Employment inevitably grows as a company gains traction, but what is the relationship between the number of employees and valuation for early-stage companies? Based on data collected on investments made by 74 ACA Angel Member Groups in approximately 1000 companies in 2024, this article offers some insights on this topic.

First, a caveat: The data used for this analysis is FTE including all employees, which is what we have access to. Team size is normally not a direct driver of valuation, unless it is in a field such as AI where the number of engineers might be a factor due to the frequency of “acqui-hires”; in these instances, the rest of the team is often let go, so looking at total headcount adds noise. But with that caveat, let’s see what we can learn.

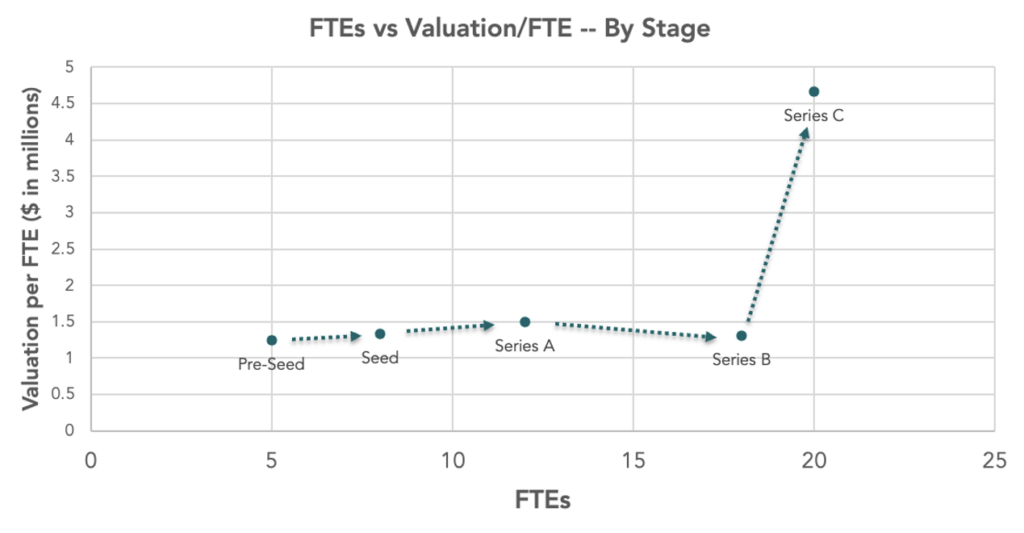

Overall, Figure 1 shows team sizes grow as a company progresses in its development, and valuation per FTE grows gradually through these successive stages of development.

FIGURE 1: VALUATION/FTE RELATIVELY FLAT UNTIL SERIES C

Source: 2025 ACA Angel Funders Report

Median headcount rises in orderly steps—from 5 FTEs at pre-seed to 20 FTEs by Series C—yet valuation per employee does not follow a straight upward line. Investors pay roughly $1.25M per FTE at pre-seed and only modestly more through Series A ($1.5 M/FTE). Efficiency compresses at Series B ($1.3M/FTE) perhaps as companies bulk up on go-to-market hires before scale economics kick in. Only after clearing these growth pains does the multiple leap, with Series C medians topping $4.7 M per FTE—a testament to proven product-market fit and the strategic scarcity of late-stage angel opportunities. However, it is worth noting that angels rarely are involved in the negotiations on valuation in Series B and beyond – later stage investors lead these rounds and angels basically “take it or leave it.” So a different set of dynamics are in force for those later stage deals and depend on such factors as competition for the deal amongst VCs.

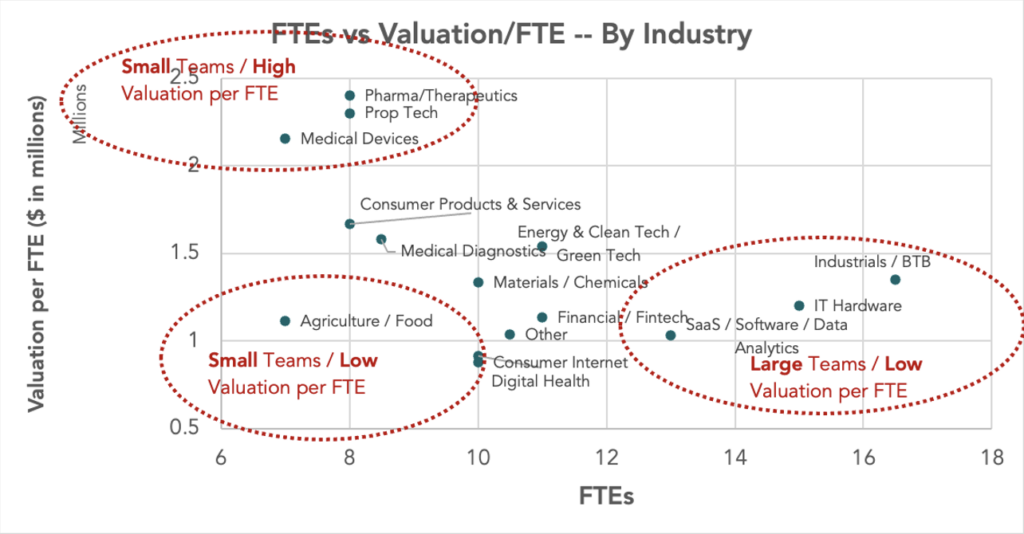

In terms of industriessignificant variation in team size and valuation per employee across industries:

FIGURE 2: RELATIONSHIP OF TEAM SIZE TO VALUATION

Source: 2025 ACA Angel Funders Report

Here are some observations on these industry differences displayed above:

- Intangible-heavy models seem to trade at a discount. Consumer Internet and Digital Health companies price at a median of $0.9M per FTE, the lowest in the data set, perhaps reflecting modest barriers to entry and abundant comparables.

- Software sits mid-pack. SaaS/Data Analytics clears $1.0M per FTE at the median, but its $2.0M average shows a far right tail of premium-valued platforms.

- Hard-tech commands higher multiples. Materials/Chemicals, Industrials/BTB, and Energy/Clean-Tech cluster between $1.3M and $1.6M per employee—roughly 40-70 % above consumer web plays—perhaps compensating for longer development cycles.

- Regulated life-science and asset-centric verticals lead the table. Medical Devices posts a $2.2M median (and a $3.1M average), while PropTech tops the list at $2.3M per FTE

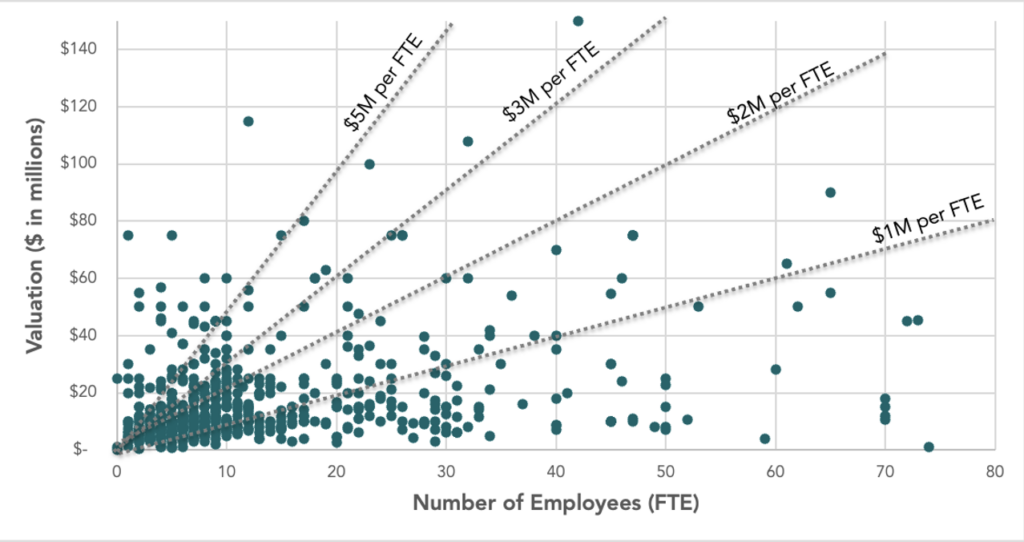

Valuation depends on much more than just team size. Figure 3 plots pre-money valuation against full-time headcount for 2024 angel rounds and illustrates how sharply “price-per-employee” compresses as companies scale:

FIGURE 3: VALUATION DEPENDS ON MUCH MORE THAN TEAM SIZE

Note: Data points where Valuation per FTE exceeds $140M or FTE exceeds 80 are not shown

Source: 2025 ACA Angel Funders Report

Roughly two-thirds of the sample employs ≤ 15 people; within that cohort valuations scatter widely—from single-digit millions up to a lone outlier above $110M—but most companies fall below the $5 million-per-FTE isocline. Once a venture grows beyond ∼25 FTEs, valuations converge into a much tighter band of $1–2M per employee and rarely exceed $60 M, signaling that investors anchor later-stage pricing to more conventional revenue and cost metrics.

The pattern implies a two-step dynamic:

- Early-stage premium: Small, R&D-heavy teams can command lofty per-capita valuations when the story hinges on IP, scarcity, or network effects. Deals above the $3–5 million-per-FTE lines are outliers and should be underwritten only when the addressable market and barriers to entry justify the multiple.

- Scaling discipline: As payrolls grow, valuation uplift lags headcount growth; capital efficiency is rewarded, and investors appear reluctant to pay beyond about $2 M per incremental employee without clear revenue traction.

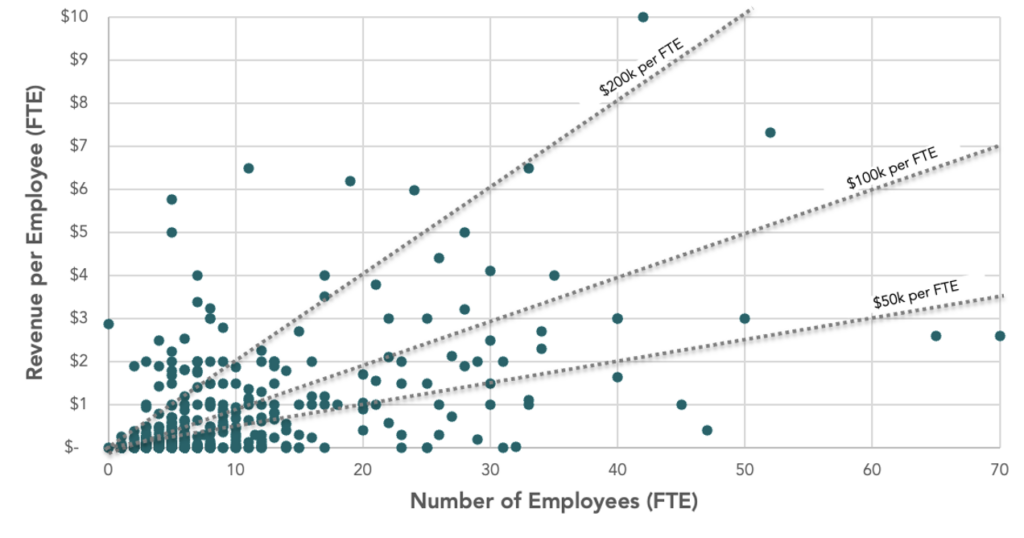

Turning to productivity, Figure 4 shows there is a wide range of revenue-per-employee:

FIGURE 4: 2024 REVENUE PER EMPLOYEE SHOWS WIDE RANGE OF PRODUCTIVITY

Note: Data points where Revenue per FTE exceeds $10M or FTE exceeds 70 are not shown

Source: 2025 ACA Angel Funders Report

Nearly three-quarters of these companies in our 2024 sample employ fewer than 20 people, and the great bulk of those firms cluster below the $100K-per-FTE guideline (dotted reference lines at $50K, $100K and $200K). Even as staffing rises toward 50–70 full-time employees, only a handful of points crest the $100K line and fewer than five exceed $200K, indicating that scale has not yet translated into markedly better revenue productivity. The lone outliers—sub-20-employee teams posting $300–700K per head—underscore that capital-efficient business models are possible but exceptional. For investors, the distribution suggests a realistic operating benchmark of $50-100K per employee during the angel stage; ventures already clearing $200K per head warrant premium pricing, while those languishing below $50K should face tighter milestone-based tranches or operating fixes before fresh capital is committed.

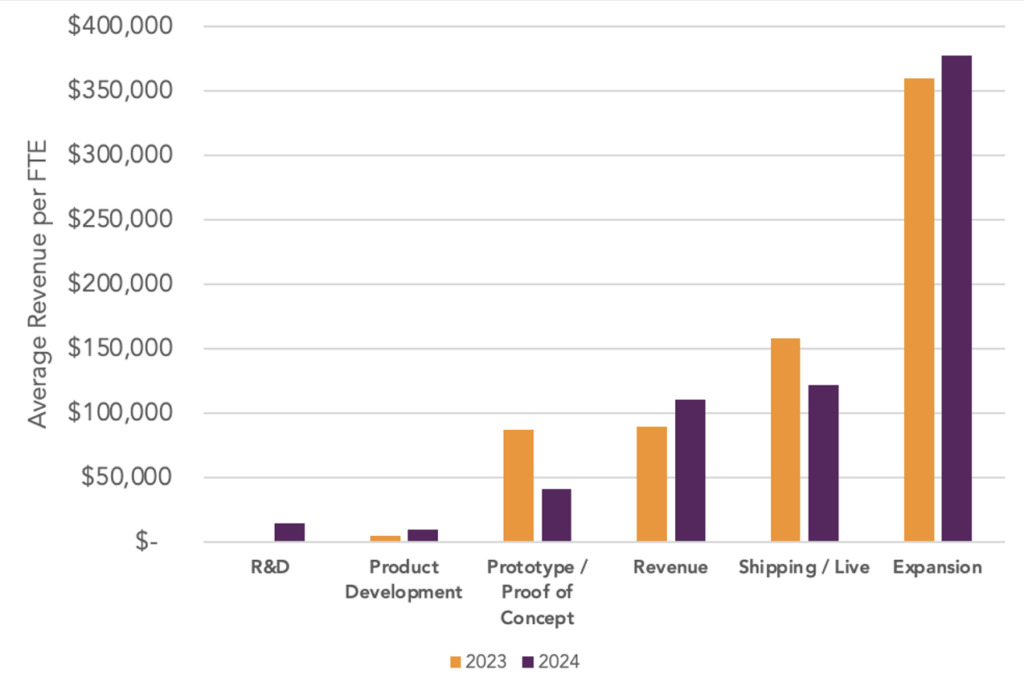

Figure 5 shows revenue per employee rises sharply as ventures progress through their operating life cycle:

FIGURE 5. REVENUE PER EMPLOYEE GROWS WITH DEVELOPMENT STAGE

Source: 2025 ACA Angel Funders Report

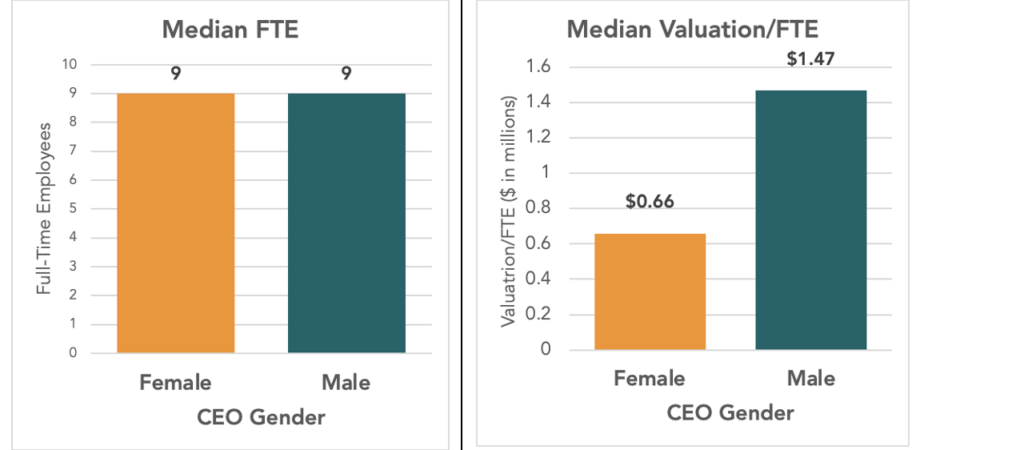

Next, let’s look at CEO demographics. Figure 6 shows staffing scale and valuation efficiency for companies led by female versus male CEOs which surfaces two clear, if contrasting, patterns:

- Team size parity—on paper. At the median, both cohorts run lean nine-person teams. However, the average male-led venture employs 47 FTEs—more than double the female average of 19—implying a handful of sizeable, outlier teams skew the mean upward.

- Valuation discount for women-led firms. Despite similar (median) staffing, female-run companies are priced at a slightly lower valuation per employee—$1.33 M versus $1.47M for their male-run peers. The gap is similar when using the mean ($2.08M vs $2.51M

FIGURE 6: VALUATION/FTE HIGHER FOR COMPANIES LED BY MALE CEOS

Source: 2025 ACA Angel Funders Report

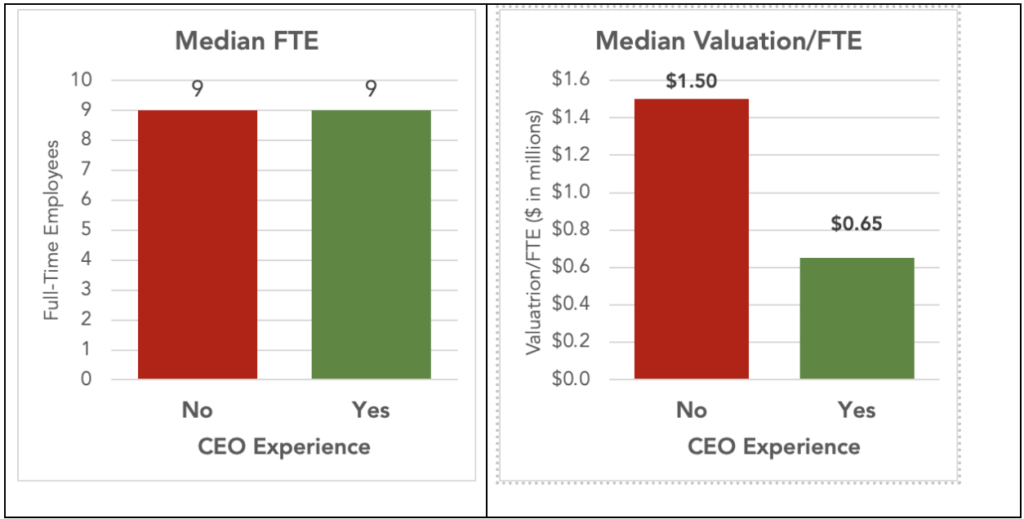

What about CEO experience? Figure 7 shows a surprising result — prior CEO experience does not seem to translate into higher pricing at the angel stage. Companies led by first-time CEOs command the richer multiple—about $1.5M of pre-money valuation per full-time employee (FTE) at the median—more than double the $0.65M awarded to teams headed by repeat CEOs.

FIGURE 7: NO PREMIUM FOR EXPERIENCED CEOS

Source: 2025 ACA Angel Funders Report

Team size does not explain the gap: both cohorts staff a median of nine FTEs. What differs is profile: ventures run by experienced leaders are, on average, much larger (74 versus 29 employees), suggesting they have progressed into headcount-heavy scale-up phases where investors anchor valuation to revenue and capital efficiency rather than leadership résumé. Early-stage backers appear willing to pay a premium for breakout potential in lean, founder-driven start-ups—even when the chief executive is new to the role—whereas seasoned CEOs tend to be raising at later, more metrics-driven inflection points that dilute valuation per head. For investors this means CEO pedigree alone should not dictate pricing; stage, burn, and capital intensity remain stronger determinants of value.

Looking ahead, 2025 should be a watershed year for startups thinking about FTEs and capital raising. AI is causing the entire model to flip. Recent studies by Bloomberg and others strongly suggest that the new goal is to give the greatest valuation to those building companies with the fewest staff (the inverse of this article’s historical discussion)—and the race is on to champion the first unicorn built by a solopreneur. As many of these studies have indicated, scale used to take 200+ staff and $25M in funding. AI-infused companies can get there with a much smaller staff and with as little as $2.5M in funding. So this author expects the future to be different form the past.

KEY TAKEAWAYS

- A rule-of-thumb range of $1–3M valuation per FTE captures the bulk of market reality, while anything materially above $5M per FTE requires exceptional proof points—or a second look at the cap-table assumptions.

- But beyond such rules of thumb, it is essential to factor in industry and stage of development – as well as other factors – when determining an appropriate valuation

- Valuation benchmarks vary two-to-three-fold across sectors; using a one-size-fits-all rule of thumb risks overpaying for talent-light web startups or underpricing IP-rich device companies. Anchoring negotiations to peer-group medians—while stress-testing for outlier distortion—provides a more defensible starting point for term-sheet discussions.

- Growth in valuation needs to be supported by revenue traction rather than sheer headcount expansion, and recognize that the largest increase in valuation per employee occurs after the scaling phase has de-risked the model.

- Looking ahead, there is likely to be a shift to building companies with the fewest staff, leveraging AI. So past. Is not prologue.

AUTHOR: John Harbison, Chairman Emeritus of TCA Venture Group and ACA Board Member