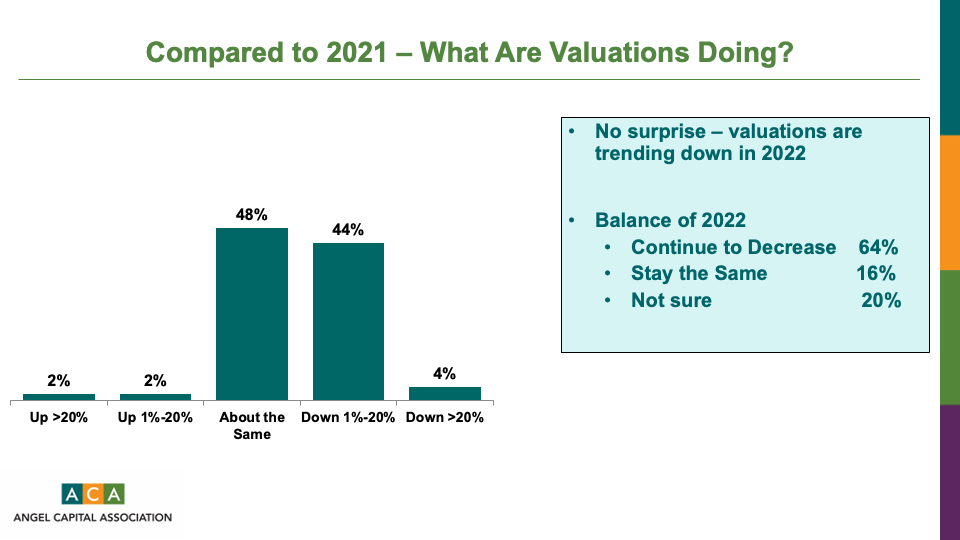

The Angel Capital Association will soon be publishing the 2022 Angel Funders Report which provides significant insights into angel investing trends in 2021.Today’s environment is much more challenging, even more than the COVID epidemic of the last several years. This, of course, is due to many factors including falling valuations in public markets, rising interest rates, supply chain disruptions, increasing inflation, and geopolitical conflict. And broader economic conditions have already impacted private capital. Crunchbase recently published a report indicating that as of the end of the third quarter, 2022 late-stage venture capital and private equity funding to VC backed companies was down 40% quarter over quarter and 63% year over year. Early-stage venture funding also saw a 25% decline quarter over quarter and a 39% decline year over year.

As noted, much has changed from last year to this year. Given the magnitude of those changes the ACA also conducted a 2022 Angel Investing Sentiment Survey in September, 2022. This survey was sent to ACA angel groups and involved responses to 12 questions centered around investing sentiment in 2022 versus 2021 by angel groups and angel group members. The accumulated data was summarized and a report has been prepared on the responses by the 44, primarily large angel groups, that responded to this survey.

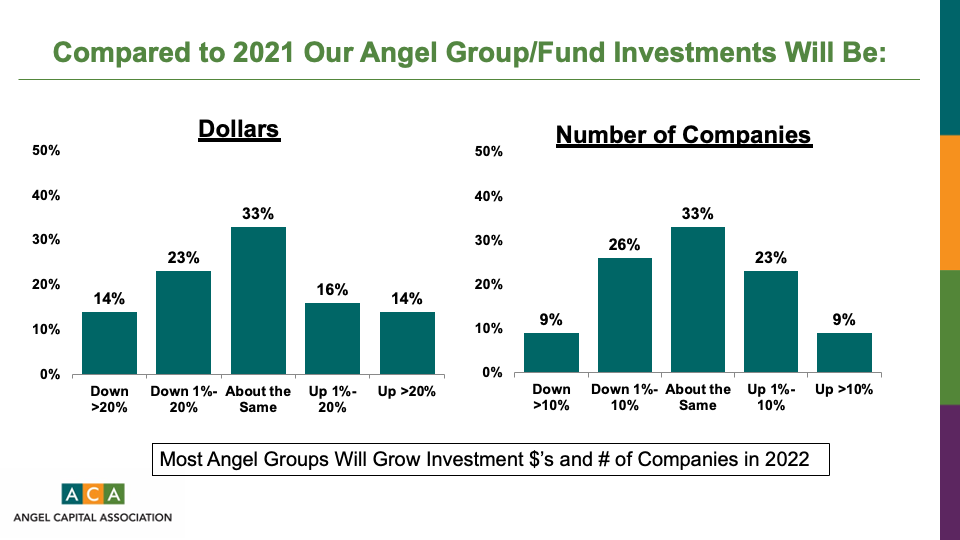

The first chart we are sharing here asked what angel groups estimate their 2022 investments in terms of dollars and the number of invested companies will be compared to 2021. Unlike venture capital investing in 2022 compared to 2021, which is likely to see a sharp decline, angel groups responded very differently. In terms of dollars, 63% of groups indicated that invested dollars will be the same or even up 1% to 20% year over year (16% ) or even up more than 20% versus last year (14% of groups). Only a combined 37% of angel groups expected invested dollars to be either slightly down (1% to 20%) or down more than 20%. As you review the data on the number of companies, again it indicates that 65% of the angel groups believe that company investments will be the same or even higher (32% of responses) in 2022 versus 2021. Only 35% of the respondents expect the number of company investments to decline in 2022.

- In summary we believe angel groups and individual angels continue to be resilient and are continuing to fund companies even in a down economy while we are seeing VC’s pulling back. Angels recognize that it takes a long time to build companies, so recent ups and downs are not deterring angels and that their investment is going to be longer than the current business cycle. Lower valuations in public markets and elsewhere are also impacting early-stage companies and savvy angels realize that the current environment is a strong investing opportunity rather than a barrier.