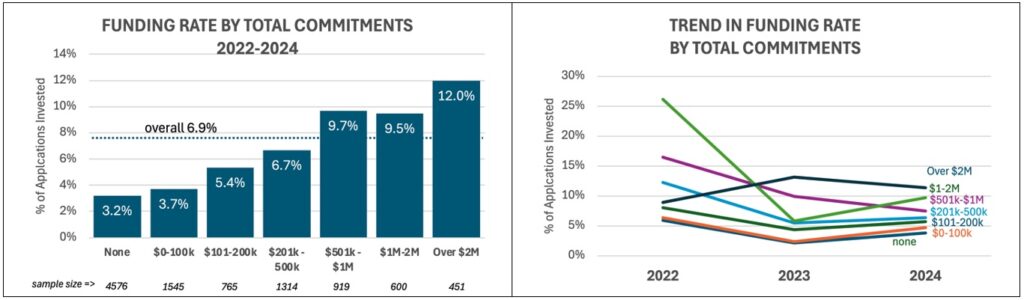

The funding rate consistently increases the larger the commitments which are disclosed at the time of application. Companies with no commitments are only being funded 3.2% of the time and this steadily rises to 12% for companies with more than $2 million in commitments. Commitments signal both validation by other investors and less risk that the round will realize sufficient funding. Commitments in the current round also may be a signal that the company is in an attractive enough space that follow-on funding is more likely to be available once milestones are achieved — meaning financing risk may be perceived as lower.

Source: Dealum

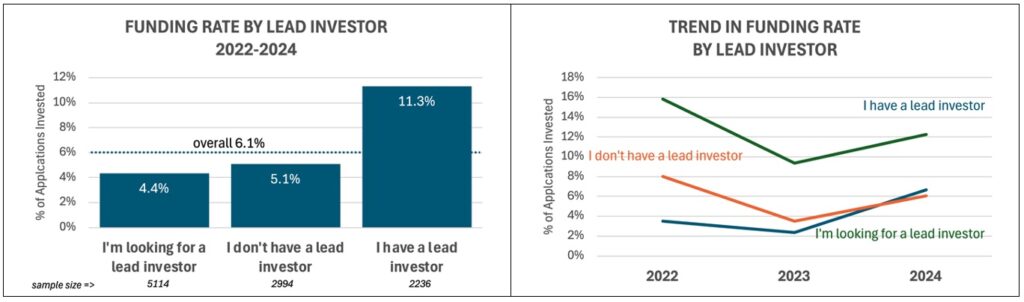

Another factor viewed favorably is whether a lead investor has been secured. This not only means that commitments have been made (see above), but also suggests that terms have been negotiated and hence the deal is more ready for additional investment. Many investors are willing to follow others but not willing to invest the time (and capital) to be the lead; they don’t want to be at the front of the spear.

Source: Dealum

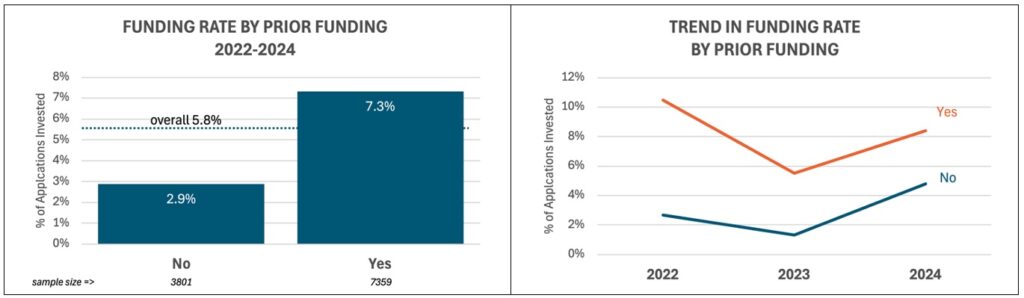

Another point of validation that increases funding rates is whether there has been at least one prior funding round. Companies with prior funding receive investment 7.3% of the applications, compared to 2.9% when there is no prior funding.

Source: Dealum

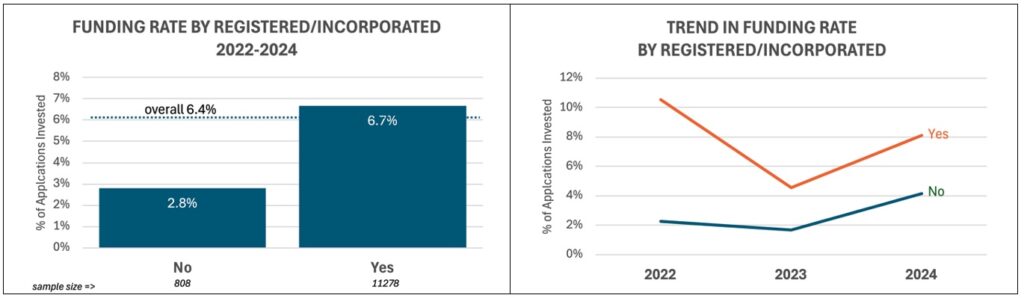

An overlooked factor is whether the company has already been registered and incorporated at the time of the application. When companies have not yet taken that step, they receive funding only 2.8% of the time compared to 6.7% for those already incorporated. Lack of registration may suggest that the company is less mature at the time of application, since obviously all companies are registered by the time they close on their funding. Thankfully, 93% of the companies were registered at the time of application. But any company not getting this done before they start raising money is hurting themselves by reducing their prospects for funding.

Source: Dealum

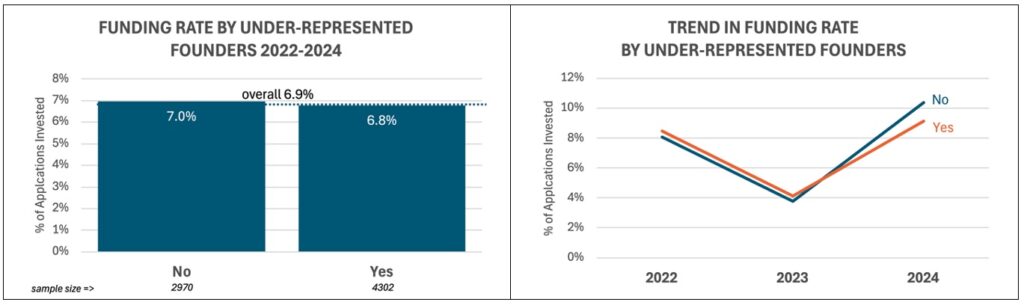

Finally, it is encouraging that investors seem to be blind about whether or not the founders include under-represented minorities. The funding rate is nearly identical at 6.8% for those with under-represented founder compared to 7.0% for those without under-represented founders.

Source: Dealum

Part Two of this analysis will be published in March and will cover:

- Country

- Region within the US

- State/Province

- Industry

- Technology

- Exit Strategy

KEY TAKEAWAYS

- The dramatic funding rate drop in 2023 seems to have largely reversed in 2024 – suggesting that we may be pulling out of this downturn.

- Investors are more likely to invest in companies that are more mature and have taken risks off the table. Therefore, this means higher funding rates:

- The later the round stage

- The later in the development cycle

- In cases where the company has been through an accelerator/incubator.

- Funding rates are higher when there is validation in terms of the presence of a lead investor, the amount of commitments at the time of application, and the existence of funding in prior rounds.

AUTHOR:

- John Harbison, Chairman Emeritus of TCA Venture Group and ACA Board Member, with help from the team at Dealum.

About Dealum

Dealum is the leading deal flow and collaboration platform for angel groups, built with angel network managers in mind. The platform makes deal sharing and syndication, pipeline and funnel management, and investor communication more efficient while creating a collaborative and thriving early-stage investor ecosystem. https://dealum.com/