By: Peter Walker, Head of Insights, Carta and Data Storyteller

One of the questions I’m asked most is, “how likely is ____?” How likely is an acquisition? How likely is it my company makes it to Series A? So many probabilities.

So let’s take a concrete example and run through the possibilities.

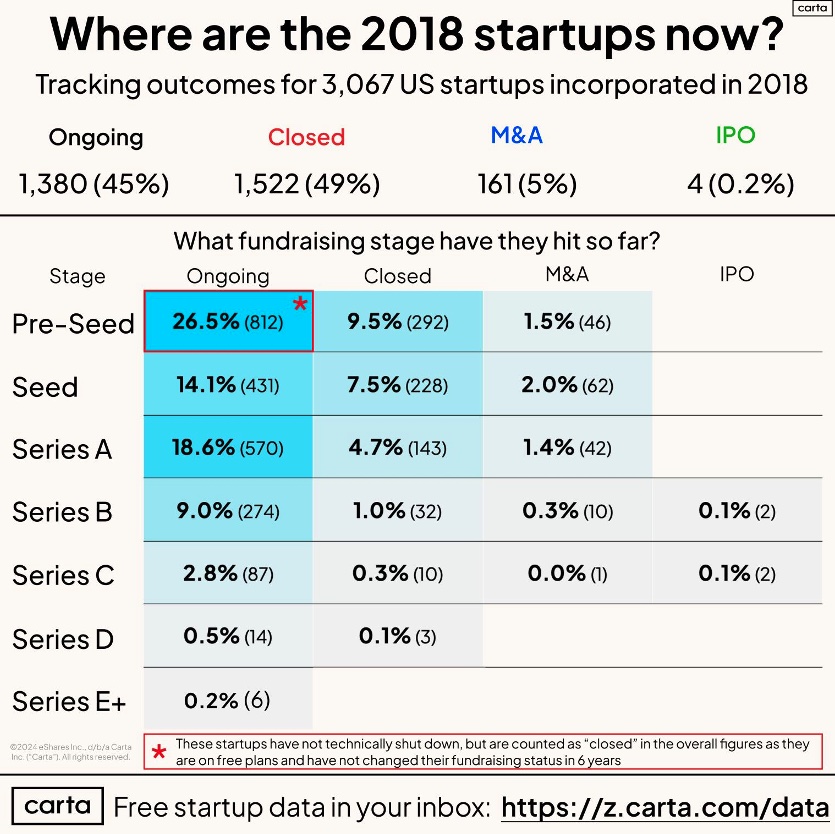

There have been 3,067 US startups that incorporated in 2018 who used Carta as their cap table provider. This analysis looks back over their progress in the intervening 6 or so years.

𝗢𝘃𝗲𝗿𝗮𝗹𝗹 𝗦𝘁𝗮𝘁𝘂𝘀

- 1,380 startups are still ongoing (45%)

- 1,522 startups have shut down (49%) | 𝘪𝘯𝘤𝘭𝘶𝘥𝘦𝘴 ”𝘰𝘯𝘨𝘰𝘪𝘯𝘨“ 𝘱𝘳𝘦–𝘴𝘦𝘦𝘥, 𝘴𝘦𝘦 𝘣𝘦𝘭𝘰𝘸

- 161 have been acquired (5%)

- 4 have IPO’d (0.2%)

Couple caveats before we jump into the progress tracker. These are US startups only. Pre-seed means they have yet to raise any priced round, though some have raised capital on SAFEs or Convertible Notes. All sectors included except Biotech/Pharma, which was removed because of how different the IPO market is for those companies.

How far has this cohort of companies gone so far?

- About 38% remain in the Pre-Seed stage. It’s a little tricky to see exactly what’s happening in this stage (as Carta is free for anyone who has yet to raise $1 million – so many companies simply don’t close their accounts).

- 24% made it to a priced Seed round. Most total acquisitions at this stage as well.

- 25% are at Series A! Largest group of “ongoing” companies remain here.

- About 10% have raised a Series B – and we have our first IPO at this stage as well (meaning Series B was the last round raised before going public).

- Only 3.2% have gotten through their Series C fundraise in 6 years

- 0.7% have made it to Series D or beyond.

Those later stages get narrow pretty damn quickly.

Now – fundraising isn’t the only measure of a company’s progress (or perhaps even the best one). I’m sure there are companies in this sample who decided to stop raising rounds and revenue-fund their growth. I just can’t tell which they are so can’t plot them separately.

Hopefully this lends a little data to the feelings around VC-backed startup outcomes. I wonder what surprises you most – or which year you’d like us to dig into next!

OUTCOMES AFTER SIX YEARS

Source: Carta post in LinkedIn

Subscribe to Carta’s Data Minute newsletter here for this sort of data-driven startup analysis every week.