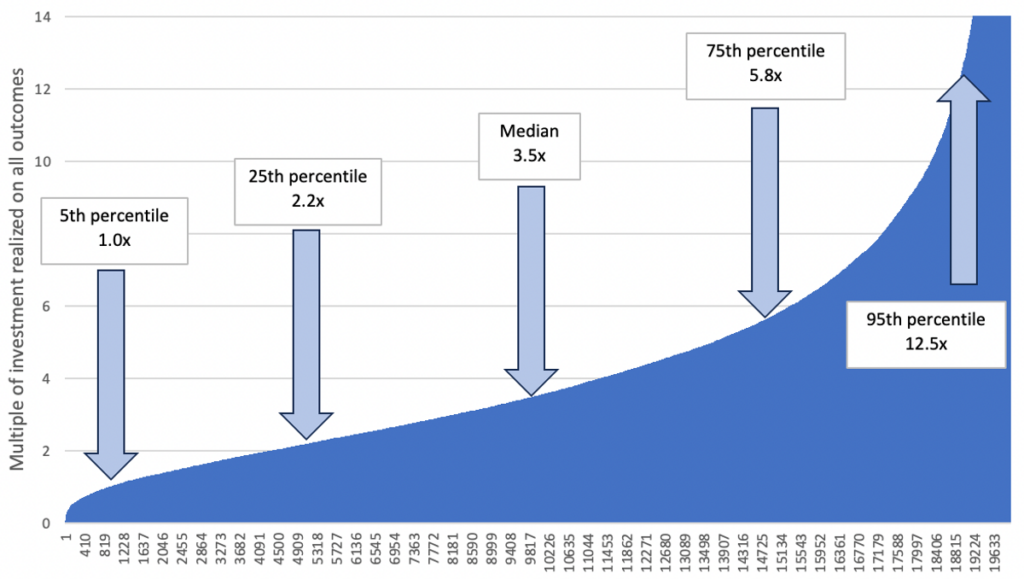

We all know that investing in startup companies is inherently risky. Over half of early-stage investments typically fail to return any capital, with the top 10% usually returning 85-90% of all the cash proceeds. The game is won on “grand slam home runs,” not “singles.”

In order to justify investing in an asset class with this high amount of failure risk we would need to see much higher returns. With an adequately diversified portfolio of early-stage companies, there is compelling evidence that the return on early-stage investment can indeed be compelling. This data insight article explores the comparison with other asset classes.

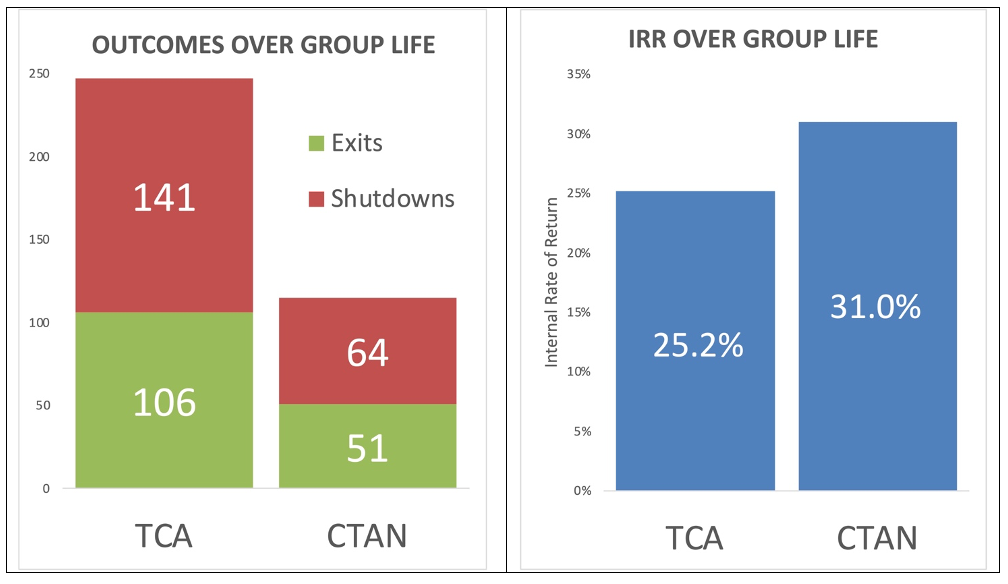

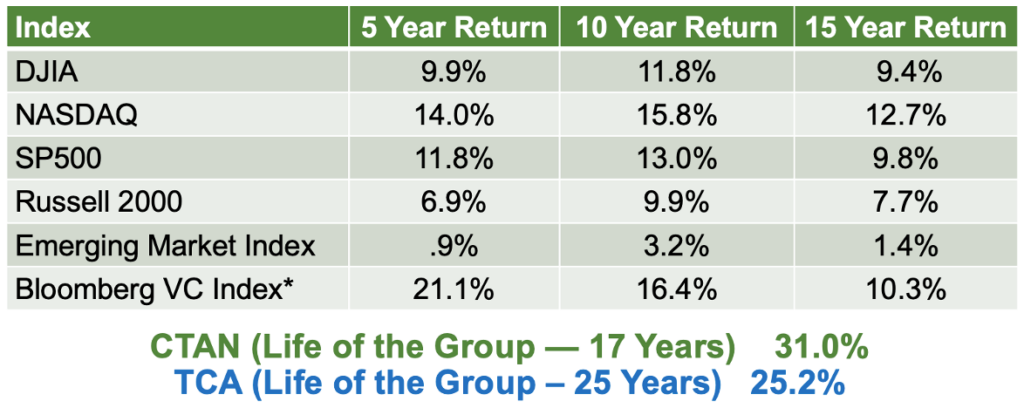

Two of ACA’s largest angel groups have kept track of IRR (internal rate of return) for all outcomes. The IRR for Central Texas Angels Network’s 115 outcomes between 2006-2022 is 31% and the IRR for Tech Coast Angels’ 247 outcomes between 1997-2022 is 25% (assuming one invested equal amounts in all companies):

FIGURE 1: THE IRR FOR TECH COAST ANGELS AND CENTRAL TEXAS ANGELS NETWORK

Source: 247 Tech Coast Angels outcomes from 1997-2022; 115 Central Texas Angel Network outcomes from 2006-2022.

Both angel group portfolios offer statistically significant sample sizes, and three previous large studies by Professor Rob Wiltbank also showed IRR’s in a similar range: 27% (2007 study), 22% (2009 study) and 22% (2016 study).

But how does this compare to other asset classes for comparable periods of time? Here is data for a range of other equity investments:

FIGURE 2: ANGEL RETURNS COMPARE TO OTHER POTENTIAL INVESTMENTS

Source: JP Morgan, Central Texas Angel Network (2006-2022), Tech Coast Angels (1997-2022)

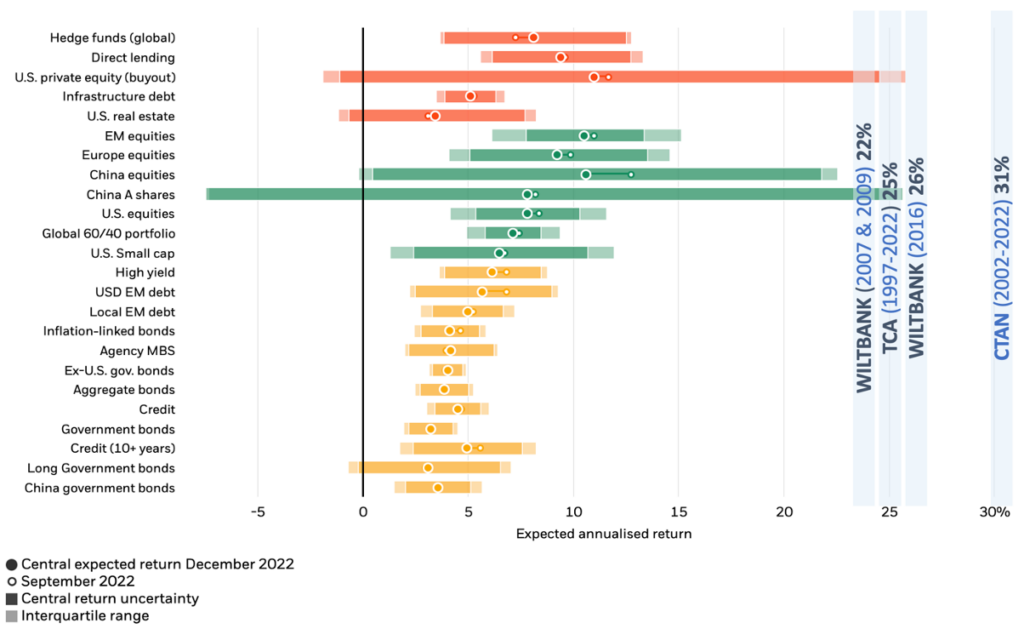

Blackrock has done extensive modeling of returns by asset class for public equities and these angel returns beat even the highest quartiles for every class of investment covered in the Blackrock Study:

FIGURE 3: ASSET RETURN EXPECTATIONS AND UNCERTAINTY 20 YEAR RETURN TIME PERIOD

Note: Returns for venture capital and buyout are based on net internal rates of return since inception for vintage years 1980-2018; returns for hedge funds and mutual funds are based on trailing 5-year annualized returns net of expenses with income reinvested through 12/31/2019.

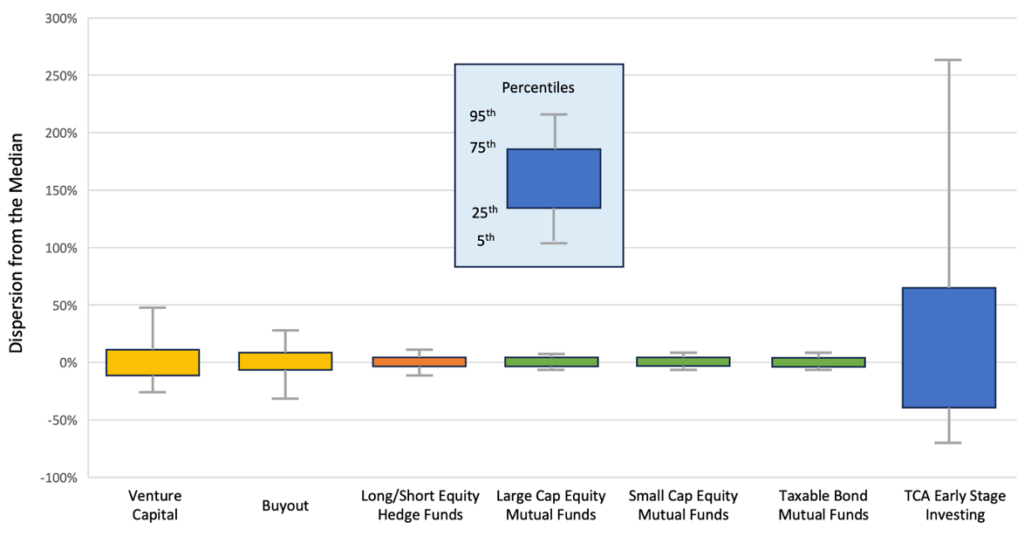

Source: Morgan Stanley, Morningstar Direct and PitchBook; Tech Coast Angels Montecarlo simulation of 20,000 outcomes in a portfolio of 25 investments

Key Takeaways:

- Angel Investing as an asset class offers potential returns far greater than any other asset class, given the possibility of achieving extraordinary multiples (exceeding 100x) on a few companies (TCA has had 4 out of 247 outcomes in this category).

- Diversification is critical given the rare nature of those “grand slam home runs”, and a smart angel investor should seek a robust number of early-stage investments in his/her early-stage portfolio.

- While other asset classes offer lower returns, the dispersion around those returns is far lower – so it is wise to keep early-stage as only a small portion on one’s investable assets. 10-20% is often cited as a good rule of thumb.

Author:

- John Harbison, Chairman Emeritus of TCA Venture Group and ACA Board Member.