The purpose of this data insight is to share with everyone the thoughts and feedback of leaders of angel groups about their own group and angel investing in general as we collectively came out of the COVID pandemic in 2021 compared to what angel groups feel about their own group and angel investing two years later in 2023. This historical or look back perspective is based on a survey conducted by the Angel Capital Association in Q1 and Q2 of 2021 compared to the same survey conduct two years later in 2023. As a result, we are able to understand and contrast the sentiments of angel groups in 2023 compared to 2021. It is important to look back and review actual data around angel group behavior in order to dispel theories or unsubstantiated assumptions people may have during these two important timeframes.

Let’s first look at the make-up of angel groups participating in both surveys. 68% of the groups are a network or a network with a sidecar fund. Another 18% are strictly a fund and the remaining 14% are of some other structure. In addition, 64% of angel groups have individual members making the investment in start-ups, while 32% of angel groups employ a fund or form a LLC or SPV for investment purposes. In addition, 33% prefer investing within a 150-mile radius of their base, while 38% of angel groups consider deals across North America and the remaining 29% will also consider deals outside of North America.

In the 2021 survey when asked to compare themselves to the previous twelve months people were obviously comparing themselves to 2020, the year in which almost everyone experienced lockdowns due to the COVID pandemic. We asked the question about their member behaviors compared to the previous 12 months and in the 2021 survey 42% indicated the membership meeting attendance had increased compared to only 30% who indicated that in the 2023 survey. The overall investment level in new deals by members increased by 42% in the 2021 survey compared to 31% in the 2023 survey when asked the same question. Investments in new deals by members was up 46% in the 2021 survey versus only up 25% in the 2023 survey compared to the previous year. Valuations on each deal in 2021 were up in approximately 59% versus the belief of angel groups only 24% of the deal valuations were up in 2023 compared to the previous year. Finally, when asked to describe the overall health of their angel group or fund in the 2021 survey, 90% of respondents indicated it was stable and/or actively growing and in 2023 the answer to that question was very similar at 88%. The response to this question in both surveys speaks to the overall health of angel groups during the pandemic lockdown and the macroeconomic conditions impacting all of us in 2023.

We also surveyed angel groups about their portfolio companies. The survey asked if their companies had increased employee headcount and revenue growth. As you can see on the chart below, we were somewhat surprised there are not significant differences when reviewing the responses in the 2021 and 2023 survey’s past 12-month data. Employee headcount did increase in 65% of portfolio companies as reported in the 2021 survey, however headcount also grew in 57% of portfolio companies in the 2023 survey data compared to the previous year. Again, no significant differences were noted in 2021 versus 2023 surveys when looking at the revenue in portfolio companies. In the former revenues grew in 75% of the portfolio companies compared to the previous year and in the latter headcount also grew in 70% of the portfolio companies. No surprise on the growth in headcount and revenues reported in 2021 versus the lockdown year of 2020, but given the much higher interest rates in 2023, higher inflation and consumer sentiment, we were surprised to see the figures reported in the 2023 responses.

Figure 1: How Have Your Portfolio Companies Changed in the Past 12 Months?

Source: Angel Capital Association’s Investor Sentiment Survey

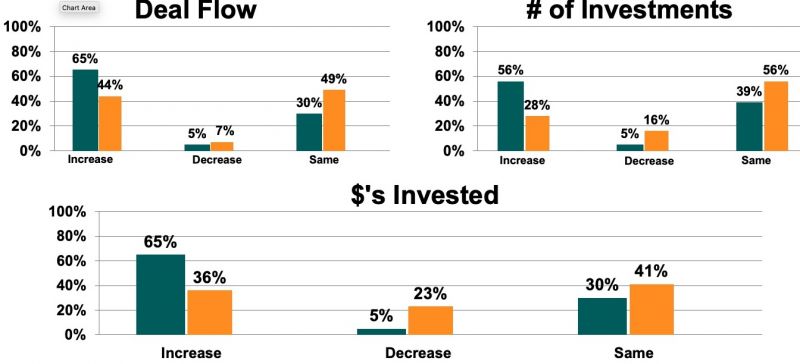

Looking forward instead of backwards we saw dramatic differences when asked questions around the overall investing landscape by the angel groups or funds as noted on the chart below. While there were not statistically large differences in deal flow coming to angel groups, we again saw large differences in the number of investments angel groups were expecting to invest in and the amount of dollars to be invested. Coming out of the pandemic in 2021, 56% of angel groups expected to increase their number of investments compared to the previous year while that number shrank to only 28% in 2023. Only 5% of angel groups anticipated a decrease in the number of investments in 2021 compared to the next 12 months, but that number rose to 16% in 2023. Total dollar investments were anticipated to increase by a very large 65% of surveyed angel groups in 2021 but that number was down significantly at only 31% in 2023. Only 5% of angel groups were forecasting dollars invested by angel groups to decrease in 2022 compared to 2021 but was dramatically different with 23% of angel groups in 2023 anticipating a decrease in dollars invested in that year compared to the following year. We believe economic conditions definitely impacted responses in the 2023 survey.

Figure 2: In The Next 12 Months What Do You Think Will Change?

Source: Angel Capital Association’s Investor Sentiment Survey

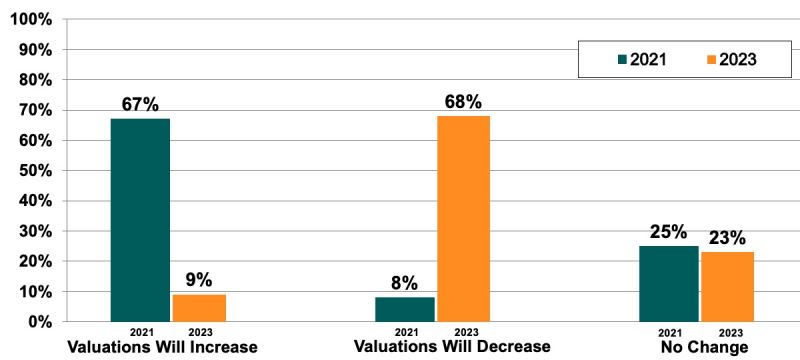

Perhaps one of the largest differences year over year was in valuations as noted on the chart below. Back in 2021 coming off the pandemic challenges 67% of angel groups believed valuations were expected to increase. Yet looking at the response to the same question in 2023 only 9% believed valuations were likely to increase in the next 12 months. However, in 2023 a very large 68% believed valuations were likely to decrease year over year compared to the figure of only 8% of angel groups in 2021 anticipating a decrease in valuations. The number of angel groups anticipating no change was virtually the same at 25% in 2021 and 23% in 2023. We are all familiar with the challenges start-up companies were experiencing raising funds in 2023 due to many macroeconomic factors and the response to this question by angel groups reflects these macro issues.

Figure 3: In The Next 12 Months What Do You Think Will Happen to Company Valuations?

Source: Angel Capital Association’s Investor Sentiment Survey

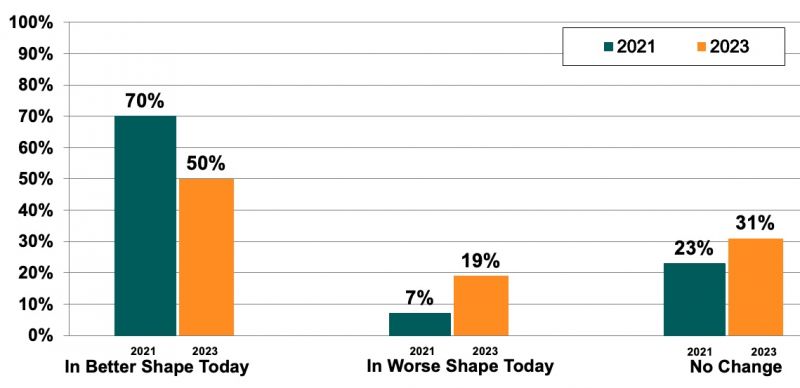

Differences in angel group portfolio companies were also noted when asked the question around status of their portfolio companies when compared to the previous year as noted in the chart below. In the 2021 survey 70% of angel groups believed the overall health of the portfolio companies was in better shape compared to the previous 12 months which is no surprise, while that number fell to 50% in 2023. Also of note is that in 2021 only 7% felt their portfolio companies were in worse shape, however that number rose by almost a factor of three to 19% in 2023.

Figure 4: Compared to 12 Months Ago, in General Our Portfolio Companies Are:

Source: Angel Capital Association’s Investor Sentiment Survey

We have all seen venture capital funding decrease in 2023 compared to 2022. According to Pitchbook total venture funding in the United States was $166B in 2023 down 31% year over year. In addition, Pre-Seed/Seed venture funding was $16B in 2023 which was down 35% from the prior year. In the case of angel groups or angel funds a full 77% anticipated that dollars invested would increase year over year or stay the same which is a stark contrast to venture groups. Angel groups appear much more resilient and willing to continue to invest in start-ups despite many macroeconomic challenges. This data insight provides historical context of angel group sentiment in a very important timeframes the period when we were beginning to emerge out of the COVID pandemic in 2021 and provides a perspective of this time frame to the challenging year for other very different reasons of 2023. The Angel Capital Association is now collecting angel group investments for the 2023 period and the results and analysis of the data will be published in our upcoming ACA Angel Funders Report, the definitive source of angel investing trends in North America.

Key Takeaways:

Angel groups appear much more resilient and willing to continue to invest in start-ups despite many macroeconomic challenges

In contrast, most VCs pulled back their funding in 2023 both in terms of dollars invested and the number of companies which received that funding

There were higher expectations for lower valuations in the 2023 survey

Author:Rick Timmins, ACA Board Member, Chair, ACA Data Analytics Committee and Member, Central Texas Angel Network