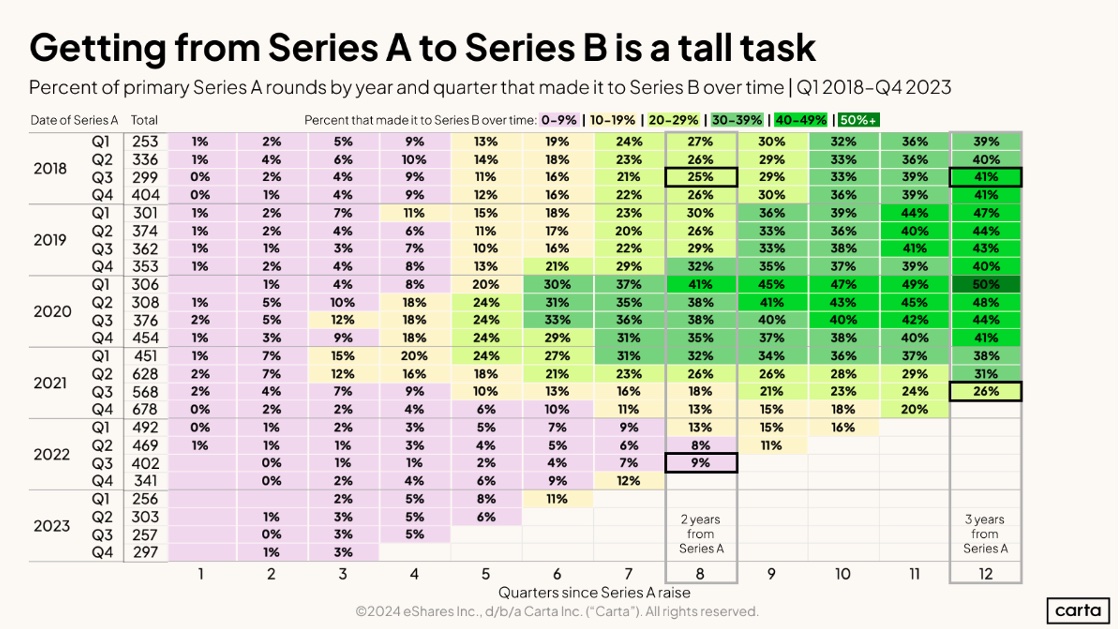

Subject: Getting From Series A to Series B Is a Tall Task

The gap between Series A and Series B has apparently widened to a chasm for recent cohorts.

Source: Carta Data Minute, October 2024

In the chart above, each row represents a set of companies that raised their Series A in a specific quarter. The percentages reflect the share of that cohort that raised a Series B over time. We’ll call this the “graduation rate”.

And recently we have fewer graduates. Only 9% of companies that raised their Series A in Q3 of 2022 have made it to Series B in 2 years (vs 25% that did so for the Series As of Q3 2018).

Three hypotheses:

A. Low graduation rates reflect the harsh reality of fundraising post gold rush. Most Series A companies would love to raise a B but can’t because the market has shifted dramatically underneath their feet.

B. Many of these would-be Series Bs have actually become profitable (or close to it) before needing to raise. This makes the graduation rate look bad but who cares, the companies have taken financial control back for themselves.

C. A is true BUT we can expect graduation rates for cohorts in late 2023 and especially 2024 to be back to 2018 or 2019 levels. This is because startups raising Series A last year or this year are likely to have materially better traction / revenue / etc. than those that raised in 2021.

I’ll take D, all of the above (but more A and C than B – I just don’t think many companies who started down the venture path have made the full pivot to profitability). Could be wrong though!

Whatever the final outcomes, it’s just a stark reminder of how crucial timing is for the viability of many startups. Getting caught in the wrong macro environment can be damaging—and it makes the success stories all the more impressive.

Subscribe to Carta’s Data Minute newsletter here for this sort of data-driven startup analysis every week.

AUTHOR: Peter Walker, Head of Insights @ Carta and Data Storyteller