We all know that the success in angel investing involves many factors. We continue to understand this as we develop more analysis to support this belief. Examples of these factors include valuations, due diligence, building a portfolio of companies, business sectors, angel engagement and others. Several monthly ACA Data Insights have been published on these items and others.

One of the items the Central Texas Angel Network (CTAN) reviewed was angel engagement with start-up companies. CTAN is a large angel network in Austin, Texas formed in 2006. Through 2022 CTAN has invested over $125M in 208 companies. CTAN has no fund, so when an investment is made in a company by a member, his/her individual name or entity is on the cap table. There are many ways angel engagement can occur with an entrepreneur and start-up company. One of the primary ways for angels to engage with entrepreneurs is through a personal relationship as a mentor/advisor which can occur both prior to and after an investment has been made. Individuals serving as an advisor can assist with hiring/recruiting, customer engagement, and product development. These roles are generally unpaid.

Another type of engagement is serving as a Board member or Board observer for a start-up. Start-up boards are generally formed when first outside money is invested in a start-up company. In many cases this outside money is from angel investors. Generally speaking when enough CTAN members invest money in a start-up an initial board is formed. In the case of CTAN, when we lead the due diligence of a company and at least 5 or more members are investing collectively $400,000 or more we require a Board be formed with a Board of Directors. This requirement is specified in the Term Sheet we negotiate with the entrepreneur and it will stipulate that one of the Board members will be a CTAN member. Often times this is a CTAN member who participated in the due diligence and has experience or knowledge of the start-up’s business. This Board member must have the approval of the founder. Usually, Board Members (and observers) are compensated through stock options.

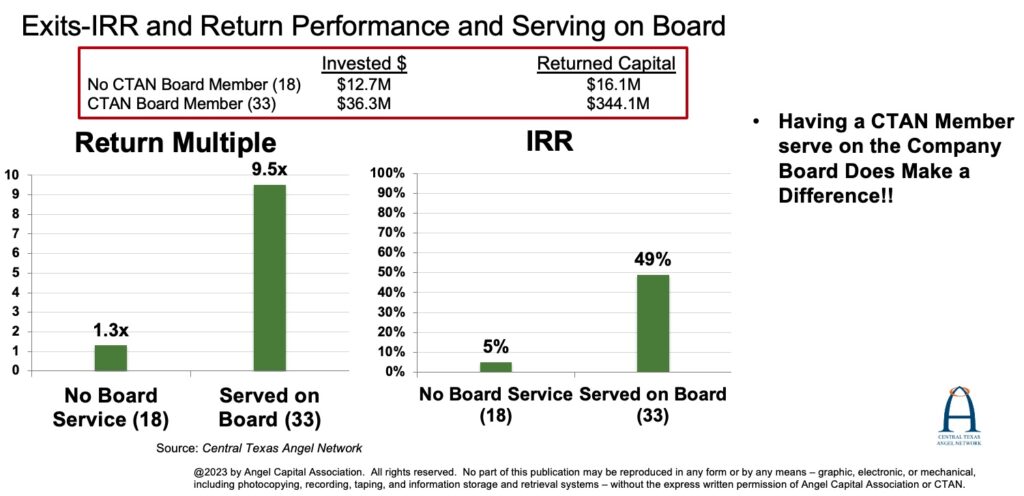

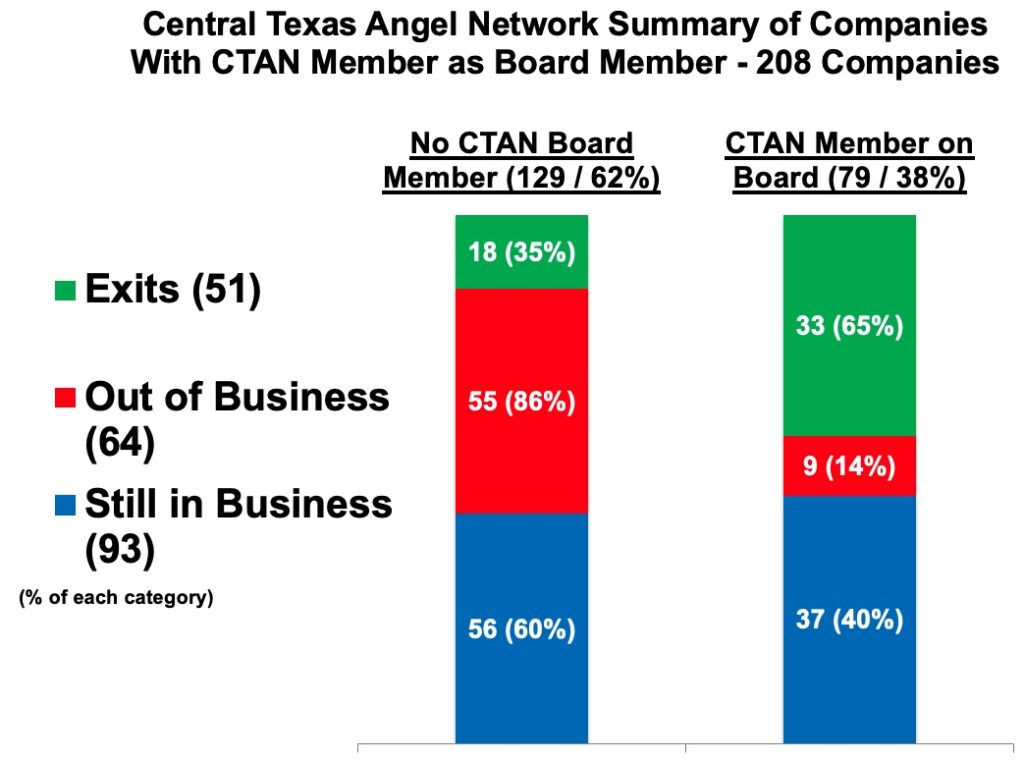

CTAN is a very data-centric angel group and we wanted to look at our portfolio performance to determine if Board service by a CTAN member was making a difference. Of the 208 companies in which CTAN members have invested, a total of 64 have shut down or gone out of business, 51 companies have provided members with an exit, and 93 companies are still in business. We decided to look at the 51 companies that provided members with an exit. Shown below is a chart which measures the return multiple and internal rate of return for exited companies. Of the 51 exited companies 33, or 65% had a CTAN Board member and 18, or 35% did not have a CTAN member serve on the Board:

FIGURE 1: ENGAGEMENT DRIVES RETURNS

The results are dramatically different. In terms of a return multiple those companies with a CTAN Board had a multiple of 9.5x versus a 1.3x in companies with no CTAN member serving on the Board. The internal rate of return (IRR) also produced dramatically different results. The IRR without a CTAN Board member was 5% compared to an IRR of 49% when there was a CTAN member serving on the Board.

Notably, a total of $49.0M was invested in the companies with exits and $36.3M or 74% was deployed to companies with a CTAN Board member versus $12.7M or 26% which was invested in companies where we did not take a Board seat.

Finally, the failure rate was lower for companies where there was a CTAN Board member. Of the 64 companies that went out of business, only 9 of these companies or 14% had a CTAN Board member when the investment was made. In contrast, 65% of the exits and 40% of the active companies had a CTAN Board Member per the chart below.

FIGURE 2: Summary of Companies With CTAN Member as Board Member - 208 Companies

There are many factors likely impacting these results, but the execution abilities or performance of the CEO and his/her team primarily led to this success. Other factors include due diligence on the 33 companies that had Board service and in most cases the 18 companies without Board service did not qualify for due diligence. The issue of Board service is another metric to help determine before an investment is made and during the life cycle of the start-up to help determine if a company will be successful. Another similar study done by Alex Brown of Launchpad Venture Group also showed 20% better returns from companies in which one of their members had a Board seat versus companies without a Board member.

It should also be noted that the Ann and Bill Payne ACA Angel University offers a course on how to effectively serve as a Board member of a start-up company.

Key Takeaway:

While not the only factor in determining the success of a start-up company, having a knowledgeable and active Board member can help drive success in a start-up company and is a factor that should be evaluated.

Author:

- Rick Timmins, Central Texas Angel Network and ACA Board Member.