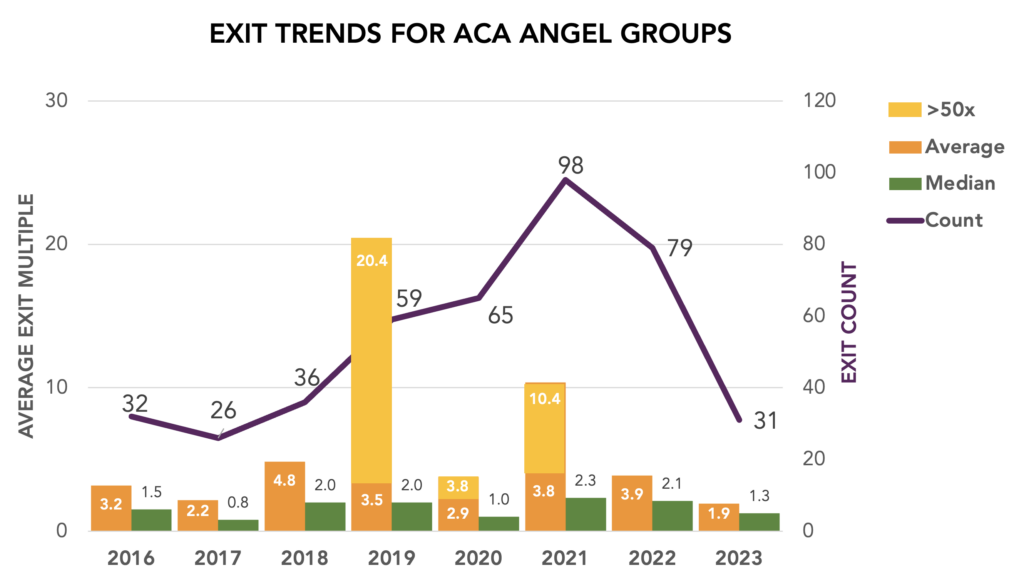

Our community of early-stage investors is experiencing a significant dry spell in terms of exits. This Data Insight documents the trends, and explores the question of if and when we might begin to see more exits?

Since 2016, the Angel Capital Association has been tracking in our community the number of exits and the multiples realized, compiling the results of the 60-70 angel groups that reported their information as part of the data collection for ACA’s annual Angel Funders Report. Since 2021, the number of exits as well as the average and median exit multiples have been declining dramatically. Note that the 2019 average multiple was boosted by one 1000x return (Pinterest from New York Angels), the 2020 average multiple was boosted by one 58x return (Companion Medical from TCA Venture Group) and the 2021 average multiple was boosted by one 368x return (Procore Technologies from TCA Venture Group). The chart leaves those in because outsized grand slam home runs like those are what drives the higher return in this asset class. Note the darker orange color in the chart below shows the average multiple without those outsized exits:

Source: 2024 ACA Angel Funders Report

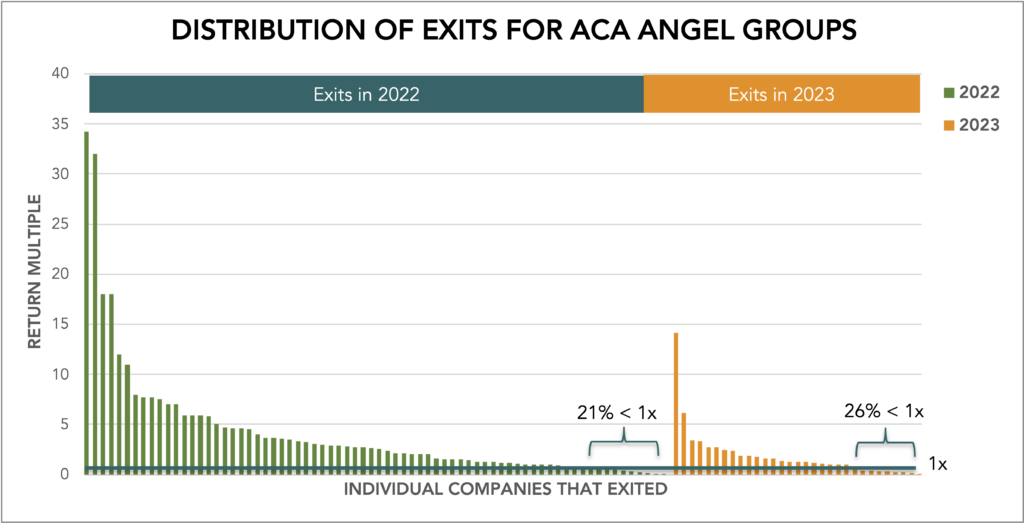

Focusing on the change between 2022 and 2023 shows a decline both in the number of exits, and the multiples on those exits. The percentage of exits that failed to return 100% of the capital invested also increased from 21% of the 2022 exits to 26% of the 2023 exits.

Source: 2024 ACA Angel Funders Report

Taking a longer view using TCA Venture Group’s exits by year over its long history shows a similar pattern since 2016. While the number has rebounded in 2024, only three of the six exits so far in 2024 returned at least the amount invested. One of those was even an IPO, but the return was only 1.5x. But taking a longer view by including data from 2000 – 2016 shows that exits tend to flourish just before major stock market corrections (and the connected decline in early stage funding activity after those corrections). Even the recovery in number of exits so far in 2024 is somewhat of a mirage since the average multiple is very low (many of these are distressed sales when companies have difficulty raising funds in the current changing funding environment).

Source: TCA Venture Group (2024 data is through October 2024)

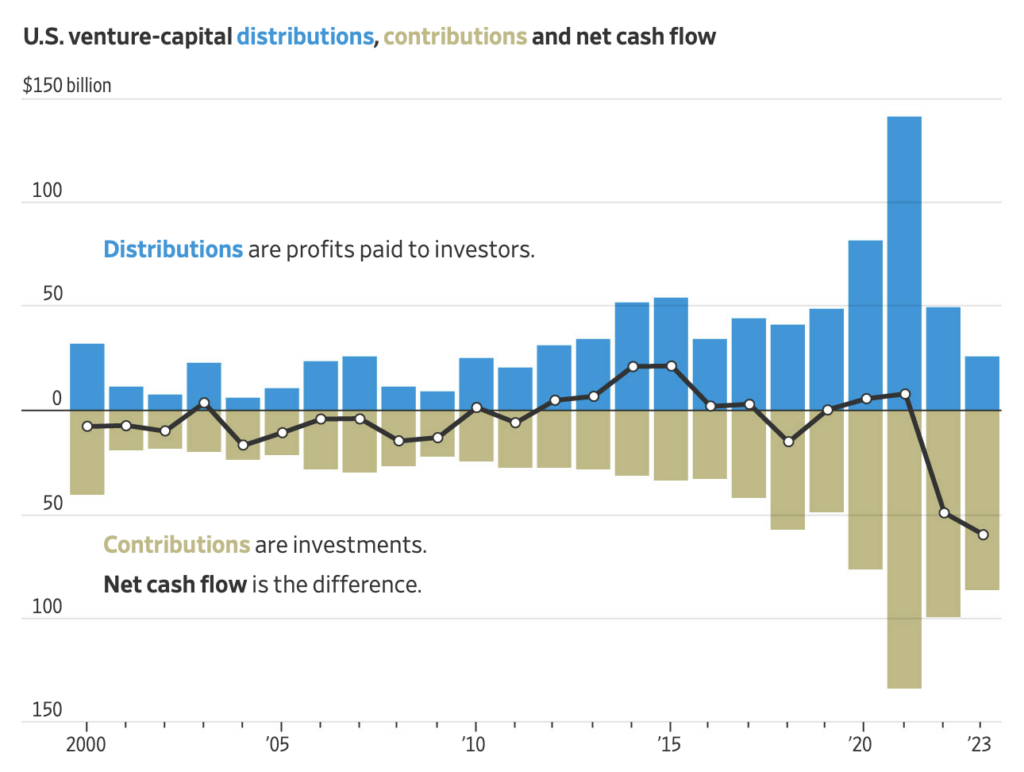

These trends in angel investing are paralleled more broadly in the arena of VC exits which are experiencing a similar recent dearth of activity. According to The Wall Street Journal, in 2023 the U.S. VC industry invested $60 billion more into startups than it collected back in returns, citing PitchBook data. That is the largest deficit recorded in PitchBook’s 26 years of data.

Source: Wall Street Journal and Pitchbook

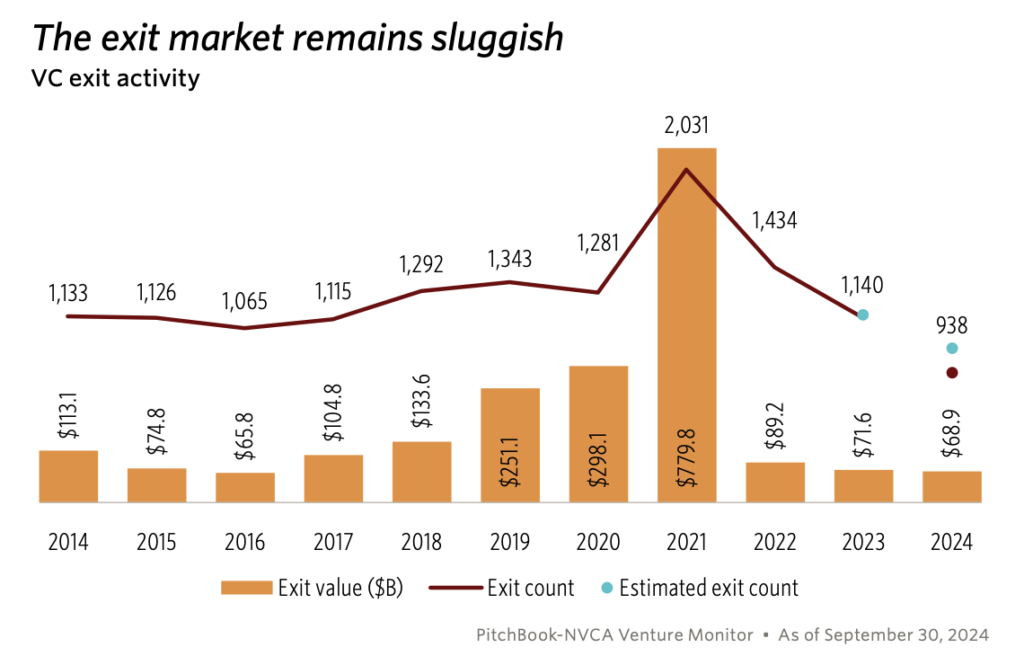

VC exit values have slowed to a trickle in the last three years (2022-2024):

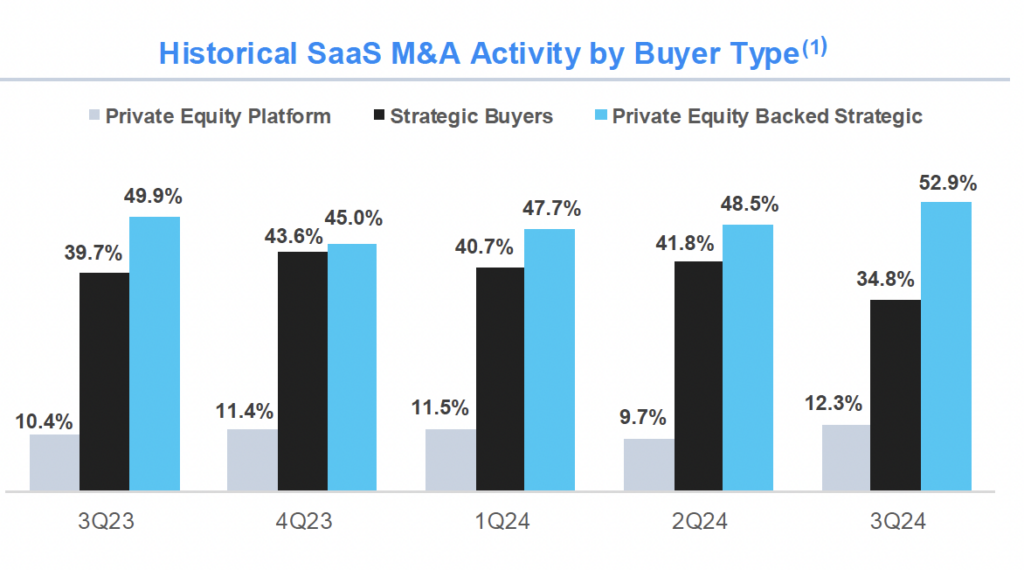

The primary drivers of exits are pull (market demands) and push (candidate companies’ boards,VCs and the I-bankers they work with). Angels typically have little influence over exits taking place after Series A—those are typically in the hands of the VC-dominated boards. Looking at angel data alone is insufficient since our exits are affected by the broader world of VC-backed company exits and the overall exit climate. And one other factor: 60%+ of recent SaaS M&A (which itself amounts to a high % of all M&A) has had PE as the buyer, so PE buyer trends are important, too.

While Software/Saas is only one market, SEG (Software Equity Group) estimates that 65% of Software or SaaS-related M&A overall is PE related:

Source: Software Equity Group

“Voluntary” M&A (M&A not caused by balance sheet weaknesses) is often gated by Boards or bankers’ sense of the willingness of buyers to pay what Boards/Management are seeking—increasingly, as per the above paragraph, what PE is willing to pay. Since 2022, exit values have fallen, discouraging some companies from seeking exits, while those running out of cash flood the inboxes of business development teams at the major buyers – which in turn helps drive down exit valuations. Since 2022, Bankers and Boards have been telling management in sectors whose market multiples have fallen to wait until “conditions improve and valuations bounce back.” And note that the top I-bankers will not undertake M&A transactions if: 1) they think that buyer expectations are inflated and won’t be met (or the deals they find won’t close because management will reject them); or 2) the M&A value won’t satisfy minimum I-banker fees which bankers expect.

The slowdown is the result of many macro-economic trends that are well known. Other factors such as declining M&A value, a slowdown in growth capital for seed and series A companies — allowing them to achieve the metrics needed for M&A valuations acceptable to management and Boards. This phenomenon is referred to as the “Series B, Series C crunch”.

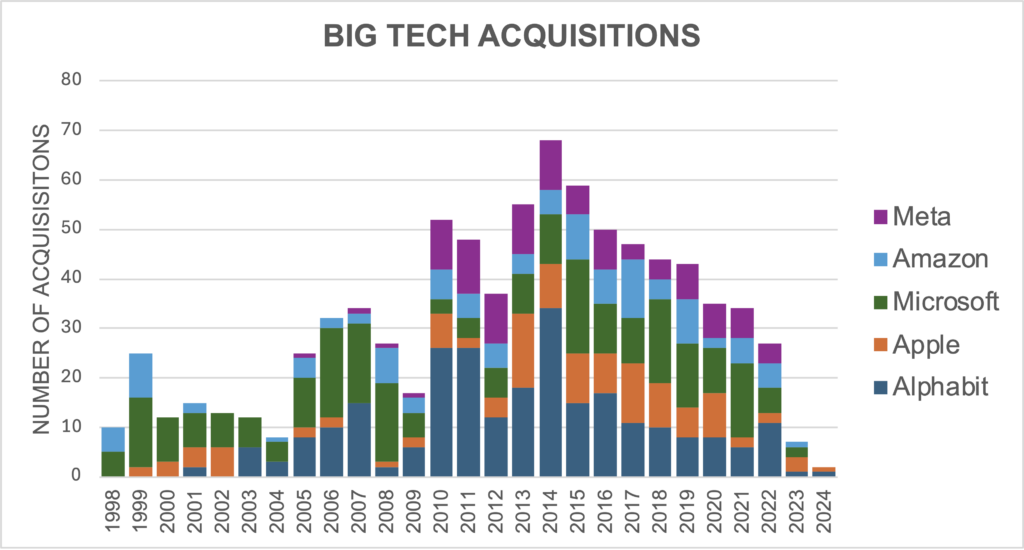

But one specific reason for the dry spell that goes beyond the typical investment cycles is the increase during the Biden administration in antitrust actions against Big Tech. In that environment of increased scrutiny, acquisitions by Big Tech (which have fueled much of the M&A activity in early stage in the past decade) have slowed to a crawl. Antitrust is one of the reasons exits in Big Tech have shifted to PE buyers, as described above. PE firms have been dealing with Hart-Scott-Rodino antitrust clearance issues since 1976, well before any recent greater scrutiny by the Biden administration and are experienced in working the system. But their main advantage is that a financial buyer escapes antitrust issues about consolidation into a monopoly.

Source: Analysis of Wikipedia entries through October 2024

The pharma/device industry has been somewhat more resilient. The pandemic shut down clinical trials for two years and otherwise diverted the attention of medical professionals, which is a factor contributing to the delays in exits as development timelines extended by at least two years. Plus, with the IPO market narrowing for these companies, the potential buyers can afford to take their time and ensure more traction or wait for more data, before they commit to a purchase. In 2022, a major bio-pharma company noted specifically that M&A was going to slow dramatically because “buyers are not willing to pay what sellers expect and sellers expectations are inflated.”

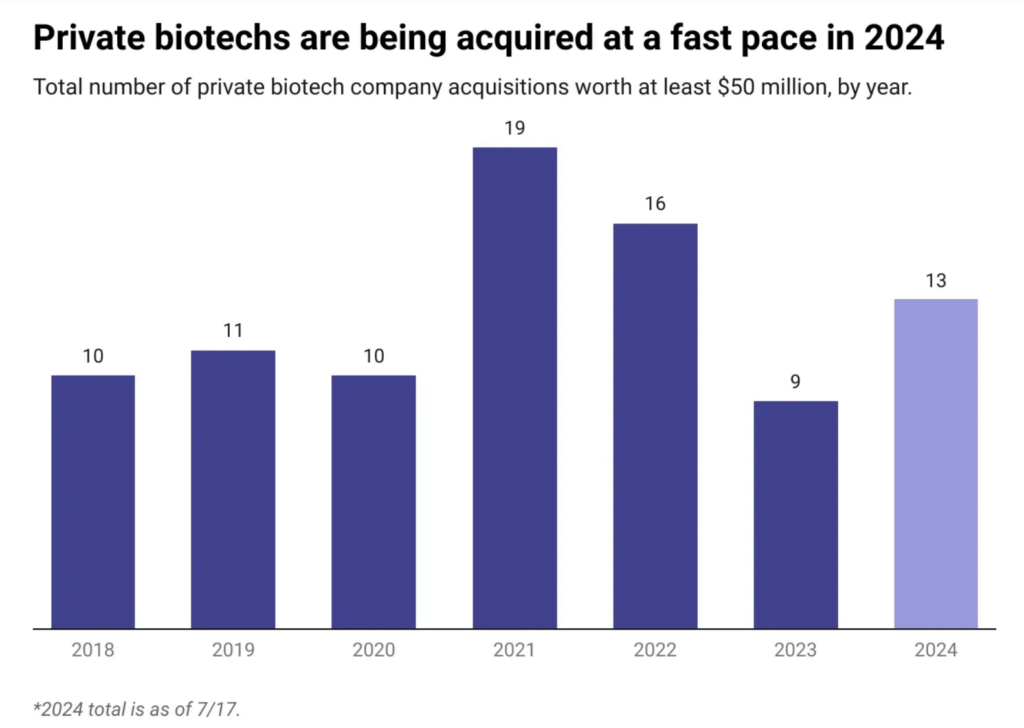

There are some encouraging signs that private BioTech M&A is picking up in 2024:

Source: Ben Fidler/BioPharma Dive

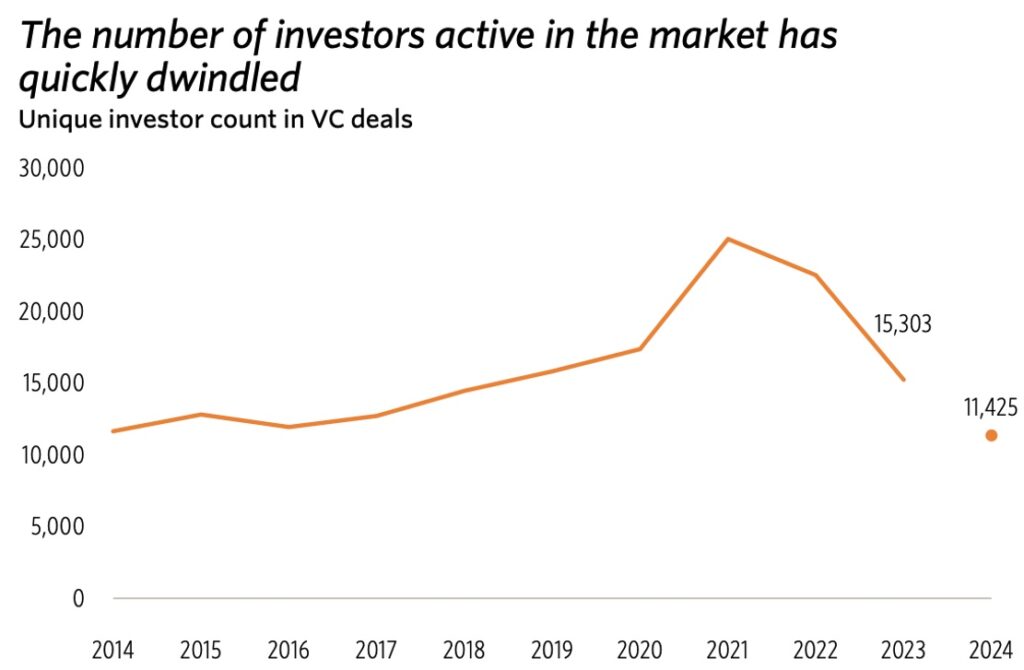

The dearth of exits is contributing to a reduction in the number of early-stage investors.

So where is this all going?

M&A, like all valuations, has its own internal feedback loops from public and private valuations and industry comparables. As valuations (and market multiples) increase, there will be more M&A as Boards/Management see closer alignment between company expectations and what buyers are willing to pay—and that has already begun to happen in 2024. I believe the current misalignment is due to public valuations/comparables which fell in 2023, and is the root cause of the missing M&A for strong companies (outside of AI which has behaved very differently from the non-AI market).

There is some hope that the new Trump administration might reverse some of the recent antitrust scrutiny of Big Tech acquisitions, but that is speculative because there have been mixed signals from President-elect Trump and Vice President-elect Vance – they seem to remain hostile to some of Big Tech such as Google. But if a reversal occurs, such a relaxation could open up the spigot for tech deals again.

However, once the M&A and IPO activity recovers in terms of number of exits, it remains to be seen if the valuation multiples recover due to the persistence of high starting valuations in Pre-Seed, Seed and Series A round which are the focus of most investments by Angel groups. The dramatic drop in valuations was in later stages, leaving early-stage relatively flat. That compression could be a damper on future exit returns.

KEY TAKEAWAYS

- Exits have been trending down both in terms of number and multiple realized

- Heightened anti-trust scrutiny of Big Tech has been a significant driver

- Exits should begin to rebound as they have in past cycles, but the multiples realized may not be as robust as a five years ago due to high starting valuations for much of the past decade

- The key trigger will be a bounce-back in exit valuations that inspire more companies to pursue exits

AUTHOR: John Harbison, Chairman Emeritus of Tech Coast Angels and ACA Board Member