The great bull market of 2010 – 2021, fueled by cheap capital, caused a nearly unprecedented rise in the valuations of speculative assets, from real estate to angel and venture equity. By 2021 investors were paying 2x the “normal” price of early-stage deals, 4x for growth deals and 7x for late-stage deals.

As presidential economic advisor, Herbert Stein, famously said, “Things that can’t go on, don’t.” With war, inflation, supply chain disruption, epidemics and the end of nearly free capital, the twelve-year party ended in 2022.

What some have called “startup apocalypse,” began with a decline in the S&P 500 (losing 20% of its value by Q4) and similar declines in other public markets. Over the course of the year as IPOs were delayed, M&A deals cancelled, and unicorns were de-horned, the malaise spread to late stage and finally Series C and Series B deals, causing a severe capital crunch. VCs triaged their portfolios, with a survival of the fittest ethos and capital became harder to find. Venture funding fled to safety, often to less capital-intensive stages, deals less sensitive to quarterly fluctuations, notably to early stage and away from Series B and later deals supporting existing companies.

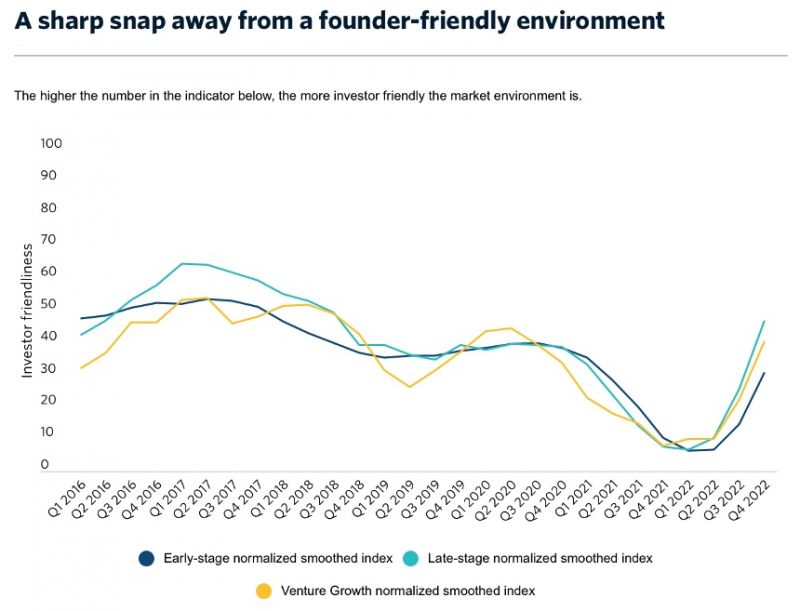

The sharp reversal in 2022 from bubble to sober economics is well illustrated by Pitchbook’s index(1) of how founder or investor friendly the investing climate is. By mid-2022 the index had quickly reversed from a founder to investor friendly investing climate. (Exhibit 1)

Exhibit 1

(1) Pitchbook combines liquidation preferences, other deal terms and investor sentiment into a single index. When the index slopes downward, the climate is considered management friendly. When the index slopes upward, the climate is investor friendly.

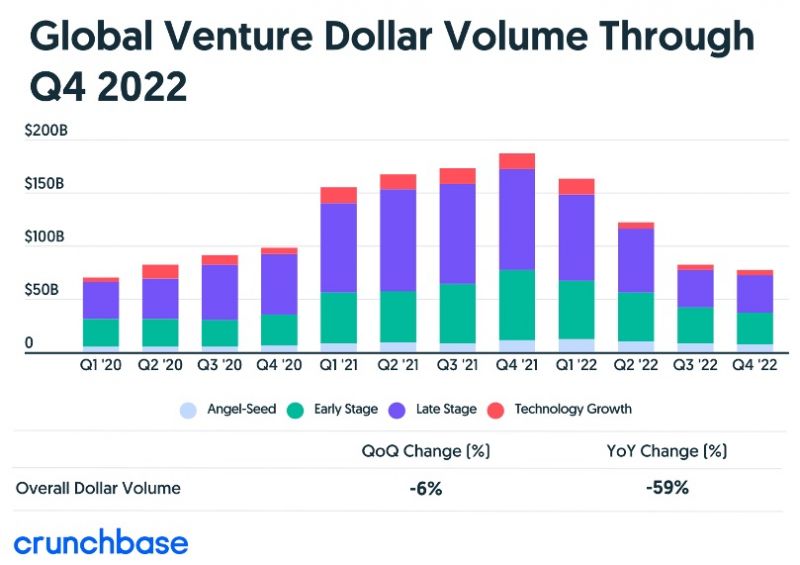

Exhibit 2

Globally, venture funding fell by nearly 60% from 2021 to 2022. (Exhibit 2)

US venture funding fell 31% overall. While early-stage venture started 2022 at a level commensurate with 2021, by Q4’22 dollars invested in early-stage deals ($10.7B) had fallen by 55% from Q1 ($23.8B) (Pitchbook) and declined further in 2023.

Late-stage funding showed even sharper declines. In another reversal from 2021, capital demand was 1.5x the supply of early-stage capital; late-stage capital was even scarcer, as the demand was more than 2.5x the supply (Pitchbook) as VCs reserved capital for their best performing companies and were less likely to take mid to later stage risks, given that exit markets were closed. The length of time between rounds increased and the step-up between rounds fell to record lows (1.6x) further discouraging investor participation.

2022 experienced venture deal trends that would continue into 2023:

- More investor leverage, tougher deal terms.

- Significant dollar investment pull back by as much as 55% by the end of 2022 and further declines in 2023.

- Flight to safety: more early-stage deals and fewer and harder to raise follow-on capital from Series B onward, except for the best performing portfolio companies.

- Overall increasing capital crunch as growing demand outstripped dwindling supply.

- Significantly lower returns as the exit markets were virtually closed in 2022.

How did US angels react to the capital market inversion in 2022? How did angel behavior change from 2021 to 2022? Did angels pull back from investing? Did we change our investing profile? Did we do fewer deals? Did we flee to safer deals and entrepreneurs with successful track records? Did we invest in less speculative vertical markets? And did we see lower returns in 2022?

Data from the recently published 2023 Angel Capital Association Angel Funders Report can provide answers to these questions.

The decline in angel funding was similar to the decline in venture funding. While corporate venture invested 50% less than in 2022 and VCs invested overall 31% less, angels invested 27% less. (Exhibit 3), with the decline in funding more likely due to fewer angel groups actively investing than to changes in the behavior of angels who continued to invest. (Exhibit 3)

Exhibit 3

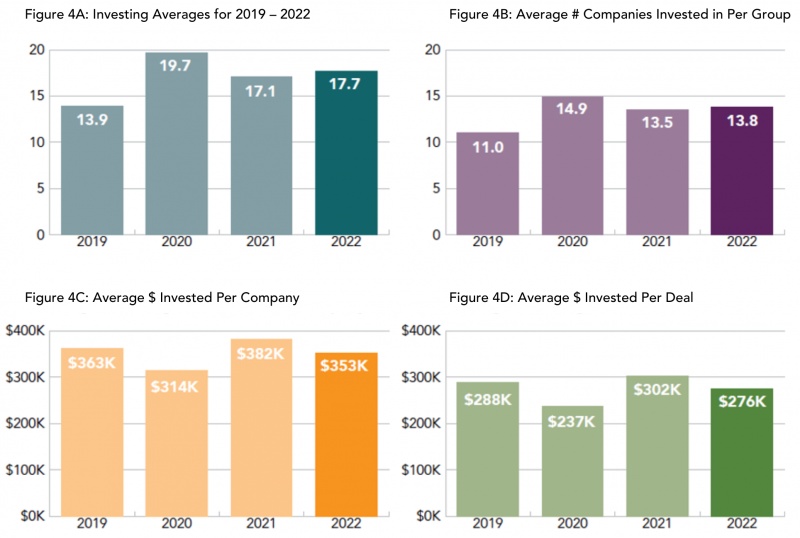

While the aggregate amount invested fell (a decline in the number active groups), similar to overall VC dollars, the behavior of angel groups did not change. (Exhibit 4)

Exhibit 4

As these exhibits indicate, ACA angel groups invested in more deals and more companies per group in 2022 than in 2021. The average investment per company in 2022 was 93% of 2021’s amount and the average investment per deal in 2022 was 91% of the prior year. Dollars per company and per deal declined, but remained at 90% or more of the investments of the prior year. In a period of significant turmoil, angels continued to invest in deals and companies at near record levels.

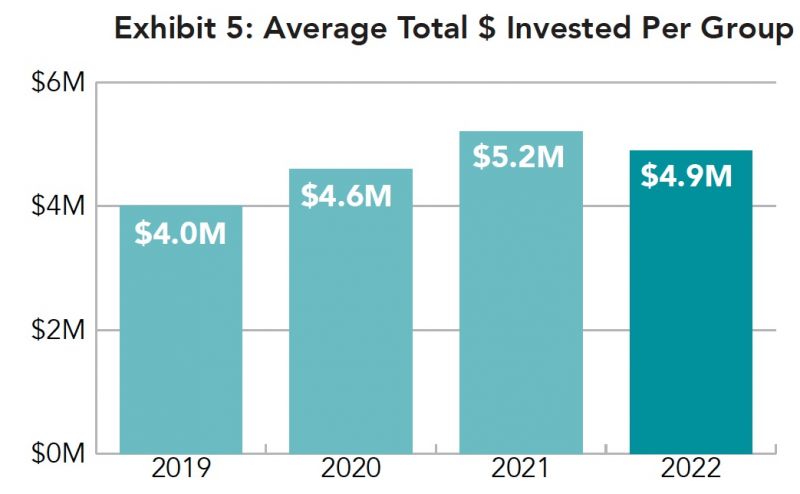

The total dollars invested annually per angel group fell only 5%, the second highest total since the ACA began tracking investments by group. (Exhibit 5) While the aggregate angel dollars fell 27% due to fewer active groups, on a per-group basis angel group investing exhibited no significant change in activity in 2022.

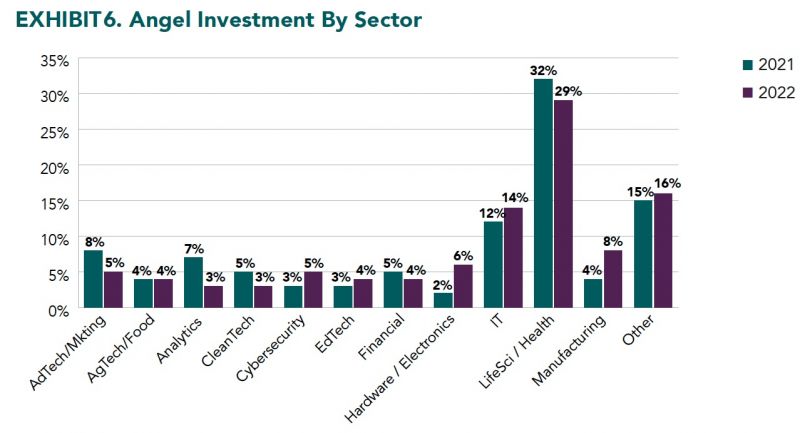

Angel vertical market investing remained consistent regardless of boom (2021) or bust (2022 market conditions. (Exhibit 6) While numbers fluctuated slightly (due to sampling variation) the overall “shape” of distributions of vertical markets remained very similar between 2021 and 2022.

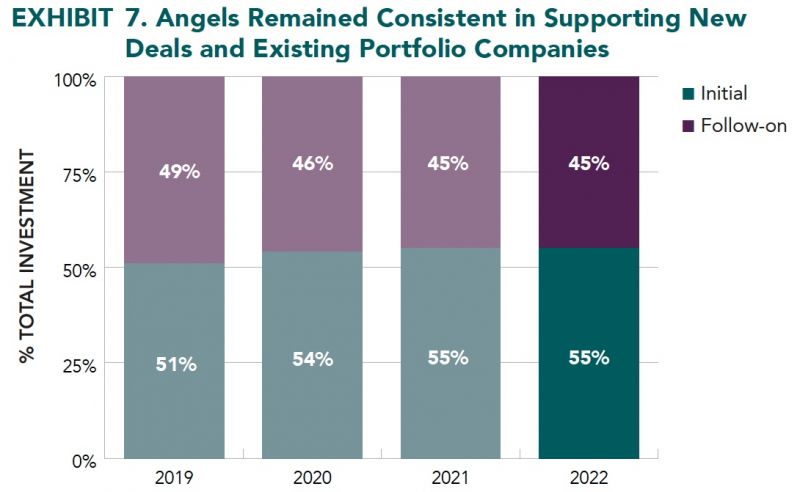

Angels continued to fund both new and follow-on deals at the same rates as in prior years. There was no reduction of emphasis on either new or portfolio supporting deals. (Exhibit 7)

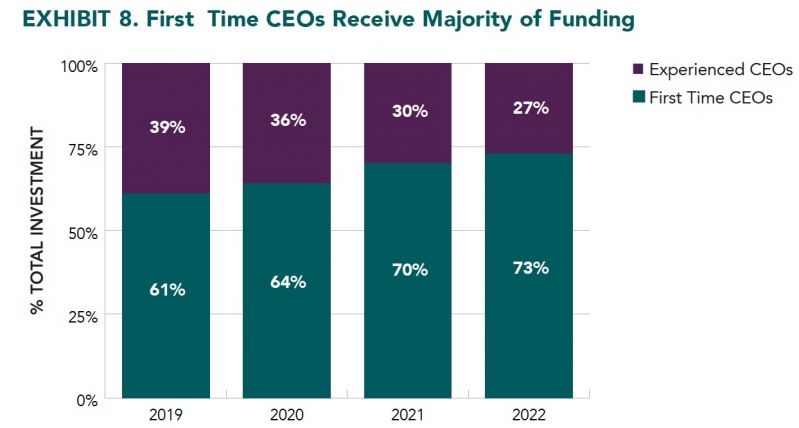

Similarly, angels did not flee to the safety of experienced CEOs despite a tougher climate. Angels funded first time CEOs at a record 73% of deals. (Exhibit 8)

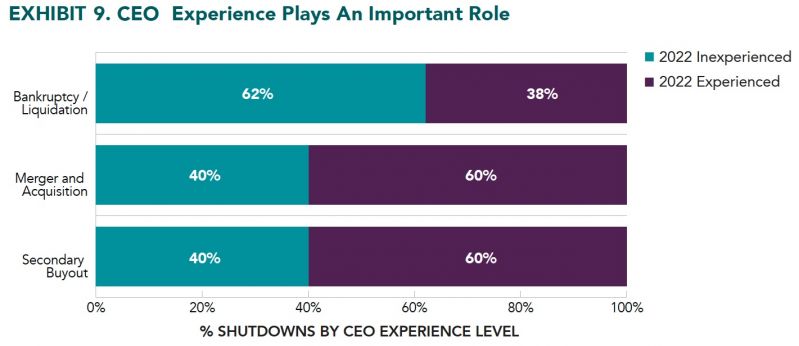

Angel support of first time CEOs remained strong, despite first time CEOs having more failures and fewer positive exits than experienced CEOs. (Exhibit 9)

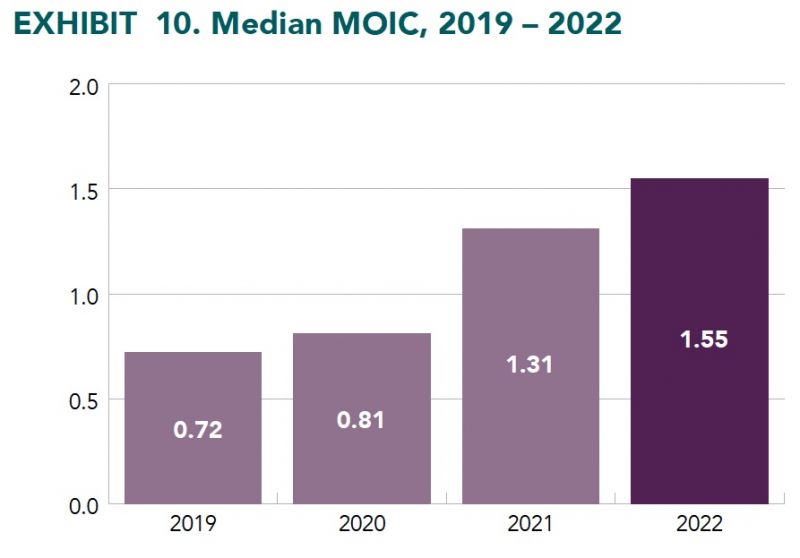

While 2022 was a very tough year for venture-backed M&A and IPOs, angel exits saw an increase in the median multiple of invested capital (MOIC) returned to investors. As Exhibit 10 indicates, half (the median) of all non-liquidation angel exits reported to the ACA returned 1.55x or more of the capital invested.

Key Takeaways:

In reviewing investing in 2022, angels demonstrated the persistence and consistency that has marked mentor capital over the long term. Angels did not exhibit strong swings in behavior when behavior as economic climates change.

- Angels did not retreat from the market or demonstrate a “flight to safety.”

- More first time CEOs were funded than at any time since the ACA has collected data.

- Total dollars per deal and per invested company were similar to investments in prior years.

- Angel groups invested more than 90% of the total dollars invested in 2021.

- Angel returns on a per-exit basis actually improved in 2022.

- Overall angel group investing behavior remained consistent with prior years.

These ongoing trends have earned angels the reputation of “persistent capital,” even in the face of a serious bear market in venture capital.

This persistence in good times and troubled times is an important reason for entrepreneurs to welcome angel capital. We take risks on first-time CEOs to an ever-greater degree. We continue to back our portfolio companies. And angel group support of our local communities remains very consistent, a reliable source of support, year-in, year-out in for innovation across North America.

Author:

- Ronald Weissman, Chairman of the Angel Capital Association’s Board of Directors, Chairman of the Band of Angels Software Special Interest Group, and a principal analyst for the past three years of the ACA’s Angel Funders Report.