By Christopher Mirabile, ACA Chair Emeritus & Launchpad Venture Group Executive Chair

By Christopher Mirabile, ACA Chair Emeritus & Launchpad Venture Group Executive Chair

Every experienced angel knows how important the quality of the founding team is when selecting investments. We’ve all heard the maxims: “Team, Market, Product, in that order!” “An A+ team with a B+ plan will out-perform a B+ team with an A+ plan every time.” And so forth. Experienced angels also instinctively know that CEO swaps are very risky and potentially costly. As a result, angels are always looking for a CEO who can “scale.” That magical person who not only has the skills to go from $0 to $1M and $1M to $10M, but also from $10M to $100M and even beyond.

Unfortunately, skilled CEOs with that kind of versatility are actually pretty hard to find. Probably harder than we realize, because we somewhat regularly find ourselves in angel investing situations where our founding team has run out of talent relative to the job at hand. “Ooops. Are we now dead in the water?” we wonder. Can we attract new talent to this struggling business? Would we be better off trying to find a coach and mentor (and maybe a COO or other senior manager) to help? There is probably no single universally applicable answer to these questions, because the facts and unique circumstances around each situation are going to differ, but perhaps there is some data that would help?

How Prevalent Are CEO Changes?

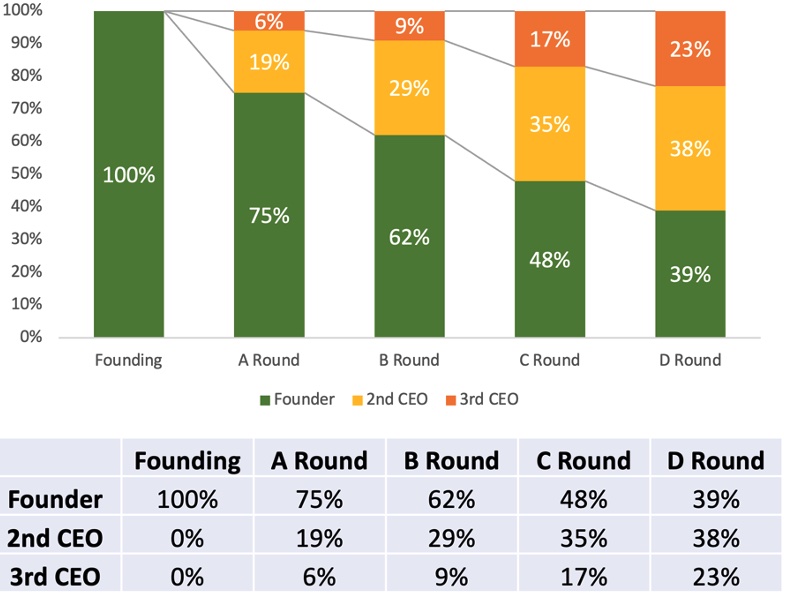

FIGURE 1: National CEO Transition Experience

Source: The Founders Dilemma, Noam Wasserman

Academic and author Noam Wasserman, perhaps best known for his 2012 book The Founder’s Dilemmas: Anticipating and Avoiding the Pitfalls That Can Sink a Startup, offers some data on the prevalence of founder transitions. Wasserman looked at quantitative data from 10,000 startups. Wasserman shows that CEO transitions are remarkably common with startups. One quarter have replaced their CEO by the time they raise a Series A, and, shockingly, less than 40% are still on their first CEO by the time they raise a Series D round of funding. In fact, nearly a quarter of those are on their THIRD CEO by that point.

What Are The Consequences of CEO Transitions?

More than half of the companies in Wasserman’s study had changed CEOs by the Series C round. But at what cost? Is this just the natural process of bringing in professional leadership as a company scales and matures, or are investors taking a hit on these transitions?

At Launchpad Venture Group we wanted to know the answer to that question of whether investors are taking a hit on CEO transitions. Our diligence process already stressed the importance of finding the best possible teams we could, and on trying to figure out whether those teams had the ability to scale. But was that work worthwhile? What did it cost us to be wrong?

Using outcomes data from the “exited” subset of the 140 companies we have backed in our 20+ year history, our resident data guru Alex Brown took a look at CEO transitions and how they turned out for us.

What did we learn? Two things:

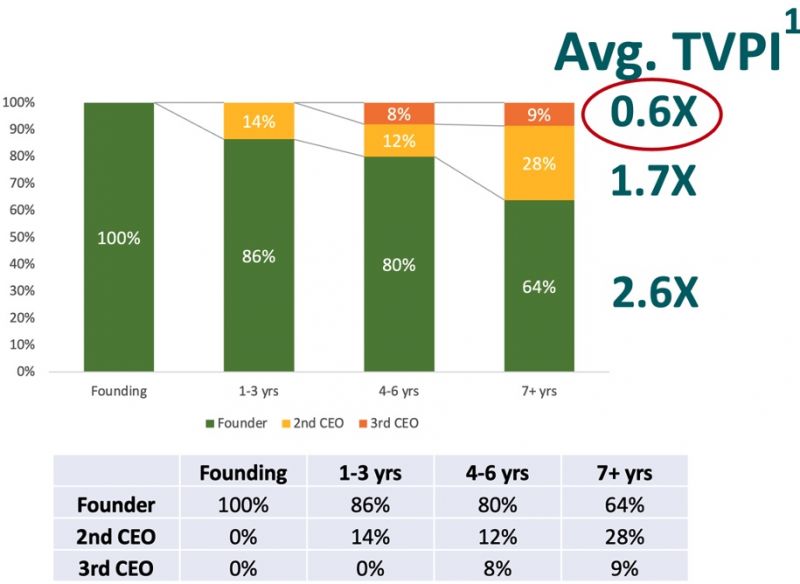

FIGURE 2

Source: Launchpad Portfolio Data

In 64% of our companies, the CEO made it more than seven years. Those companies had by far the best return multiples. We saw an average return multiple of 2.6X with single CEO companies. The 28% of companies experiencing just one CEO change were still a winning proposition, showing a 1.7X return multiple as a group, but they were still a much weaker outcome overall – 35% lower. And the companies that needed two CEO changes were money losing as a group, showing an average return multiple of just 0.6X. That is a marked difference; chose a great CEO and you are looking at an average return approaching 3X. Back the wrong CEO and you are lucky to get your money back.

What actionable lessons can we take away from this data? Well, before we draw conclusions, we need to acknowledge three things. First, correlation and causation are not the same and one needs to be careful assuming a causal connection when it could be correlational or two seemingly connected factors which are actually independently connected to a third factor. For example, in this case, common sense dictates that if the CEO is being changed, things are already not going perfectly smoothly. However, I would argue that the converse is also somewhat true – if the CEO is good, that is one less thing to go wrong and therefore you have a better probability of success and higher returns.

Second, it is possible that the reason we saw lower rates of CEO change is that angels are just more patient about replacing CEOs or lack the political power (or legal means) to do so. There is probably some truth to that as a general proposition, but it may not entirely explain the lower rate of CEO changes in our case. Launchpad strongly prefers to lead its rounds, and typically does, and we virtually always take a board or observer seat. We also place fairly large bets and tend to follow on fairly strongly over time, so it is not uncommon for us to hold 10% or more of a company in the later years. So we often have a voice at the table and some voting clout to back it up. And, sure enough, throughout our 20+ year history, we have a track record of initiating CEO changes where we felt they were necessary.

Third, we must acknowledge the difficult dynamics of attracting new CEOs to young companies with shaky financials. It stands to reason that the only companies that are going to be able to attract good replacement CEOs are going to be the solid companies with more potential. Again, that may be the case as a general matter, but it does not fully explain our data. If it is not possible to attract new CEOs to angel backed companies, how were we able to do it 36% of the time? And even with the ones that were extra messy, how were we able to attract a THIRD CEO nearly 10% of the time? Certainly, smaller angel-backed companies may not have quite as easy a time replacing CEOs as bigger more cash-rich companies, but they definitely can do it.

So for us, the three take-aways from this data were clear. The first conclusion was that the time we spend in diligence really evaluating founding teams, and especially founding CEOs, is well worth it. Finding good CEOs who can scale themselves as they grow a company is correlated with much higher average returns. The second conclusion is that even if we don’t nail it on the CEO choice, we might still be OK if the opportunity is good and the CEO is decent enough to make some progress before getting replaced. Having to replace a CEO when things are going OK still costs a bit, knocking nearly a third off your returns, but is not fatal. The third conclusion is that when we bet wrong on the CEO, and the company goes on to flounder and cannot attract a “keeper” replacement CEO, we are done for, and, on average, are going to lose money.

For Launchpad, the three key takeaways from this study of CEO transitions are:

- CEO due diligence is worth the effort – finding a great CEO who can stick and scale will significantly increase your odds, on average.

- With a solid company, a CEO near-miss hurts, but may not be fatal. If a CEO is decent but not great, and the company is able to make some progress despite needing to replace the CEO, investors may still get a positive return. Not as high, on average, as companies with no CEO change, but not necessarily a loss.

- If the CEO is a big miss and second one also needs to be replaced, it is likely game-over. Few startups are going to survive two early CEO changes. If your CEO is not working out, have a bias for action and make the change early, before the company has dug itself into too deep of a hole to attract a decent replacement. Otherwise, on average, you are looking at negative returns.